Hilltop Holdings Inc

$ 37.02

-1.17%

05 Mar - close price

- Market Cap 2,297,367,000 USD

- Current Price $ 37.02

- High / Low $ 37.31 / 36.69

- Stock P/E 14.19

- Book Value 36.42

- EPS 2.64

- Next Earning Report 2026-04-23

- Dividend Per Share $0.72

- Dividend Yield 1.9 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.08 %

- 52 Week High 40.20

- 52 Week Low 26.75

About

Hilltop Holdings Inc. provides consumer and commercial banking and financial products and services. The company is headquartered in Dallas, Texas.

Analyst Target Price

$40.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-29 | 2025-10-23 | 2025-07-24 | 2025-04-24 | 2025-01-30 | 2024-10-24 | 2024-07-25 | 2024-04-18 | 2024-01-25 | 2023-10-19 | 2023-07-20 | 2023-04-20 |

| Reported EPS | 0.69 | 0.74 | 0.41 | 0.21 | 0.55 | 0.46 | 0.31 | 0.42 | 0.44 | 0.57 | 0.28 | 0.4 |

| Estimated EPS | 0.44 | 0.49 | 0.41 | 0.27 | 0.28 | 0.37 | 0.26 | 0.25 | 0.4 | 0.48 | 0.4 | 0.25 |

| Surprise | 0.25 | 0.25 | 0 | -0.06 | 0.27 | 0.09 | 0.05 | 0.17 | 0.04 | 0.09 | -0.12 | 0.15 |

| Surprise Percentage | 56.8182% | 51.0204% | 0% | -22.2222% | 96.4286% | 24.3243% | 19.2308% | 68% | 10% | 18.75% | -30% | 60% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-23 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.56 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | Jan 1970 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-27 | 2025-11-21 | 2025-08-29 | 2025-05-22 | 2025-02-27 | 2024-11-22 | 2024-08-30 | None | 2024-02-28 | 2023-11-28 |

| Amount | $0.2 | $0.18 | $0.18 | $0.18 | $0.18 | $0.17 | $0.17 | $0.17 | $0.17 | $0.16 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: HTH

2026-03-06 19:52:26

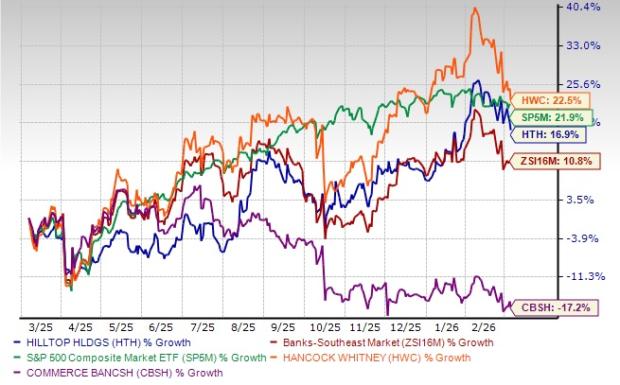

Hilltop Holdings (HTH) has seen its shares rise 16.9% over the past year, outperforming its sector but lagging the S&P 500. The company benefits from increased net interest income, effective cost management, and a strong financial position with investment-grade credit ratings. However, challenges include persistent asset quality concerns, rising credit loss provisions, and underperformance in its mortgage origination division, leading analysts to rate HTH as a Zacks Rank #3 (Hold) due to earnings caution and elevated valuation.

2026-03-06 17:52:26

Hilltop Holdings (HTH) stock has gained 16.9% over the past year, outperforming its industry but underperforming some peers. The article evaluates HTH's fundamentals, highlighting strengths like NII growth, prudent expense management, and a solid balance sheet. However, concerns such as poor asset quality, weak mortgage origination segment performance, and a stretched valuation suggest it's a cautious bet for investors.

2026-03-04 10:52:41

Royce & Associates LP increased its stake in Hilltop Holdings Inc. by 16.9% in the third quarter, purchasing an additional 40,902 shares. Other institutional investors also adjusted their positions in HTH, with hedge funds and institutional investors collectively owning 57.13% of the stock. Insider selling by CEO Martin Bradley Winges and CEO Steve B. Thompson was also reported, while analysts have a "Moderate Buy" consensus rating for the company with a price target of $37.50.

2026-03-03 21:52:42

Hilltop Holdings (HTH) has seen a recent pullback but boasts strong multi-year returns. While Simply Wall St calculates a fair value suggesting it's 3.2% undervalued, its P/E ratio is higher than the industry average, and earnings are forecast to shrink. The article encourages investors to analyze the numbers to make an informed decision.

2026-03-03 13:52:11

Vanguard Group Inc. decreased its stake in Hilltop Holdings Inc. ($HTH) by 2.7% in Q3, selling 141,709 shares, but still holding 8.18% of the company. Hilltop reported a Q3 EPS beat of $0.69 against an estimated $0.46, although revenue missed expectations; the company also raised its quarterly dividend to $0.20. Insider sales were noted from CEO Martin Bradley Winges and Steve B. Thompson, while institutional investors own a significant portion of the stock.

2026-03-03 07:52:11

Hilltop Holdings Inc. (NYSE:HTH) has received a consensus 'Moderate Buy' rating from five research firms, with an average 12-month price target of $37.50. This recommendation comes after the diversified financial services company reported strong Q4 2025 earnings of $0.69 per share, surpassing estimates, and increased its quarterly dividend. The Dallas-based company offers commercial banking, mortgage lending, and capital markets services.