IDACORP Inc

$ 143.26

-0.13%

24 Feb - close price

- Market Cap 7,752,787,000 USD

- Current Price $ 143.26

- High / Low $ 143.74 / 141.27

- Stock P/E 24.69

- Book Value 65.11

- EPS 5.81

- Next Earning Report 2026-04-30

- Dividend Per Share $3.46

- Dividend Yield 2.47 %

- Next Dividend Date 2026-03-02

- ROA 0.02 %

- ROE 0.09 %

- 52 Week High 145.94

- 52 Week Low 105.98

About

IDACORP, Inc. is dedicated to the generation, transmission, distribution, purchase and sale of electrical energy in the United States. The company is headquartered in Boise, Idaho.

Analyst Target Price

$146.22

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-12 | 2025-10-30 | 2025-07-30 | 2025-04-30 | 2025-02-13 | 2024-10-31 | 2024-08-01 | 2024-05-02 | 2024-02-15 | 2023-11-02 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0.78 | 2.26 | 1.76 | 1.1 | 0.7 | 2.12 | 1.71 | 0.95 | 0.61 | 2.07 | 1.35 | 1.11 |

| Estimated EPS | 0.7334 | 2.25 | 1.67 | 1.048 | 0.6259 | 2.18 | 1.37 | 1.16 | 0.6 | 1.98 | 1.24 | 0.92 |

| Surprise | 0.0466 | 0.01 | 0.09 | 0.052 | 0.0741 | -0.06 | 0.34 | -0.21 | 0.01 | 0.09 | 0.11 | 0.19 |

| Surprise Percentage | 6.354% | 0.4444% | 5.3892% | 4.9618% | 11.839% | -2.7523% | 24.8175% | -18.1034% | 1.6667% | 4.5455% | 8.871% | 20.6522% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-30 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.19 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | May 2025 | Feb 2025 | Dec 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-02 | 2025-12-01 | 2025-09-02 | 2025-05-30 | 2025-02-28 | 2024-12-02 | 2024-08-30 | 2024-05-30 | 2024-02-28 | 2023-11-30 |

| Amount | $0.88 | $0.88 | $0.86 | $0.86 | $0.86 | $0.86 | $0.83 | $0.83 | $0.83 | $0.83 |

Next Dividend Records

| Dividend per share (year): | $3.46 |

| Dividend Yield | 2.47% |

| Next Dividend Date | 2026-03-02 |

| Ex-Dividend Date | 2026-02-05 |

Recent News: IDA

2026-02-22 12:28:00

This article analyzes Idacorp Inc. (IDA) with a focus on its impact on rotational strategy timing, identifying weak near-term sentiment but strong mid and long-term outlooks. It provides detailed AI-generated trading strategies including long, breakout, and short positions with specific entry, target, and stop-loss levels. The analysis also covers multi-timeframe signal strength, support, and resistance levels for the stock.

2026-02-21 01:49:48

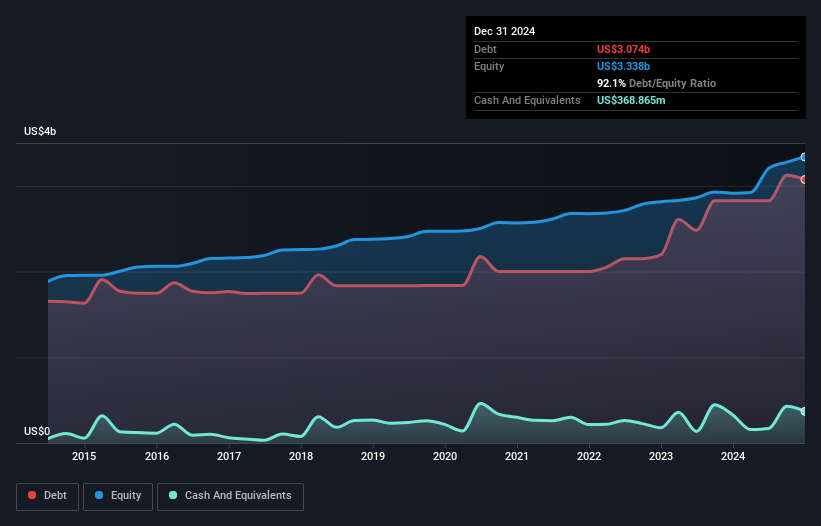

The article discusses IDACORP's debt and financial health, noting that while the company uses debt, its interest coverage is weak, and it has substantial negative free cash flow. Despite an improvement in EBIT, the significant liabilities relative to its market capitalization suggest potential risks for shareholders, leading to a cautious outlook on the stock.

2026-02-20 16:49:32

Mizuho analyst Anthony Crowdell maintained an "Outperform" rating on Idacorp (IDA) and raised its price target to $148.00 from $141.00, indicating a positive outlook. This update comes amidst other recent analyst adjustments, with the average analyst target price for IDA implying a slight upside from its current price, while GuruFocus estimates a potential downside based on its GF Value. Idacorp, an electric utility holding company operating through Idaho Power, continues to be a focus for market analysts.

2026-02-20 16:49:32

IDACORP (IDA) reported strong fourth-quarter 2025 earnings of 78 cents per share, surpassing the Zacks Consensus Estimate by 5.4% and increasing 11.4% year-over-year due to customer growth, rate changes, and lower tax expenses. The company's total revenues reached $405.2 million, up 1.8% from the previous year, although it slightly missed the consensus estimate. IDACORP also provided optimistic 2026 earnings guidance, projecting $6.25-$6.45 per share, and outlined significant capital expenditure plans.

2026-02-20 12:57:58

IDACORP, Inc. reported its Q4 and full-year 2025 earnings, showcasing its 18th consecutive year of EPS growth with diluted earnings per share of $5.90. The company initiated its 2026 EPS guidance at $6.25 to $6.45, reflecting an 8% growth rate over 2025 results. Key highlights include robust customer growth in Idaho Power's service area, significant infrastructure projects like B2H and SWIP-North, and a substantial increase in CapEx forecast to $7 billion over the next five years to support growth and maintain a strong balance sheet.

2026-02-20 00:57:43

IDACORP announced strong financial results for 2025, with increased fourth-quarter and full-year earnings driven by customer growth and rate adjustments. The company also provided an optimistic earnings forecast for 2026, supported by a significant multi-year investment in infrastructure, including new transmission lines and renewable energy projects. These capital expenditures are expected to more than double the average annual spending of the previous five years.