Herc Holdings Inc

$ 148.59

1.64%

24 Feb - close price

- Market Cap 4,878,398,000 USD

- Current Price $ 148.59

- High / Low $ 150.38 / 144.71

- Stock P/E 4873.00

- Book Value 58.50

- EPS 0.03

- Next Earning Report 2026-04-16

- Dividend Per Share $2.80

- Dividend Yield 1.82 %

- Next Dividend Date 2026-03-04

- ROA 0.04 %

- ROE N/A %

- 52 Week High 187.47

- 52 Week Low 94.23

About

Herc Holdings Inc. is an equipment rental provider primarily in the United States and internationally. The company is headquartered in Bonita Springs, Florida.

Analyst Target Price

$177.09

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-17 | 2025-10-28 | 2025-07-21 | 2025-04-21 | 2025-02-11 | 2024-10-22 | 2024-07-23 | 2024-04-23 | 2024-02-13 | 2023-10-23 | 2023-07-25 | 2023-04-20 |

| Reported EPS | 2.07 | 2.22 | 1.87 | 1.3 | 3.58 | 4.35 | 2.6 | 2.36 | 3.24 | 4 | 2.69 | 2.35 |

| Estimated EPS | 1.94 | 2.5 | 2.53 | 2.2119 | 3.9439 | 4.48 | 2.91 | 2.15 | 3.47 | 4.15 | 3.13 | 2.14 |

| Surprise | 0.13 | -0.28 | -0.66 | -0.9119 | -0.3639 | -0.13 | -0.31 | 0.21 | -0.23 | -0.15 | -0.44 | 0.21 |

| Surprise Percentage | 6.701% | -11.2% | -26.087% | -41.227% | -9.2269% | -2.9018% | -10.6529% | 9.7674% | -6.6282% | -3.6145% | -14.0575% | 9.8131% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-16 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.7754 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-04 | 2025-12-26 | 2025-09-05 | 2025-06-13 | 2025-03-04 | 2024-12-27 | 2024-09-06 | 2024-06-14 | 2024-03-07 | 2023-12-26 |

| Amount | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $0.665 | $0.665 | $0.665 | $0.665 | $0.6325 |

Next Dividend Records

| Dividend per share (year): | $2.80 |

| Dividend Yield | 1.82% |

| Next Dividend Date | 2026-03-04 |

| Ex-Dividend Date | 2026-02-18 |

Recent News: HRI

2026-02-24 09:52:55

Herc Holdings (HRI) released its Q4 2025 earnings, which were negatively impacted by its largest-ever acquisition, leading to revenue growth concerns and margin compression. Despite missing revenue and EBITDA estimates, the company beat adjusted EPS expectations. This article highlights five key analyst questions from the earnings call, focusing on synergy realization, specialty growth, and profitability of mega projects, as the company navigates integration and aims for market recovery.

2026-02-22 13:38:01

Herc Holdings Inc. (HRI) stock has risen by 6.21% despite missing Q4 revenue forecasts, driven by strong operational resilience and strategic expansion, including the acquisition of H&E. The company's adjusted EPS of $2.07 exceeded expectations, and robust gross and EBIT margins, alongside significant historical revenue growth, indicate healthy fundamentals. Herc is strategically positioned for future growth, anticipating mid-to-high single-digit rental revenue growth and improved EBITDA in 2026, though high leverage remains a point of caution.

2026-02-21 13:50:42

Herc Holdings Inc. (HRI) saw its stock rise by 6.21% following a strong quarterly earnings report, with adjusted EPS of $2.07 exceeding expectations despite a slight revenue miss. The company's strategic acquisition and promising 2026 guidance, including projected rental revenues between $4.275B and $4.4B, underpin positive analyst sentiment despite high leverage. Technical analysis suggests near-term bullish momentum, with a key support level at $152.5.

2026-02-21 03:21:11

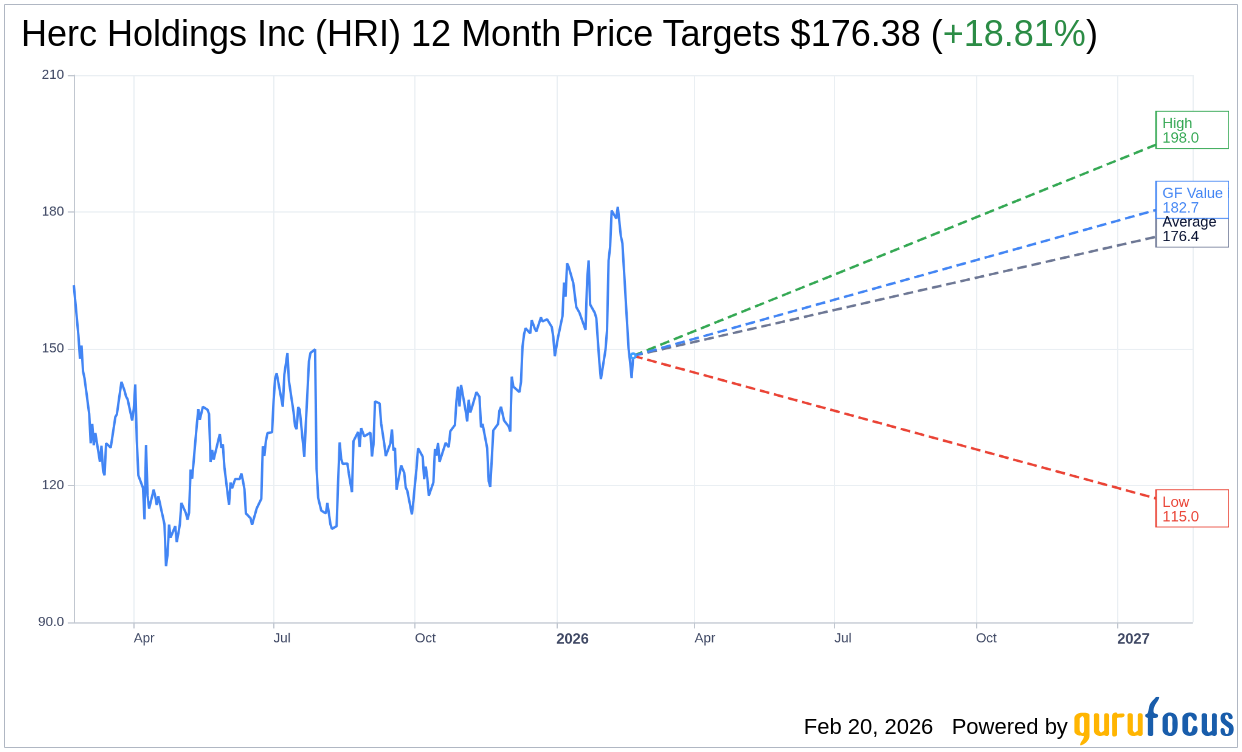

Herc Holdings Inc (HRI) saw its stock price rise by 3.38% on February 20, reaching an intraday high of $148.80 before closing at $148.45. This places HRI 21.18% below its 52-week high and 54.34% above its 52-week low. Analyst forecasts suggest an average target price of $176.38, implying an 18.81% upside, while GuruFocus estimates a fair value of $182.67, indicating a 23.05% upside.

2026-02-20 22:01:02

Herc Holdings Inc. (HRI) has seen its stock price target raised by Wells Fargo and Barclays, reflecting confidence in the company's performance despite a recent stock drop. The company reported strong Q4 2025 EPS, driven by the H&E acquisition, and anticipates healthy revenue growth for 2026, though high debt levels and market volatility pose challenges. Analysts maintain a neutral sentiment, advising caution due to mixed financial fundamentals and market dynamics.

2026-02-20 20:50:49

Herc Holdings Inc. (HRI) is reporting strong Q4 performance with a 6.87% stock increase, driven by fleet expansion and strategic acquisitions. Despite high debt-to-equity, the company shows operational efficiency and promising profitability, with analysts projecting positive growth for 2026. Key financial insights include resilient revenue growth, significant free cash flow, and outperformance of industry benchmarks, positioning HRI for aggressive market share expansion.