Hope Bancorp Inc

$ 11.63

1.48%

24 Feb - close price

- Market Cap 1,490,985,000 USD

- Current Price $ 11.63

- High / Low $ 11.66 / 11.39

- Stock P/E 24.23

- Book Value 17.81

- EPS 0.48

- Next Earning Report 2026-04-28

- Dividend Per Share $0.56

- Dividend Yield 4.89 %

- Next Dividend Date -

- ROA N/A %

- ROE 0.03 %

- 52 Week High 12.65

- 52 Week Low 8.37

About

Hope Bancorp, Inc. is the bank holding company for Bank of Hope providing banking services for small and medium-sized businesses and individuals in the United States. The company is headquartered in Los Angeles, California.

Analyst Target Price

$13.12

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-27 | 2025-10-27 | 2025-07-22 | 2025-04-22 | 2025-01-27 | 2024-10-28 | 2024-07-29 | 2024-04-29 | 2024-01-30 | 2023-10-23 | 2023-07-24 | 2023-04-24 |

| Reported EPS | 0.27 | 0.25 | 0.19 | 0.19 | 0.2 | 0.21 | 0.22 | 0.23 | 0.24 | 0.25 | 0.32 | 0.33 |

| Estimated EPS | 0.25 | 0.26 | 0.21 | 0.19 | 0.2 | 0.22 | 0.22 | 0.26 | 0.21 | 0.26 | 0.3 | 0.37 |

| Surprise | 0.02 | -0.01 | -0.02 | 0 | 0 | -0.01 | 0 | -0.03 | 0.03 | -0.01 | 0.02 | -0.04 |

| Surprise Percentage | 8% | -3.8462% | -9.5238% | 0% | 0% | -4.5455% | 0% | -11.5385% | 14.2857% | -3.8462% | 6.6667% | -10.8108% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-28 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.2267 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-20 | 2025-11-21 | 2025-08-15 | 2025-05-16 | 2025-02-20 | 2024-11-21 | 2024-08-22 | 2024-05-23 | 2024-02-23 | 2023-11-16 |

| Amount | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: HOPE

2026-02-14 08:58:26

Hope Bancorp (NASDAQ:HOPE) stock has crossed above its 200-day moving average, signaling a bullish technical move. The company recently beat Q4 earnings estimates, reporting $0.27 EPS on revenue of $145.76 million, and declared a quarterly dividend of $0.14 per share, resulting in a 4.6% annualized yield. Analysts have a "Hold" consensus rating with an average target price of $13.75, reflecting mixed sentiments.

2026-02-14 06:32:00

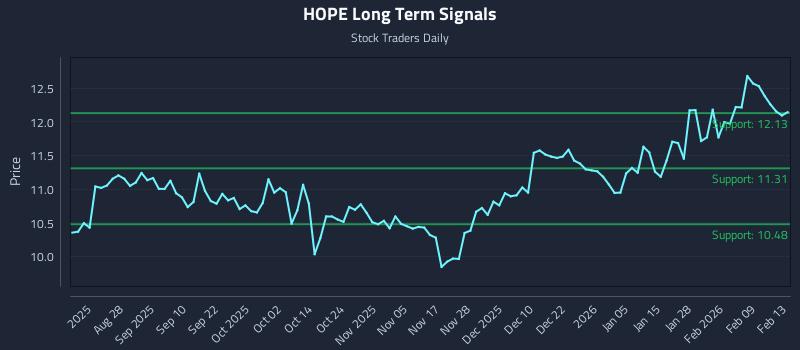

This article discusses the integration of Hope Bancorp Inc. (NASDAQ: HOPE) movement as an input in quantitative signal sets, providing an analysis of its near, mid, and long-term outlook. It details three AI-generated institutional trading strategies: a Position Trading Strategy, a Momentum Breakout Strategy, and a Risk Hedging Strategy, along with multi-timeframe signal analysis. The piece highlights key findings for HOPE, including weak near-term sentiment and elevated downside risk, while offering access to real-time signals and personalized alerts for ongoing analysis.

2026-02-10 02:27:17

An independent director at Hope Bancorp (NASDAQ: HOPE) recently sold shares worth US$708k, reducing their holding by 8.8%. While this was the largest insider sale in the last year, the sale price was close to the current share price. Insiders currently own 4.6% of the company, but there have been no insider share purchases in the last year.

2026-02-09 10:59:23

An independent director at Hope Bancorp (NASDAQ:HOPE) recently sold shares worth US$708k, reducing their holding by 8.8%. While this is the largest insider sale in the last year at the current stock price, insiders have not purchased any shares in the past year, and their overall ownership remains moderate at 4.6%. The article suggests that while insider selling is generally a negative sign, the current sale is not alarming, but advises investors to consider other risk factors before making investment decisions.

2026-02-09 10:59:14

An independent director at Hope Bancorp (NASDAQ:HOPE) recently sold US$708k worth of shares, reducing their holding by 8.8%. While this was the largest insider sale in the last year, the sale price was close to the current share price. Insiders have not purchased any shares in the last year, and despite owning 4.6% of the company, the selling trend raises concerns for potential investors.

2026-02-07 03:42:38

Hope Bancorp director Ha Daisy Y sold 56,553 shares of common stock across two transactions on February 5th and 6th, 2026, totaling approximately $708,083. Following these sales, the director still holds a significant amount of Hope Bancorp stock directly and indirectly. The sales occurred after Hope Bancorp reported strong fourth-quarter 2025 earnings which surpassed Wall Street expectations, leading to a rise in stock price.