Itau Unibanco Banco Holding SA

$ 9.26

-0.75%

25 Feb - close price

- Market Cap 102,106,153,000 USD

- Current Price $ 9.26

- High / Low $ 9.36 / 9.15

- Stock P/E 11.87

- Book Value 3.60

- EPS 0.78

- Next Earning Report 2026-05-05

- Dividend Per Share $2.96

- Dividend Yield 31.7 %

- Next Dividend Date 2027-01-11

- ROA 0.02 %

- ROE 0.21 %

- 52 Week High 9.60

- 52 Week Low 4.37

About

Ita Unibanco Holding SA offers a range of financial products and services in Brazil and internationally. The company is headquartered in So Paulo, Brazil.

Analyst Target Price

$8.33

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-04 | 2025-11-04 | 2025-08-05 | 2025-05-08 | 2025-02-05 | 2024-11-04 | 2024-08-06 | 2024-05-06 | 2024-02-05 | 2023-11-06 | 2023-08-07 | 2023-05-08 |

| Reported EPS | 0.2024 | 0.2029 | 0.19 | 0.19 | 0.16 | 0.17 | 0.2 | 0.2 | 0.19 | 0.19 | 0.18 | 0.17 |

| Estimated EPS | 0.2025 | 0.2 | 0.19 | 0.17 | 0.17 | 0.18 | 0.19 | 0.2 | 0.19 | 0.19 | 0.17 | 0.17 |

| Surprise | -0.0001 | 0.0029 | 0 | 0.02 | -0.01 | -0.01 | 0.01 | 0 | 0 | 0 | 0.01 | 0 |

| Surprise Percentage | -0.0494% | 1.45% | 0% | 11.7647% | -5.8824% | -5.5556% | 5.2632% | 0% | 0% | 0% | 5.8824% | 0% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-05 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.2115 |

| Currency | USD |

Previous Dividend Records

| Jan 2027 | Dec 2026 | Nov 2026 | Oct 2026 | Sep 2026 | Aug 2026 | Jul 2026 | Jun 2026 | May 2026 | Apr 2026 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2027-01-11 | 2026-12-08 | 2026-11-10 | 2026-10-08 | 2026-09-09 | 2026-08-10 | 2026-07-09 | 2026-06-08 | 2026-05-11 | 2026-04-09 |

| Amount | $0.003308 | $0.003308 | $0.003308 | $0.003308 | $0.003308 | $0.003308 | $0.003355 | $0.003355 | $0.003355 | $0.003355 |

Next Dividend Records

| Dividend per share (year): | $2.96 |

| Dividend Yield | 31.7% |

| Next Dividend Date | 2027-01-11 |

| Ex-Dividend Date | 2026-03-03 |

Recent News: ITUB

2026-02-25 11:19:00

Itaú Unibanco (ITUB) achieved a record 23.4% Return on Equity (ROE) in 2025, up from 19.3% in 2021, driven by a 40% loan portfolio growth and successful digital transformation efforts that improved its efficiency ratio to 38.8%. Despite pressures on net interest margin and some asset quality concerns, the bank's CEO highlighted strategic positioning for long-term value creation through disciplined capital allocation and AI integration. The article also includes promotional content for an AI stock investment opportunity.

2026-02-24 20:52:24

The Zacks Foreign Banks Industry, featuring companies like HSBC, Itau Unibanco, and Barclays, is poised for growth due to continued operational restructuring and the positive impact of lower interest rates stimulating borrowing and reducing funding costs. Despite uneven global economic recovery, these banks are enhancing efficiency, reallocating capital to high-growth areas, and benefiting from technology investments. The industry, ranked in the top 9% by Zacks, shows promising earnings outlook and currently trades at a significant discount compared to the broader market and its sector.

2026-02-23 12:46:27

The foreign banking industry is poised for sustainable growth due to ongoing restructuring efforts, improved cost efficiency, and declining interest rates, despite uneven global economic recovery. This article highlights three foreign bank stocks – HSBC Holdings (HSBC), Itau Unibanco Holding (ITUB), and Barclays PLC (BCS) – as strong investment opportunities, detailing their strategies for efficiency, market expansion, and technological advancement. These companies are viewed favorably by Zacks Investment Research, which forecasts continued outperformance for the industry.

2026-02-22 02:37:42

Analysts at Itaú Unibanco Holding SA have revised their 2023 GDP estimates for Argentina from a contraction of 1.5% to 3%, citing the severe drought and tighter import controls. The drought is expected to cause a 20% drop in soybean and corn production, significantly impacting the country's foreign exchange reserves and ability to meet IMF program requirements. Argentina is a major global exporter of soybean products, making this agricultural downturn a critical economic factor.

2026-02-21 14:15:26

Tredje AP fonden has made a significant new investment in Itau Unibanco Holding S.A. (NYSE:ITUB), purchasing 7,224,000 shares valued at approximately $53 million during the third quarter. This investment, representing about 0.07% of the company, comes as Itau Unibanco receives positive analyst sentiment, including "Buy" ratings and an average target price of $9.00. Despite missing recent quarterly EPS estimates, the bank maintains a strong market presence and has declared a monthly dividend.

2026-02-20 04:57:41

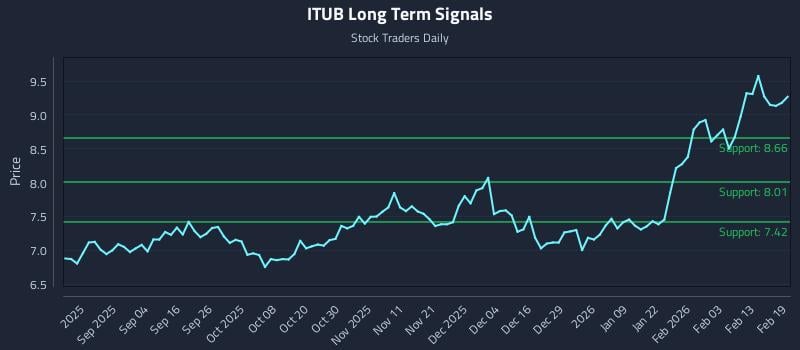

This article analyzes Itau Unibanco Banco Holding Sa (NASDAQ: ITUB), identifying weak near-term sentiment but strong mid and long-term support signals. It provides three AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop loss zones. The analysis also includes multi-timeframe signal strengths, support, and resistance levels for the stock.