ChipMOS Technologies Inc

$ 39.98

14.00%

24 Feb - close price

- Market Cap 1,222,196,000 USD

- Current Price $ 39.98

- High / Low $ 40.40 / 36.89

- Stock P/E 584.50

- Book Value 1.06

- EPS 0.06

- Next Earning Report 2026-02-24

- Dividend Per Share $1.20

- Dividend Yield 2.38 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.01 %

- 52 Week High 45.43

- 52 Week Low 12.24

About

ChipMOS TECHNOLOGIES INC. The company is headquartered in Hsinchu, Taiwan.

Analyst Target Price

$20.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-19 | 2025-11-04 | 2025-08-12 | 2025-05-09 | 2025-02-22 | 2024-11-05 | 2024-08-13 | 2024-05-09 | 2024-03-21 | 2023-11-02 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0 | 0.333 | -0.75 | 0.1474 | 0.1936 | 0.2544 | 0.3823 | 0.3806 | 0.4112 | 0.5 | 0.56 | 0.18 |

| Estimated EPS | 0.335 | 0.2454 | 0.2895 | 0.18 | 0.4876 | 0.55 | 0.51 | 0.369 | 0.4171 | 0.47 | 0.3326 | 0.16 |

| Surprise | -0.335 | 0.0876 | -1.0395 | -0.0326 | -0.294 | -0.2956 | -0.1277 | 0.0116 | -0.0059 | 0.03 | 0.2274 | 0.02 |

| Surprise Percentage | -100% | 35.6968% | -359.0674% | -18.1111% | -60.2953% | -53.7455% | -25.0392% | 3.1436% | -1.4145% | 6.383% | 68.3704% | 12.5% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Jul 2025 | Jul 2024 | Jul 2023 | Jul 2022 | Sep 2021 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-07-25 | 2024-07-26 | 2023-07-27 | 2022-07-27 | 2021-09-08 | None | None | None | None | None |

| Amount | $0.821535 | $1.11166 | $1.500668 | $2.91941 | $1.5679 | $0.935195 | $0.590963 | $0.134603 | $0.616149 | $1.026972 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: IMOS

2026-02-14 11:57:37

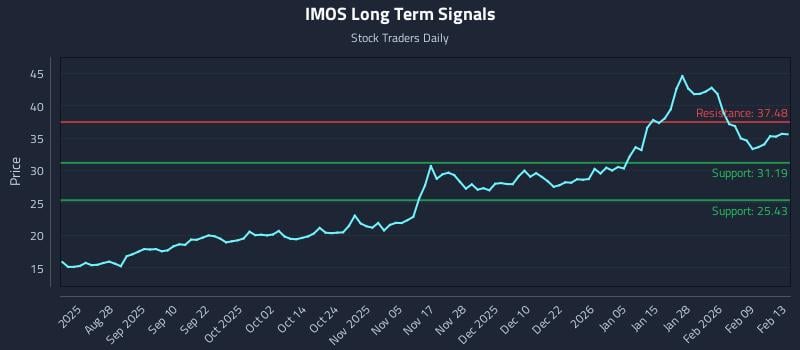

This article provides an in-depth analysis of Chipmos Technologies Inc. (NASDAQ: IMOS), highlighting a positive near-term sentiment within a long-term strong context, despite a potential mid-term weak bias. It details AI-generated trading strategies for different risk profiles, including long, breakout, and short positions, along with multi-timeframe signal analysis. The report also points out an exceptional risk-reward short setup for IMOS.

2026-02-11 05:59:30

Chipmos Technologies (NASDAQ:IMOS) experienced a substantial 82.1% decrease in short interest, falling to 16,094 shares as of January 30th from 89,881 shares on January 15th. This reduction brings the days-to-cover ratio to 0.4 days based on average trading volume, with only 0.1% of the company's stock currently sold short. Alongside this, the company reported strong quarterly EPS of $0.33, beating consensus estimates, and received upgrades from analysts, though the overall MarketBeat consensus remains "Hold."

2026-02-10 11:58:10

ChipMOS Technologies (IMOS), a Taiwan-based semiconductor assembly and test services provider, announced a significant year-on-year revenue increase of 31.2% in January 2026, reaching NT$2,290.4 million ($72.7 million). This surge marks its strongest monthly growth since June 2021, primarily driven by strong demand for high-value memory in AI and data center applications. Despite this robust revenue growth, TipRanks' AI Analyst, Spark, rates IMOS as Neutral due to concerns about weakening profitability, negative free cash flow, and a high valuation, though technical indicators like a strong uptrend and positive momentum offer some counterbalance.

2026-02-10 11:00:00

ChipMOS TECHNOLOGIES INC. announced a significant year-over-year revenue increase of 31.2% for January 2026, reaching NT$2,290.4 million (US$72.7 million). This growth is attributed to the semiconductor industry's improved cycle position and strong demand for high-value memory solutions, particularly for data center and AI applications. The company reported this as its highest year-over-year monthly revenue increase since June 2021.

2026-02-08 11:29:25

Renaissance Group LLC significantly reduced its stake in Chipmos Technologies (NASDAQ:IMOS) by 42.8% in Q3, selling 38,495 shares and retaining 51,394 shares valued at approximately $982,000. Despite this, several other institutions, including Vanguard Personalized Indexing and Creative Planning, increased their positions, bringing the total institutional ownership to 7.39%. Analysts have offered cautiously positive ratings, with the stock trading around $33.56 and reporting strong Q3 EPS figures that surpassed estimates.

2026-02-07 08:58:41

Wall Street Zen has upgraded Chipmos Technologies (NASDAQ:IMOS) from a "buy" to a "strong-buy" rating, while Weiss Ratings also raised its view to "hold." This comes after Chipmos Technologies reported strong quarterly earnings, beating analyst expectations with an EPS of $0.33 against a $0.13 consensus. The company, which operates in semiconductor assembly, testing, and packaging, has a current market capitalization of $1.18 billion and a P/E ratio of 209.75.