Hagerty Inc

$ 11.39

-1.64%

24 Feb - close price

- Market Cap 3,975,423,000 USD

- Current Price $ 11.39

- High / Low $ 11.63 / 11.35

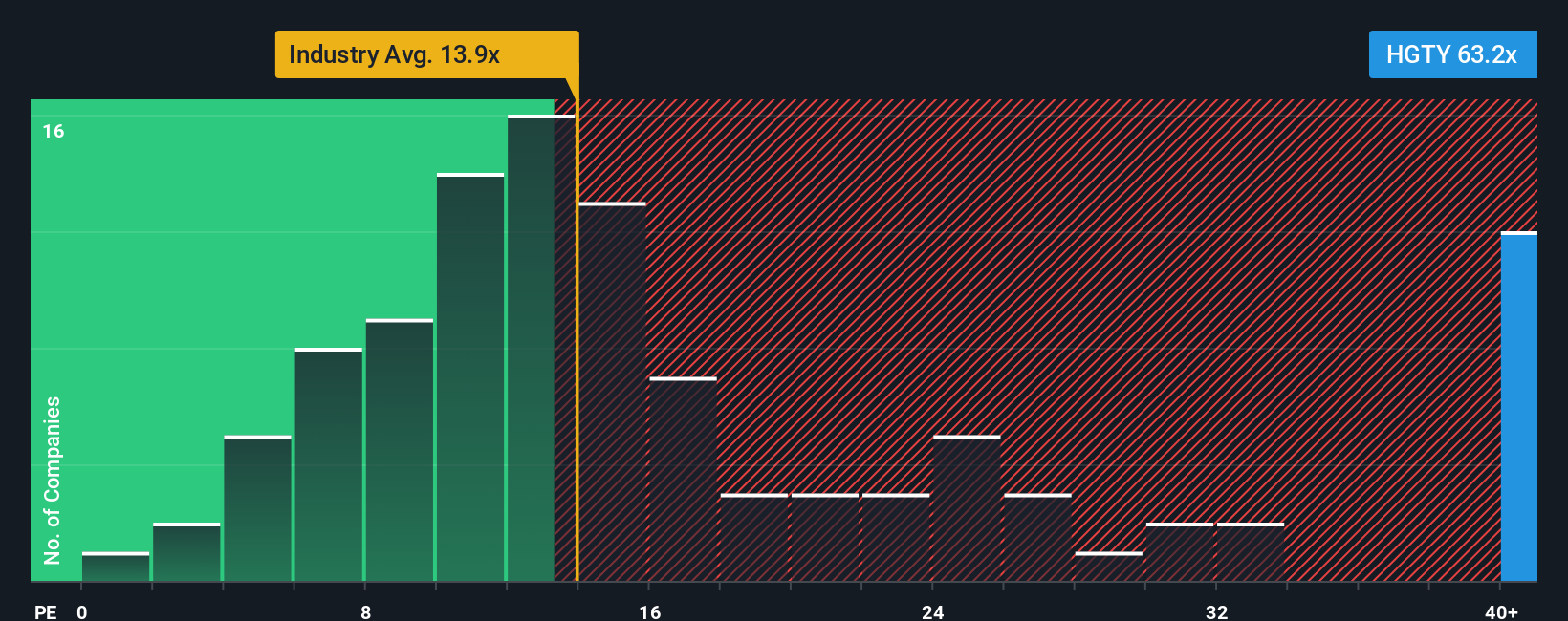

- Stock P/E 38.60

- Book Value 2.11

- EPS 0.30

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.18 %

- 52 Week High 14.00

- 52 Week Low 8.03

About

Hagerty Inc. is a premier specialty insurance provider dedicated to the automotive enthusiast market, delivering comprehensive coverage for vintage cars, motorcycles, and collectible vehicles. Employing a subscription-based model, Hagerty not only offers robust insurance solutions but also fosters a dynamic community of car aficionados through events and digital engagement. With its expertise in the collector car landscape, the company has established itself as a trusted partner, expanding its offerings to include valuation tools and investment opportunities. As demand for classic car insurance escalates, Hagerty’s innovative strategies and strong brand loyalty position it for sustained growth in the lucrative niche of automotive collectibles.

Analyst Target Price

$13.67

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-04 | 2025-08-04 | 2025-05-05 | 2025-03-10 | 2024-11-07 | 2024-08-06 | 2024-05-07 | 2024-03-12 | 2023-11-08 | 2023-08-08 | 2023-05-09 | 2023-03-14 |

| Reported EPS | 0.11 | 0.09 | 0.08 | 0.02 | 0.05 | 0.09 | -0.04 | 0.03 | 0.04 | 0.03 | -0.03 | -0.06 |

| Estimated EPS | 0.08 | 0.11 | 0.0225 | 0.0068 | 0.38 | 0.38 | 0.09 | -0.02 | 0.06 | 0.09 | -0.25 | -0.08 |

| Surprise | 0.03 | -0.02 | 0.0575 | 0.0132 | -0.33 | -0.29 | -0.13 | 0.05 | -0.02 | -0.06 | 0.22 | 0.02 |

| Surprise Percentage | 37.5% | -18.1818% | 255.5556% | 194.1176% | -86.8421% | -76.3158% | -144.4444% | 250% | -33.3333% | -66.6667% | 88% | 25% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.04 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: HGTY

2026-02-17 03:27:49

Hagerty, Inc. has expanded its senior leadership team by promoting Marc Burns to Chief Marketing Officer and appointing Matt Teshera as Senior Vice President of Marketing, aiming to boost brand awareness and membership. This move is expected to refine its tiered membership model and enhance data-driven insights. Investors will closely watch Hagerty's upcoming Q4 2025 results on February 26, 2026, to assess whether these marketing efforts translate into improved unit economics and justify its current valuation.

2026-02-15 15:27:16

Hagerty (HGTY) has appointed new marketing leaders, Marc Burns and Matt Teshera, to focus on membership experience and brand efforts, aiming to grow and retain its member base. The company's stock has seen recent easing, with a modest valuation gap pointing to it being 11.8% undervalued based on a fair value of $13.67. However, its current P/E of 36.4x is considerably higher than the industry average, suggesting high market expectations and potential risks.

2026-02-14 05:32:00

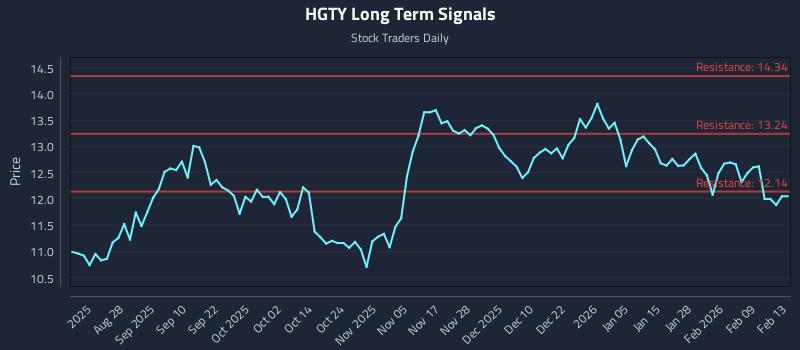

This article analyzes Hagerty Inc. (NASDAQ: HGTY) using AI models, highlighting weak near and mid-term sentiment despite a positive long-term outlook. It identifies key support and resistance levels across different time horizons and offers three distinct institutional trading strategies: Position Trading, Momentum Breakout, and Risk Hedging, all incorporating risk management for optimized position sizing. The analysis emphasizes the importance of real-time signals for traders.

2026-02-13 03:27:49

Hagerty, Inc. (NYSE: HGTY) announced it will release its fourth quarter 2025 financial results before the market opens on Thursday, February 26, 2026. The company will host a conference call on the same day at 10:00 am Eastern Time to discuss these results, with a live webcast available on their investor relations website. Hagerty, which focuses on classic car insurance and enthusiast services, also provided a brief overview of its operations.

2026-02-10 04:57:26

Hagerty, Inc. (NYSE: HGTY) has launched a free ad-supported (FAST) channel on Prime Video, making its award-winning automotive enthusiast content available 24/7. The channel will feature popular shows like "ICONS," "Revelations," and "Barn Find Hunter," expanding Hagerty's reach for car lovers. This initiative aims to enhance the driving enthusiast experience by providing easy access to hundreds of hours of high-quality, original programming.

2026-02-08 16:27:05

This article highlights recent bullish sentiments from analysts regarding two financial companies: Gemini Space Station, Inc. Class A (GEMI) and Hagerty Inc Class A (HGTY). Matthew Coad from Truist Financial maintained a Buy rating on GEMI with an average price target of $17.00, while Michael Phillips CFA from Oppenheimer reiterated a Buy rating on HGTY with a $15.00 price target, both suggesting significant upside potential.