Fiverr International Ltd

$ 11.06

3.85%

24 Feb - close price

- Market Cap 393,335,000 USD

- Current Price $ 11.06

- High / Low $ 11.17 / 10.50

- Stock P/E 19.02

- Book Value 11.41

- EPS 0.56

- Next Earning Report 2026-02-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.05 %

- 52 Week High 34.13

- 52 Week Low 10.25

About

Fiverr International Ltd. operates a global online marketplace. The company is headquartered in Tel Aviv, Israel.

Analyst Target Price

$16.22

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-29 | 2025-07-30 | 2025-05-07 | 2025-02-20 | 2024-10-30 | 2024-07-31 | 2024-05-09 | 2024-02-22 | 2023-11-09 | 2023-08-03 | 2023-05-11 | 2023-02-22 |

| Reported EPS | 0.77 | 0.69 | 0.64 | 0.64 | 0.64 | 0.58 | 0.52 | 0.56 | 0.55 | 0.49 | 0.36 | 0.26 |

| Estimated EPS | 0.68 | 0.65 | 0.59 | 0.6796 | 0.59 | 0.55 | 0.44 | 0.48 | 0.44 | 0.37 | 0.24 | 0.2 |

| Surprise | 0.09 | 0.04 | 0.05 | -0.0396 | 0.05 | 0.03 | 0.08 | 0.08 | 0.11 | 0.12 | 0.12 | 0.06 |

| Surprise Percentage | 13.2353% | 6.1538% | 8.4746% | -5.827% | 8.4746% | 5.4545% | 18.1818% | 16.6667% | 25% | 32.4324% | 50% | 30% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.7378 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FVRR

2026-02-23 04:35:54

Fiverr International (FVRR) has experienced significant share price declines over multiple years, prompting questions about its current valuation. A Discounted Cash Flow (DCF) analysis suggests the stock is undervalued by 43.1%, while its P/E ratio, though higher than industry averages, is still below a proprietary "Fair Ratio," also indicating undervaluation. The article highlights the utility of "Narratives" for investors to connect their expectations with financial forecasts and fair value estimates.

2026-02-23 00:41:44

Fiverr International Ltd. has seen its valuation grade shift from "fair" to "expensive" and its quality grade from "good" to "average," influenced by metrics like a 66 P/E ratio and a negative EBIT to interest ratio. Despite these adjustments, the company maintains strong financial performance, including positive operating cash flow and consistent positive results over the last ten quarters.

2026-02-22 06:34:49

Fiverr International (NYSE:FVRR) has received an average "Hold" rating from twelve analysts, with a 12-month average price target of $19.30, following several downgrades and price target cuts. While the company beat Q4 EPS estimates, revenue slightly missed expectations, and a cautious FY2026 outlook along with a decline in active buyers has led to a selloff, pushing the stock towards its 52-week low. Despite the negative sentiment, institutional ownership remains significant at 59%, with several funds recently increasing their stakes.

2026-02-21 11:02:03

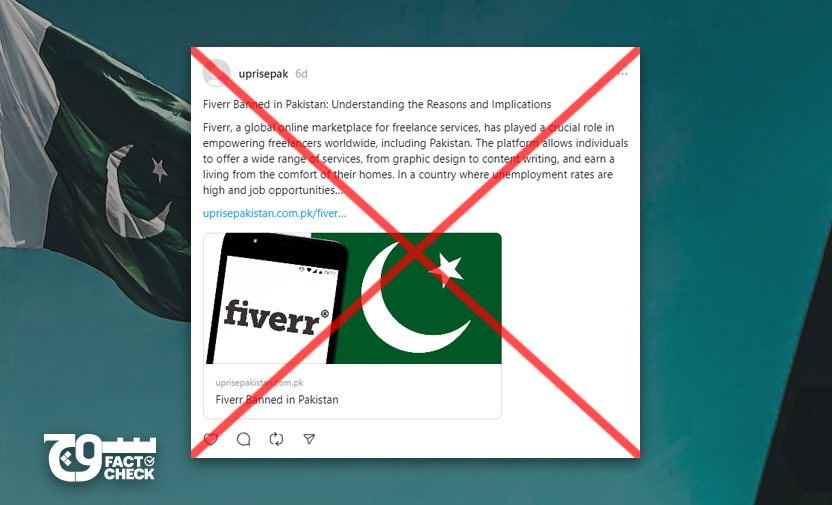

Claims that Fiverr has been banned in Pakistan are false. While some Pakistani freelancers' accounts were briefly marked as "unavailable" in August 2024 due to internet slowdowns in the country, a company spokesperson confirmed that most accounts have since returned to normal. The article clarifies that Fiverr has not suspended its services or banned Pakistani users, attributing the temporary issue to ongoing internet disruptions and a "cybersecurity upgrade" involving a national firewall.

2026-02-21 07:30:34

Fiverr International (NYSE:FVRR) was downgraded by Wall Street Zen from a "buy" to a "hold" rating, contributing to a consensus "Hold" rating among analysts with a $19.30 price target. The downgrade follows a Q4 EPS beat but a cautious FY2026 outlook and a decline in active buyers, causing a selloff and multiple analyst price target cuts. Shares are trading near their 52-week low, reflecting recent technical weakness and ongoing concerns about growth and AI disruption.

2026-02-20 12:59:47

Citigroup has downgraded Fiverr International (NYSE:FVRR) from "strong-buy" to "hold," causing the stock to plunge 8.5% to near 52-week lows, with a current market cap of $405 million. This downgrade, alongside target price cuts from several other firms, reflects concerns over the company's FY26 outlook and potential AI headwinds, despite beating Q4 EPS estimates. The consensus rating for Fiverr is now "Hold" with an average price target of $19.30.