Gilat Satellite Networks Ltd

$ 15.52

8.08%

24 Feb - close price

- Market Cap 1,050,572,000 USD

- Current Price $ 15.52

- High / Low $ 15.67 / 14.53

- Stock P/E 42.24

- Book Value 7.69

- EPS 0.34

- Next Earning Report 2026-05-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.05 %

- 52 Week High 20.38

- 52 Week Low 5.30

About

Gilat Satellite Networks Ltd. (GILT) is a premier global provider of satellite-based communications solutions, serving various sectors including telecommunications, government, and enterprise. The company emphasizes innovation and delivers an extensive range of products and services, such as satellite infrastructure, ground systems, and broadband connectivity. Renowned for its high-performance satellite broadband services, Gilat plays a crucial role in disaster recovery and rural connectivity initiatives. With a strong technology portfolio and strategic partnerships, Gilat is strategically positioned to leverage the increasing demand for global broadband access and the expansion of satellite communication networks.

Analyst Target Price

$19.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-10 | 2025-11-12 | 2025-08-06 | 2025-05-19 | 2025-02-24 | 2024-11-13 | 2024-08-07 | 2024-05-08 | 2024-02-26 | 2023-11-06 | 2023-08-08 | 2023-05-09 |

| Reported EPS | 0.2 | 0.19 | 0.21 | 0.03 | 0.15 | 0.14 | 0.02 | 0.09 | 0.06 | 0.18 | 0.08 | 0.07 |

| Estimated EPS | 0.13 | 0.1 | 0.04 | 0.07 | 0.125 | 0.05 | 0.04 | 0.06 | 0.07 | 0.04 | 0.03 | -0.01 |

| Surprise | 0.07 | 0.09 | 0.17 | -0.04 | 0.025 | 0.09 | -0.02 | 0.03 | -0.01 | 0.14 | 0.05 | 0.08 |

| Surprise Percentage | 53.8462% | 90% | 425% | -57.1429% | 20% | 180% | -50% | 50% | -14.2857% | 350% | 166.6667% | 800% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-25 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.105 |

| Currency | USD |

Previous Dividend Records

| Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|

| Payment Date | None | None | None |

| Amount | $0.63 | $0.36 | $0.45 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GILT

2026-02-23 15:20:07

Gilat Satellite Networks saw its stock rise by 7.4% after announcing new defense orders totaling $25 million and providing a 2026 revenue outlook of $500 million to $520 million. While the company demonstrates strong top-line growth, particularly in defense, its profitability metrics and net income have not kept pace with the sharp increase in sales. Investors are encouraged to consider multiple perspectives and Gilat's overall financial health, as fair value estimates vary significantly.

2026-02-23 15:13:51

Gilat Satellite Networks saw its stock rise 7.4% after announcing new defense orders totaling US$25 million and providing 2026 revenue guidance of US$500 million to US$520 million. While these developments support the company's near-term growth, the article notes that profitability has not kept pace with rising sales, suggesting a need for better margin management. Investors are encouraged to consider diverse fair value estimates and the company's fundamental analysis before making investment decisions.

2026-02-20 14:28:30

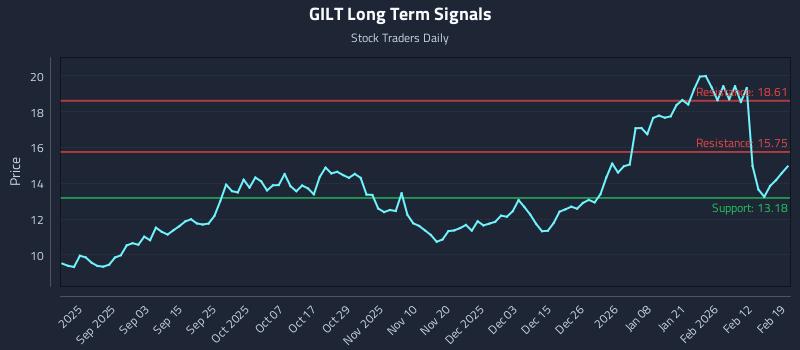

This article provides an AI-generated analysis of Gilat Satellite Networks Ltd. (NASDAQ: GILT), highlighting a positive near-term sentiment within a long-term strength context, despite a mid-term weak bias. It details exceptional risk-reward setups, institutional trading strategies (position, momentum, and risk hedging), and multi-timeframe signal analysis for GILT, indicating support and resistance levels. The report also offers real-time signals and personalized alerts for subscribers.

2026-02-19 12:57:46

Gilat Satellite Networks has secured a $9 million contract from Israel's Ministry of Defense to supply and integrate advanced satellite communication (SATCOM) systems for military use. This agreement includes next-generation defense modems and related services, designed for mission-critical operations in harsh environments. This latest contract reinforces the ongoing investment by Israel's defense sector in robust SATCOM technologies, following similar deals in previous years with Gilat, Elbit Systems, and Orbit Communication Systems.

2026-02-19 07:27:30

Gilat Satellite Networks secured a $9 million contract from Israel's Ministry of Defense to supply and integrate advanced SATCOM systems for military applications. This deal, awarded to Gilat's defense division, involves providing next-generation modems and services for mission-critical operations in challenging environments. The contract highlights Israel's ongoing investment in SATCOM, following similar awards to Gilat, Elbit Systems, and Orbit Communication Systems in recent years, aimed at strengthening secure and flexible connectivity for its defense forces.

2026-02-18 16:27:30

Gilat Satellite Networks Ltd. secured a $9 million order from Israel’s Ministry of Defense to supply and integrate defense satellite communication (SATCOM) modems and services. These modems are designed for secure communications and to scale SATCOM systems for defense operations, being suitable for harsh operational environments. Gilat Defense, the company's defense division, will be responsible for executing the work.