International General Insurance Holdings Ltd

$ 25.38

1.48%

24 Feb - close price

- Market Cap 1,079,886,000 USD

- Current Price $ 25.38

- High / Low $ 25.68 / 24.81

- Stock P/E 8.81

- Book Value 16.22

- EPS 2.84

- Next Earning Report 2026-02-24

- Dividend Per Share $0.25

- Dividend Yield 0.98 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.19 %

- 52 Week High 26.69

- 52 Week Low 20.78

About

International General Insurance Holdings Ltd. provides specialized insurance and reinsurance solutions globally. The company is headquartered in Amman, Jordan.

Analyst Target Price

$30.00

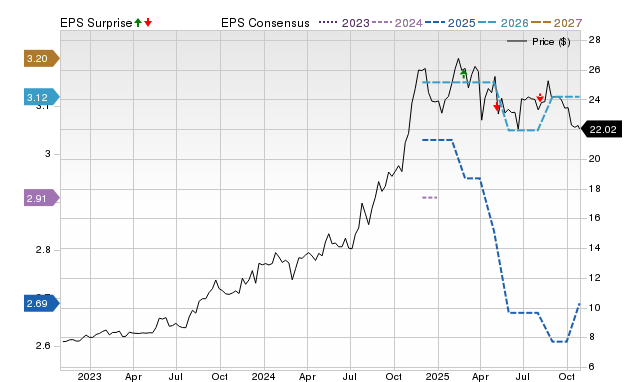

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-24 | 2025-11-04 | 2025-08-05 | 2025-05-07 | 2025-02-25 | 2024-11-05 | 2024-08-06 | 2024-05-07 | 2024-02-29 | 2023-11-14 | 2023-08-15 | 2023-05-16 |

| Reported EPS | 0 | 0.87 | 0.77 | 0.42 | 0.65 | 0.67 | 0.74 | 0.89 | 0.65 | 0.79 | 0.83 | 0.62 |

| Estimated EPS | 0.8154 | 0.86 | 0.6 | 0.47 | 0.66 | 0.56 | 0.62 | 0.67 | 0.62 | 0.5 | 0.59 | 0.3 |

| Surprise | -0.8154 | 0.01 | 0.17 | -0.05 | -0.01 | 0.11 | 0.12 | 0.22 | 0.03 | 0.29 | 0.24 | 0.32 |

| Surprise Percentage | -100% | 1.1628% | 28.3333% | -10.6383% | -1.5152% | 19.6429% | 19.3548% | 32.8358% | 4.8387% | 58% | 40.678% | 106.6667% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.72 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Apr 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Apr 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-31 | 2025-09-16 | 2025-06-18 | 2025-04-22 | 2024-12-18 | 2024-09-18 | 2024-06-20 | 2024-04-22 | 2023-12-14 | 2023-09-14 |

| Amount | $0.05 | $0.05 | $0.05 | $0.875 | $0.025 | $0.025 | $0.025 | $0.51 | $0.01 | $0.01 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: IGIC

2026-02-20 22:03:51

International General Insurance Holdings Ltd (IGIC) is projected to report earnings of 80 cents per share. This is an earnings preview from Refinitiv, indicating upcoming financial results for the company.

2026-02-18 17:27:06

International General Insurance Holdings (IGIC) is facing an expected year-over-year earnings decline despite higher revenues for Q4 2025. This situation puts pressure on management to explain how they will achieve earnings stability during the upcoming earnings call on February 24, as competitive pressures and reinsurance costs are highlighted as risks. The company's investment narrative emphasizes disciplined underwriting and measured growth, with forecasts projecting significant revenue and earnings growth by 2028.

2026-02-18 03:59:31

International General Insurance Holdings Ltd. (IGIC) is projected to report a year-over-year decline in Q4 earnings, despite an expected increase in revenues. The company is anticipated to post $0.72 per share, down 19.1%, with revenues reaching $138.2 million, up 2.2%. With a Zacks Rank #3 and an Earnings ESP of 0%, the article suggests it's difficult to conclusively predict an earnings beat for IGIC.

2026-02-17 16:28:05

International General Insurance Holdings Ltd. (IGIC) is projected to report a year-over-year decline in Q4 earnings, with an estimated EPS of $0.72, down 19.1%. Despite the earnings decline, revenues are expected to increase by 2.2% to $138.2 million. The company currently has an Earnings ESP of 0% and a Zacks Rank #3, making it difficult to conclusively predict an earnings beat.

2026-02-16 21:45:44

International General Insurance Holdings Ltd (IGIC) has made a bullish cross above a critical moving average. The stock's 52-week trading range is $15 to $27.76, with the last trade at $24.22. Analysts forecast a stock price increase, with a "Moderate Buy" rating and price targets from $28 to $32.

2026-02-14 11:27:44

This article analyzes International General Insurance Holdings Ltd. (NASDAQ: IGIC), noting weak near-term sentiment but providing specific trading strategies based on AI models. It outlines entry and exit points for long, momentum breakout, and short positions, along with risk management parameters and multi-timeframe signal analysis. The report highlights an exceptional 18.9:1 risk-reward short setup targeting 5.2% downside.