Genmab AS

$ 29.24

-0.17%

26 Feb - close price

- Market Cap 18,049,249,000 USD

- Current Price $ 29.24

- High / Low $ 29.25 / 28.80

- Stock P/E 19.02

- Book Value 94.89

- EPS 1.54

- Next Earning Report 2026-05-07

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.08 %

- ROE 0.18 %

- 52 Week High 35.43

- 52 Week Low 17.23

About

Genmab A / S develops antibody therapies for the treatment of cancer and other diseases mainly in Denmark. The company is headquartered in Copenhagen, Denmark.

Analyst Target Price

$37.39

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-17 | 2025-11-06 | 2025-08-07 | 2025-05-08 | 2025-02-12 | 2024-11-06 | 2024-08-08 | 2024-05-02 | 2024-02-14 | 2023-11-07 | 2023-08-03 | 2023-05-10 |

| Reported EPS | 0.21 | 0.65 | 0.54 | 0.31 | 0.84 | 0.29 | 0.32 | 0.29 | 0.14 | 0.46 | 0.3 | 0.05 |

| Estimated EPS | 0.37 | 0.45 | 0.34 | 0.2 | 0.28 | 0.33 | 0.32 | 0.14 | 0.3 | 0.31 | 0.29 | 0.15 |

| Surprise | -0.16 | 0.2 | 0.2 | 0.11 | 0.56 | -0.04 | 0 | 0.15 | -0.16 | 0.15 | 0.01 | -0.1 |

| Surprise Percentage | -43.2432% | 44.4444% | 58.8235% | 55% | 200% | -12.1212% | 0% | 107.1429% | -53.3333% | 48.3871% | 3.4483% | -66.6667% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-07 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.14 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GMAB

2026-02-26 08:52:31

Genmab A/S has increased its share capital through the exercise of employee warrants. The new shares will be officially listed and admitted to trading on Nasdaq Copenhagen A/S as of February 27, 2026, under ISIN DK0010272202. The total volume of shares after the change will be 64,250,721, with various subscription prices for the newly issued 12,313 shares.

2026-02-25 03:14:00

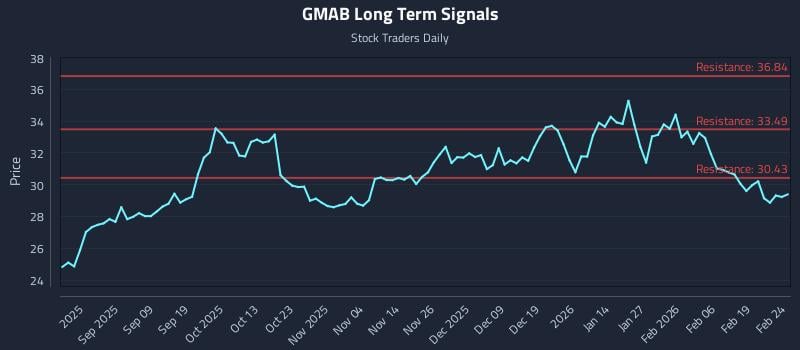

This article from Stock Traders Daily provides a detailed AI-driven analysis of Genmab A/s (GMAB), highlighting weak near and mid-term sentiment despite a long-term positive outlook. It outlines specific institutional trading strategies — Position, Momentum Breakout, and Risk Hedging — with precise entry, target, and stop-loss zones. The analysis also includes multi-timeframe signal strengths, support, and resistance levels for GMAB.

2026-02-23 16:42:46

Genmab has initiated a first-in-human Phase 1 clinical trial for GEN1106, an intravenous biological drug targeting solid tumors, including urothelial cancer. This open-label study aims to assess the safety, pharmacokinetics, and early efficacy of GEN1106, broadening Genmab's oncology pipeline. While still in early development, this initiative supports a long-term growth narrative for Genmab by investing in new solid tumor candidates.

2026-02-23 15:42:46

Genmab, a global biotech specializing in antibody medicines, announced initial transactions under its February 2026 share buy-back program. The company repurchased 63,000 shares for DKK 115.2 million between February 18 and 20, 2026, increasing its treasury holdings to 4.17% of share capital. Analysts currently rate GMAB as a Buy with a $40.00 price target, and TipRanks’ AI Analyst, Spark, rates it Outperform due to strong financial performance and strategic initiatives.

2026-02-23 15:33:17

Genmab A/S announced transactions under its share buy-back program from February 18 to February 20, 2026, repurchasing shares for a total value of DKK 115,224,550. This program aims to repurchase up to 342,130 shares with a maximum total value of DKK 725 million to fulfill commitments under the Restricted Stock Unit program. Following these transactions, Genmab holds 4.17% of its total share capital as treasury shares.

2026-02-23 14:42:46

Genmab A/S initiated a share buy-back program to repurchase up to 342,130 shares with a maximum value of DKK 725 million, expected to be completed by March 31, 2026. This program honors commitments under the Restricted Stock Unit program. Between February 18 and February 20, 2026, the company executed transactions worth DKK 115,224,550, leading Genmab to hold 2,678,851 treasury shares, representing 4.17% of total share capital.