Godaddy Inc

$ 130.26

0.14%

04 Dec - close price

- Market Cap 18,034,369,000 USD

- Current Price $ 130.26

- High / Low $ 131.74 / 129.28

- Stock P/E 22.46

- Book Value 0.68

- EPS 5.80

- Next Earning Report 2026-02-12

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.09 %

- ROE 0.37 %

- 52 Week High 216.00

- 52 Week Low 121.94

About

GoDaddy Inc. (GDDY) is a leading technology firm based in Scottsdale, Arizona, focused on providing comprehensive cloud-based solutions tailored for entrepreneurs and small businesses worldwide. The company offers a diverse portfolio of services, including web hosting, domain registration, and a suite of digital marketing tools designed to boost online presence and customer engagement. Renowned for its commitment to innovation and outstanding customer support, GoDaddy is strategically positioned to leverage the expanding digital economy while continuously evolving its offerings to address the dynamic needs of its varied clientele.

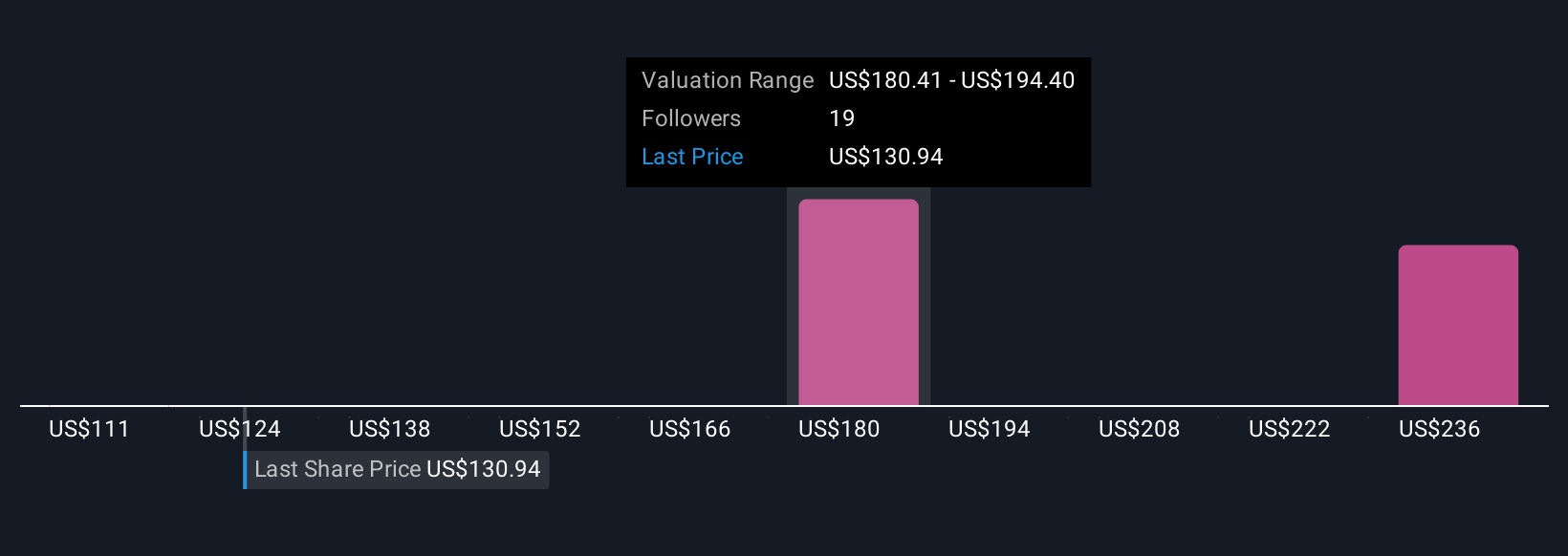

Analyst Target Price

$175.20

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-01 | 2025-02-13 | 2024-10-30 | 2024-08-01 | 2024-05-02 | 2024-02-13 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-02-14 |

| Reported EPS | 1.51 | 1.41 | 1.51 | 1.36 | 1.32 | 1.01 | 2.76 | 7.85 | 0.89 | 0.54 | 0.3 | 0.6 |

| Estimated EPS | 1.48 | 1.34 | 1.37 | 1.44 | 1.24 | 1.08 | 0.96 | 1.04 | 0.72 | 0.56 | 0.48 | 0.63 |

| Surprise | 0.03 | 0.07 | 0.14 | -0.08 | 0.08 | -0.07 | 1.8 | 6.81 | 0.17 | -0.02 | -0.18 | -0.03 |

| Surprise Percentage | 2.027% | 5.2239% | 10.219% | -5.5556% | 6.4516% | -6.4815% | 187.5% | 654.8077% | 23.6111% | -3.5714% | -37.5% | -4.7619% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.61 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: GDDY

2025-12-04 19:08:28

GoDaddy (GDDY) has expanded its agentic AI offerings with six new Airo.ai agents and an expanded Agent Name Service, aiming to deepen its digital solutions strategy. Despite recent stock price weakness, analysts see upside, and the company's shift towards recurring, higher-margin revenue streams through AI-driven products suggests potential undervaluation, with a fair value estimated at $175.06. Investors are encouraged to assess whether this presents a mispriced growth opportunity or if the market has already accounted for these advancements.

2025-12-04 01:07:54

GoDaddy Inc.'s Chief Strategy & Legal Officer reported selling 475 shares of Class A common stock on December 1, 2025, at $127.03 per share under a Rule 10b5-1 trading plan. Additionally, 360 shares were sold on December 2, 2025, at $127.94 per share to cover tax withholding obligations from vested restricted stock units, in line with company policy. Following these transactions, the officer directly beneficially owned 62,826 shares of GoDaddy Class A common stock.

2025-12-04 01:07:54

GoDaddy's CFO, Mark McCaffrey, reported an automatic sale of 3,317 shares of Class A common stock at $127.94 per share on December 2, 2025. This transaction was executed to fulfill tax withholding obligations stemming from the vesting of Restricted Stock Units, a process aligned with company policy. Following this sale, McCaffrey directly holds 66,816 shares of GoDaddy Class A common stock.

2025-12-03 01:07:54

GoDaddy Inc.'s Chief Accounting Officer sold 969 shares of Class A common stock on December 2, 2025, at $127.94 per share. This transaction was executed automatically to cover tax withholding obligations associated with Restricted Stock Unit vesting, a routine occurrence under company policy. Following the sale, the officer directly beneficially owned 19,452 shares.

2025-12-03 01:07:54

GoDaddy Inc.'s CEO, Amanpal Singh Bhutani, reported the sale of 6,932 shares of Class A common stock at $127.94 per share on December 2, 2025. This transaction was an automatic sale to cover tax withholding obligations associated with the vesting of restricted stock units. After the sale, the CEO directly owns 399,133 GoDaddy shares.

2025-12-01 21:09:12

GoDaddy recently expanded its Airo.ai online experience with six new AI agents to streamline marketing, operations, and website management for small businesses and released public developer access and standards for its Agent Name Service (ANS). These advancements position GoDaddy at the forefront of trusted AI for small businesses, aiming to simplify digital operations and enhance agent identity for the growing online economy. The new AI features, if adopted, could impact GoDaddy's investment outlook, with projected revenues of $5.9 billion by 2028 and a fair value of $175.06, providing a 37% upside.