Green Dot Corporation

$ 11.64

-1.36%

05 Mar - close price

- Market Cap 646,586,000 USD

- Current Price $ 11.64

- High / Low $ 11.83 / 11.48

- Stock P/E N/A

- Book Value 16.48

- EPS -0.84

- Next Earning Report 2026-03-12

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.05 %

- 52 Week High 15.41

- 52 Week Low 6.12

About

Green Dot Corporation is a banking and fintech holding company in the United States. The company is headquartered in Pasadena, California.

Analyst Target Price

$16.12

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-10 | 2025-08-11 | 2025-05-07 | 2025-02-25 | 2024-11-07 | 2024-08-08 | 2024-05-09 | 2024-02-27 | 2023-11-09 | 2023-08-03 | 2023-05-04 | 2023-02-23 |

| Reported EPS | 0.06 | -0.85 | 1.06 | 0.4 | 0.13 | 0.25 | 0.59 | 0.14 | 0.14 | 0.37 | 0.99 | 0.34 |

| Estimated EPS | -0.07 | 0.3 | 0.7066 | 0.3482 | 0.17 | 0.23 | 0.73 | 0.17 | 0.21 | 0.36 | 0.8 | 0.22 |

| Surprise | 0.13 | -1.15 | 0.3534 | 0.0518 | -0.04 | 0.02 | -0.14 | -0.03 | -0.07 | 0.01 | 0.19 | 0.12 |

| Surprise Percentage | 185.7143% | -383.3333% | 50.0142% | 14.8765% | -23.5294% | 8.6957% | -19.1781% | -17.6471% | -33.3333% | 2.7778% | 23.75% | 54.5455% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.02 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GDOT

2026-02-20 18:52:19

Halper Sadeh LLC, an investor rights law firm, is investigating Peakstone Realty Trust (PKST), European Wax Center, Inc. (EWCZ), Heritage Commerce Corp (HTBK), and Green Dot Corporation (GDOT) for potential violations of federal securities laws and breaches of fiduciary duties. The firm is examining the fairness of their proposed sales to other entities, suggesting that insiders may receive substantial financial benefits not available to ordinary shareholders and that the deals may limit superior competing offers. Halper Sadeh LLC encourages shareholders to contact them to discuss their legal rights and options.

2026-02-20 13:29:31

Kaskela Law LLC has launched an investigation into the proposed buyout of Green Dot Corp. (NYSE: GDOT) shareholders by Smith Ventures and CommerceOne Financial Corporation. The firm is assessing whether the offered buyout price of $8.11 in cash and 0.2215 shares of a new public company is fair and sufficient, especially considering potential conflicts of interest in the transaction process. Green Dot shareholders are encouraged to contact Kaskela Law for more information regarding their legal rights.

2026-02-13 07:59:00

Kaskela Law LLC is investigating the proposed acquisition of Green Dot Corp. (NYSE:GDOT) by Smith Ventures and CommerceOne Financial Corporation, alleging potential conflicts of interest that could render the transaction unfair to shareholders. The firm encourages Green Dot stockholders to contact them to learn more about the investigation and their legal options regarding the $8.11 cash and 0.2215 shares per common stock deal.

2026-01-22 21:38:00

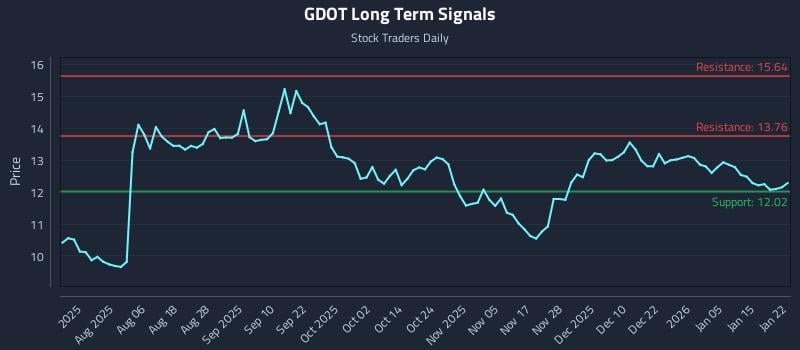

This article analyzes Green Dot Corporation Class A (NASDAQ: GDOT) using AI-generated signals for real-time trading. It highlights divergent sentiment across time horizons, indicating choppy conditions, and offers specific long, breakout, and short trading strategies with defined entry, target, and stop-loss levels. The analysis also provides multi-timeframe signal strengths, support, and resistance levels for GDOT.

2026-01-21 16:58:04

Halper Sadeh LLC, an investor rights law firm, is investigating potential violations of federal securities laws and breaches of fiduciary duties related to the sales of Penumbra, Inc. (PEN), FONAR Corporation (FONR), and Green Dot Corporation (GDOT). The firm is encouraging shareholders of these companies to contact them to discuss their legal rights and options, as there may be limited time to enforce these rights. They aim to seek increased consideration, additional disclosures, or other benefits for shareholders involved in these transactions.

2026-01-21 12:41:00

Halper Sadeh LLC, an investor rights law firm, is investigating Penumbra, Inc. (PEN), FONAR Corporation (FONR), and Green Dot Corporation (GDOT) for potential violations of federal securities laws and breaches of fiduciary duties related to their respective sales or transactions. The firm encourages shareholders of these companies to contact them to discuss their legal rights and options, including seeking increased consideration or additional disclosures.