InMode Ltd

$ 13.98

-1.55%

24 Feb - close price

- Market Cap 944,345,000 USD

- Current Price $ 13.98

- High / Low $ 14.19 / 13.95

- Stock P/E 6.28

- Book Value 9.94

- EPS 2.38

- Next Earning Report 2026-04-28

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.09 %

- ROE 0.26 %

- 52 Week High 19.85

- 52 Week Low 13.14

About

InMode Ltd. designs, develops, manufactures and markets minimally invasive aesthetic medical products based on its proprietary RF-assisted lipolysis and deep subdermal fractional RF technologies. The company is headquartered in Yokneam, Israel.

Analyst Target Price

$16.25

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-10 | 2025-11-05 | 2025-07-30 | 2025-04-28 | 2025-02-04 | 2024-10-30 | 2024-08-01 | 2024-05-02 | 2024-02-13 | 2023-11-02 | 2023-07-27 | 2023-05-02 |

| Reported EPS | 0.46 | 0.38 | 0.47 | 0.31 | 0.42 | 0.7 | 0.34 | 0.32 | 0.71 | 0.61 | 0.72 | 0.52 |

| Estimated EPS | 0.42 | 0.35 | 0.41 | 0.35 | 0.5 | 0.61 | 0.38 | 0.41 | 0.67 | 0.63 | 0.66 | 0.48 |

| Surprise | 0.04 | 0.03 | 0.06 | -0.04 | -0.08 | 0.09 | -0.04 | -0.09 | 0.04 | -0.02 | 0.06 | 0.04 |

| Surprise Percentage | 9.5238% | 8.5714% | 14.6341% | -11.4286% | -16% | 14.7541% | -10.5263% | -21.9512% | 5.9701% | -3.1746% | 9.0909% | 8.3333% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-28 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.3 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: INMD

2026-02-23 19:18:39

InMode (NASDAQ:INMD) shares gapped down following a prior closing price of $15.22, opening at $14.11, and last trading around $14.01. The company's recent earnings reported $0.46 EPS, beating consensus estimates, but revenue slightly missed expectations. Despite a consensus "Hold" rating from analysts with an average target price of $16.80, the stock has seen varied analyst adjustments, including a recent price target cut by UBS Group.

2026-02-23 15:31:53

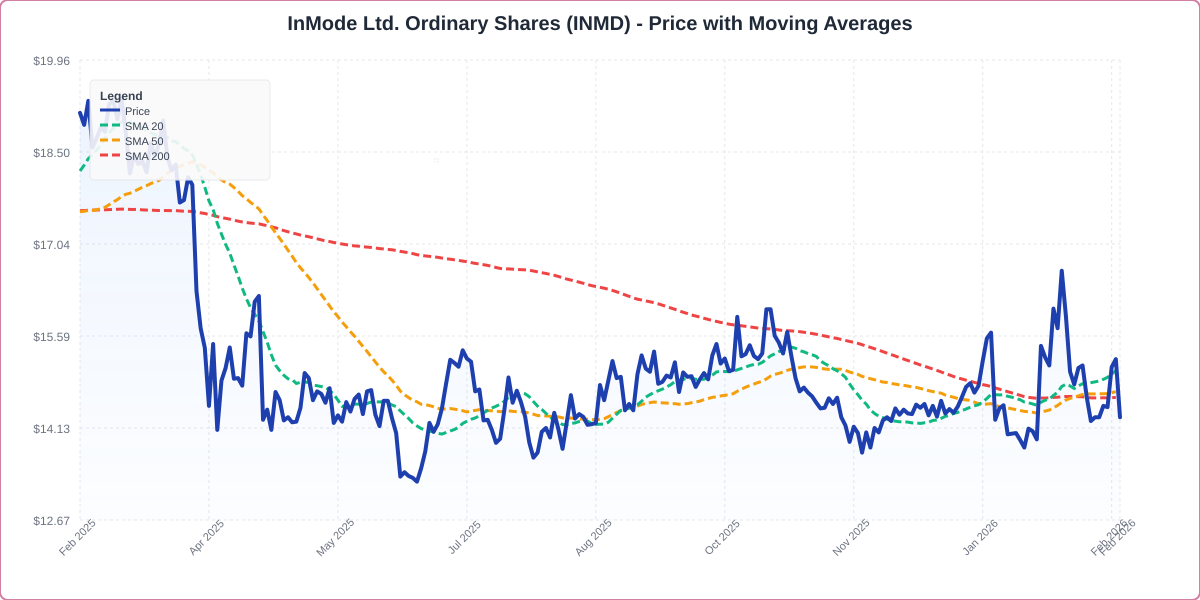

InMode's stock (INMD) fell after its board's special committee concluded its strategic review, determining that none of the proposals for a potential transaction were attractive enough or in the best interests of the company and its shareholders. The company stated it would continue to focus on its business and growth strategy to boost long-term shareholder value and does not plan further public updates on the review outcomes. Technical analysis indicates short-term weakness for INMD shares, trading below key moving averages and showing mixed momentum indicators.

2026-02-23 15:23:39

Shares of InMode Ltd (INMD) are trading lower after its special independent transaction committee concluded its strategic review without pursuing any deal, stating that none of the proposals were adequate. The company intends to continue reviewing its business and growth strategy to enhance long-term shareholder value. Technically, INMD shares show weakness, trading below key moving averages, with a neutral RSI and bearish MACD.

2026-02-23 13:43:56

InMode Ltd. shares dropped in premarket trading after the company announced it discontinued a potential takeover process. Its independent transaction committee concluded that none of the final proposals received were adequate or in the best interests of the company and its shareholders. InMode plans to continue reviewing its business and growth strategy to enhance long-term shareholder value.

2026-02-23 12:31:01

InMode's board committee has concluded its review of potential transactions, determining that all final bids undervalued the company. Consequently, the company will discontinue the process and refocus on enhancing long-term shareholder value through internal growth and cash allocation strategies. InMode does not plan further updates on the terminated review unless deemed necessary.

2026-02-23 12:08:00

InMode Ltd. announced that its independent transaction committee has concluded its review of potential transaction proposals. The committee determined that none of the final proposals were adequate or in the best interests of the company and its shareholders, and has decided to discontinue the process. InMode will now focus on reviewing its business, growth strategy, and cash allocation to enhance long-term shareholder value.