Genesis Energy LP

$ 15.59

-0.19%

26 Dec - close price

- Market Cap 1,909,219,000 USD

- Current Price $ 15.59

- High / Low $ 15.85 / 15.33

- Stock P/E N/A

- Book Value -2.44

- EPS -1.31

- Next Earning Report 2026-02-12

- Dividend Per Share $0.66

- Dividend Yield 4.23 %

- Next Dividend Date -

- ROA 0.03 %

- ROE -0.03 %

- 52 Week High 17.59

- 52 Week Low 9.50

About

Genesis Energy, LP (GEL) is a prominent midstream service provider based in Houston, Texas, specializing in the transportation, storage, and marketing of crude oil and natural gas. The company's extensive infrastructure network, which includes an array of pipelines and terminals, enables it to effectively respond to the increasing global energy demand while prioritizing operational efficiency and sustainability. With a strong management team focused on capital discipline and strategic growth initiatives, Genesis Energy is well-positioned to deliver long-term value to shareholders, presenting an attractive investment opportunity for institutional investors in today's evolving energy market.

Analyst Target Price

$19.33

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-07-31 | 2025-05-08 | 2025-02-13 | 2024-10-31 | 2024-08-01 | 2024-05-02 | 2024-02-15 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-02-22 |

| Reported EPS | -0.05 | -0.12 | -4.06 | -0.58 | -0.32 | -0.25 | -0.09 | -0.08 | 0.29 | 0.22 | -0.21 | 0.15 |

| Estimated EPS | 0.13 | -0.04 | -0.23 | -0.31 | -0.1 | -0.03 | 0.01 | 0.23 | 0.25 | 0.27 | 0.13 | 0.15 |

| Surprise | -0.18 | -0.08 | -3.83 | -0.27 | -0.22 | -0.22 | -0.1 | -0.31 | 0.04 | -0.05 | -0.34 | 0 |

| Surprise Percentage | -138.4615% | -200% | -1665.2174% | -87.0968% | -220% | -733.3333% | -1000% | -134.7826% | 16% | -18.5185% | -261.5385% | 0% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Jan 1970 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | Aug 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-14 | None | 2025-05-15 | 2025-02-14 | 2024-11-14 | 2024-08-14 | 2024-05-15 | 2024-02-14 | 2023-11-14 | 2023-08-14 |

| Amount | $0.165 | $0.165 | $0.165 | $0.165 | $0.165 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GEL

2025-12-19 11:10:19

Genesis Energy, L.P. recently reported a US$9.2 million net profit for fiscal Q3 2025, largely due to strong performance in its offshore pipeline transportation segment. This offshore-driven turnaround is a key aspect of Genesis Energy's investment narrative, with RBC Capital highlighting offshore volume growth and improved cash generation. However, investors need to consider the sustainability of this recovery and other financial factors like leverage and distribution coverage.

2025-12-19 10:09:39

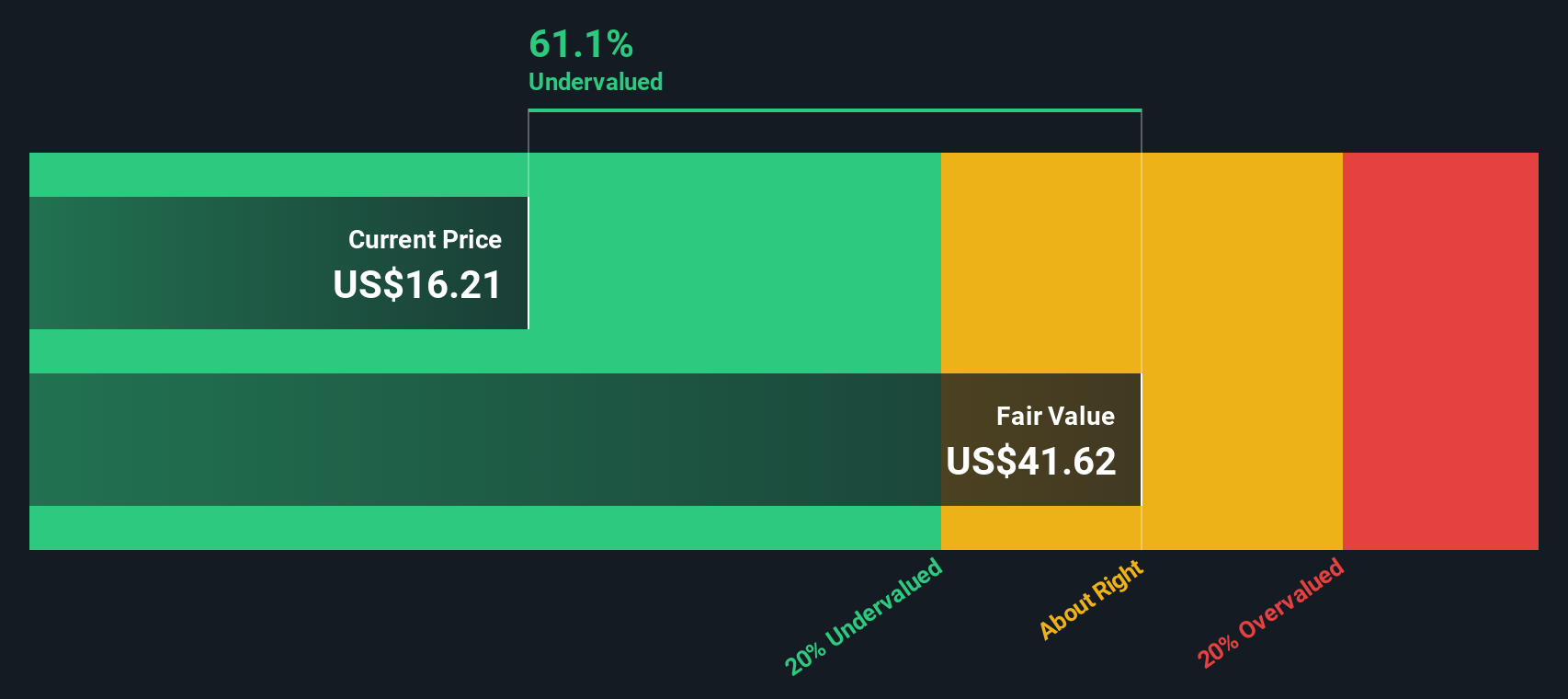

Genesis Energy (GEL) recently reported a Q3 2025 net profit of US$9.2 million, largely driven by its offshore pipeline transportation segment. This turnaround is seen as a key factor in offsetting a patchy profit record and tight balance sheet, prompting firms like RBC Capital to maintain positive commentary. The sustainability of this offshore-driven recovery and its impact on leverage, distribution, and capital needs will be crucial for investors, especially with the stock trading above its estimated fair value.

2025-12-19 07:09:16

Genesis Energy, L.P. recently reported a Q3 2025 net profit of US$9.2 million, largely due to strong performance in its offshore pipeline transportation segment. This offshore-driven turnaround is central to the company's investment narrative, with RBC Capital highlighting volume growth and improved cash generation. However, the sustainability of this recovery and its impact on the annualized distribution, given the tight balance sheet and less than one year of cash runway, remain key factors for investors.

2025-12-18 10:09:20

Chickasaw Capital Management LLC has reduced its stake in Genesis Energy, L.P. (NYSE:GEL) by 19.9% in the third quarter, selling 705,589 shares and now holding 2,845,825 shares, making it their 10th largest holding. Despite this reduction, institutional investors collectively own 66.82% of Genesis Energy, with other firms like MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increasing their positions. Analysts currently have a "Moderate Buy" rating with a target price of $19.50 for GEL, even though the company recently reported an EPS miss and negative profitability metrics, while offering a 4.2% dividend yield.

2025-12-15 09:09:05

Genesis Energy (GEL) has seen a significant turnaround, reporting a $9.2 million profit in Q3 and a nearly 48% year-to-date share price return. Despite trading at a heavy discount to analyst targets and a low price-to-sales ratio of 0.7x compared to industry averages, there's a tension with a fair price-to-sales ratio estimated at 0.3x, suggesting potential overvaluation based purely on fundamentals. However, a DCF model indicates the stock could be deeply undervalued, with a fair value around $47.95 per unit, three times its current price.

2025-12-14 23:45:00

Genesis Energy, L.P. (GEL) has seen a more than 52% increase year-to-date, with RBC Capital reiterating a Buy rating and a $20 price target. This bullish sentiment is driven by strong fiscal Q3 2025 results, demonstrating a net income of $9.2 million, and potential growth in offshore volumes. The company's offshore pipeline transportation segment was a key contributor to its financial performance.