Good Times Restaurants Inc

$ 1.16

2.20%

26 Dec - close price

- Market Cap 12,284,900 USD

- Current Price $ 1.16

- High / Low $ 1.25 / 1.15

- Stock P/E 11.60

- Book Value 3.13

- EPS 0.10

- Next Earning Report 2026-02-05

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.04 %

- 52 Week High 2.65

- 52 Week Low 1.10

About

Good Times Restaurants Inc. (GTIM) is a dynamic player in the fast-casual dining industry, based in Lakewood, Colorado. The company sets itself apart with a diverse menu that emphasizes quality and innovation, catering to an expansive customer base while prioritizing exceptional service. With a strategic focus on market expansion and adaptability to emerging trends in food service, Good Times Restaurants is strategically positioned to enhance its competitive advantages and drive sustainable growth in a rapidly evolving market landscape.

Analyst Target Price

$5.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-12-18 | 2025-08-07 | 2025-04-30 | 2025-01-29 | 2024-12-12 | 2024-08-01 | 2024-05-02 | 2024-01-31 | 2023-12-14 | 2023-08-03 | 2023-05-09 | 2023-02-02 |

| Reported EPS | None | 0.14 | -0.0587 | 0.0152 | 0.0212 | 0.1197 | 0.055 | -0.05 | -0.02 | 0.07 | 0.8937 | -0.01 |

| Estimated EPS | None | 0 | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | 0.14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-05 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GTIM

2025-12-26 02:10:37

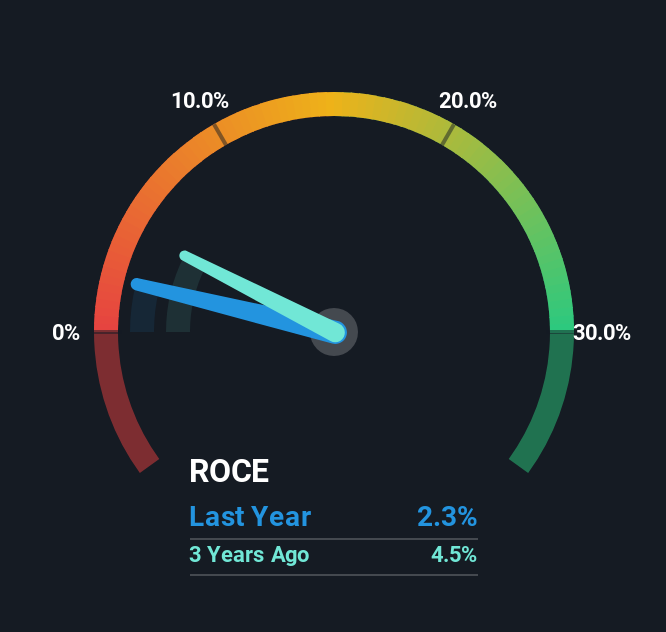

Good Times Restaurants (NASDAQ:GTIM) is showing promising trends in its Return on Capital Employed (ROCE). Although its current ROCE of 2.3% is lower than the industry average, it has increased by 98% over the last five years using roughly the same amount of capital, indicating improved efficiency without additional investment. This efficiency growth could make the company an appealing investment, especially given its 61% stock decline over the past five years.

2025-12-25 02:11:43

Good Times Restaurants Inc. reported a challenging Q4 2025 with revenue declines and increased costs, leading to a net loss and negative adjusted EBITDA. Despite these difficulties, the company saw sequential improvements in same-store sales and is implementing strategic initiatives like operational improvements, targeted value promotions, and loyalty program enhancements to drive future growth. Management expressed optimism for Q1 2026, anticipating improved sales and profitability.

2025-12-23 23:09:41

Good Times Restaurants Inc. (GTIM) reported a challenging Q4 2025 with revenues down 5.1% to $34 million and a net loss of $3,000 to common shareholders. Despite this, the company's stock rose 4% in aftermarket trading, signaling investor optimism for future improvements. Good Times anticipates improvements in same-store sales and Adjusted EBITDA in Q1 2026, driven by new product strategies, operational enhancements, and modest price increases.

2025-12-23 22:09:41

Good Times Restaurants Inc. reported a fiscal fourth-quarter loss of $3,000, with a per-share loss of less than 1 cent on revenue of $34 million. For the full year, the company posted a profit of $1 million, or 10 cents per share, on revenue of $141.6 million.

2025-12-23 21:09:41

Good Times Restaurants (GTIM) reported a fall in its fiscal year revenue. This short news item from Refinitiv provides a headline only, indicating financial performance for the company.

2025-12-23 21:09:41

Good Times Restaurants Inc. (Nasdaq: GTIM) reported its financial results for the fiscal fourth quarter and full fiscal year ended September 30, 2025. The company saw a 0.5% decrease in total revenues for the year, alongside decreases in same-store sales for both its Good Times and Bad Daddy’s brands. Despite a net loss attributable to common shareholders in the fourth quarter, the fiscal year concluded with a net income of $1.0 million, and management expressed optimism for improved performance in fiscal 2026.