Sprott Focus Trust

$ 10.06

1.76%

24 Feb - close price

- Market Cap 296,761,000 USD

- Current Price $ 10.06

- High / Low $ 10.06 / 9.88

- Stock P/E 22.47

- Book Value 8.38

- EPS 0.44

- Next Earning Report -

- Dividend Per Share $0.60

- Dividend Yield 6.14 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.05 %

- 52 Week High 10.06

- 52 Week Low 5.88

About

Sprott Focus Trust (FUND) is a prominent closed-end fund that specializes in the precious metals and natural resources sectors, managed by the experienced team at Sprott Asset Management. The fund aims to deliver total returns through a rigorous investment strategy focused on capital appreciation and income generation from high-quality equities in the metals and mining industries. With a keen focus on fundamental research and an understanding of macroeconomic trends, Sprott Focus Trust presents institutional investors with a compelling opportunity to diversify their portfolios and gain targeted exposure to the dynamic commodities market.

Analyst Target Price

N/A

Quarterly Earnings

| Jun 2025 | Dec 2024 | Dec 2022 | Jun 2022 | Dec 2021 | Jun 2021 | Mar 2021 | Dec 2020 | Sep 2020 | Jun 2020 | Mar 2020 | Dec 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-09-05 | 2025-03-10 | 2023-03-10 | 2022-08-25 | 2022-03-04 | 2021-08-30 | 2021-06-30 | 2021-03-08 | 2020-12-31 | 2020-08-28 | 2020-06-30 | 2020-03-09 |

| Reported EPS | 0.26 | 0.18 | 0.81 | -0.85 | 0.24 | 1.51 | 0.7572 | 1.43 | 0.7351 | -1.05 | -0.5274 | 0.98 |

| Estimated EPS | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise | 0.26 | 0.18 | 0.81 | -0.85 | 0.24 | 1.51 | 0.7572 | 1.43 | 0.7351 | -1.05 | -0.5274 | 0.98 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jul 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-29 | 2025-09-29 | 2025-06-30 | 2025-03-28 | 2024-12-30 | 2024-09-30 | 2024-07-01 | 2024-03-28 | 2023-12-28 | 2023-09-29 |

| Amount | $0.1911 | $0.1274 | $0.128 | $0.1305 | $0.2161 | $0.1301 | $0.1299 | $0.1286 | $0.127 | $0.1238 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FUND

2026-02-13 22:12:00

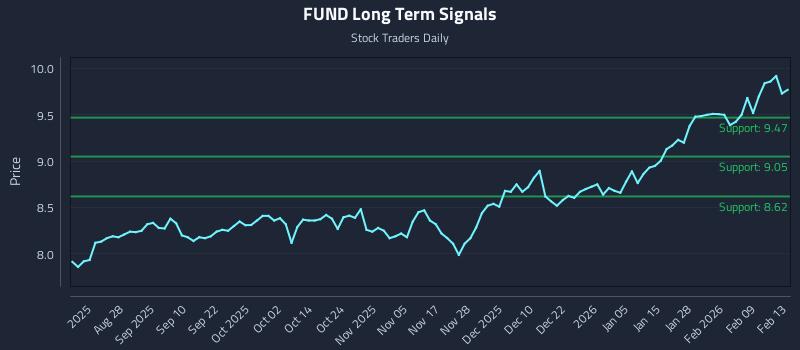

This article provides an in-depth analysis of Sprott Focus Trust Inc. (FUND) using AI-generated signals and volatility zones. It highlights strong sentiment across all time horizons supporting an overweight bias, alongside specific trading strategies for different risk profiles. The analysis includes entry, target, and stop-loss levels for position trading, momentum breakout, and risk-hedging strategies.

2026-02-09 15:27:37

This article identifies the best-performing ETFs for UK investors in January 2026, highlighting that uranium and Korea equity funds were top performers. It lists the top 10 ETFs, providing key metrics such as expense ratios and Morningstar categories for each. The article also explains what ETFs are and offers advice on screening them for long-term investment.

2026-02-01 10:32:14

Sprott Physical Silver Trust (PSLV) saw its stock price plunge 27.2% due to a sharp sell-off in silver, closing Friday at $26.41. Silver spot prices dropped 27.7% after reaching a record high the previous day, impacting other silver-backed funds as well. Analysts attribute the decline to profit-taking, a stronger dollar, and the appointment of Kevin Warsh to lead the Federal Reserve, leading to increased volatility and a focus on how the trust's discount to NAV will normalize as markets reopen.

2026-01-22 19:56:00

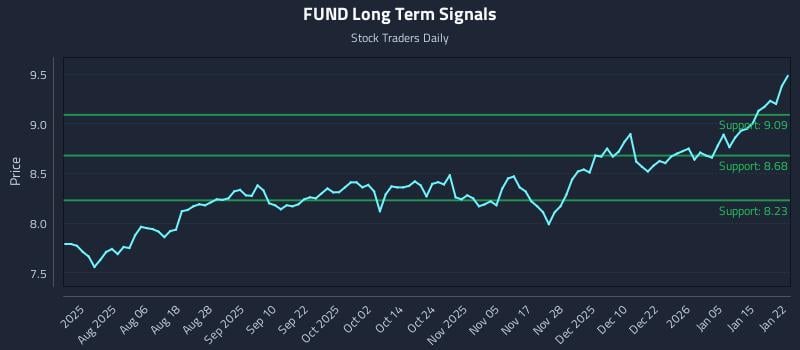

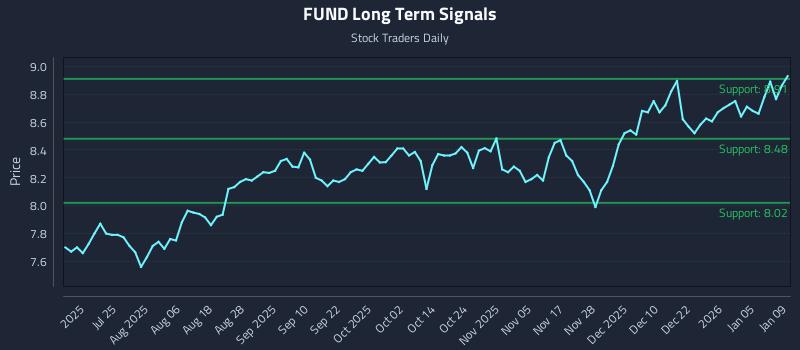

This article provides an analysis of Sprott Focus Trust Inc. (NASDAQ: FUND), highlighting strong sentiment across all horizons and suggesting an overweight bias. It presents three institutional trading strategies (Position Trading, Momentum Breakout, and Risk Hedging) with specific entry, target, and stop loss levels. The analysis also includes multi-timeframe signal data with identified support and resistance levels.

2026-01-11 18:48:00

This article provides an AI-generated analysis for Sprott Focus Trust Inc. (NASDAQ: FUND), highlighting near-term strong sentiment transitioning to mid-term neutrality and long-term positive bias. It presents three institutional trading strategies (Position, Momentum Breakout, and Risk Hedging) with specific entry, target, and stop-loss levels. The analysis also includes multi-timeframe signal analysis and current AI-generated signals for support and resistance.

2026-01-08 03:11:51

Sprott Focus Trust (NASDAQ:FUND) recently saw its stock price cross above its 50-day moving average of $8.49, trading as high as $8.90 with significant volume. The company also increased its quarterly dividend to $0.1911, yielding 8.6% annually, and a portfolio manager acquired a substantial number of shares, increasing his stake to over 3 million shares. Institutional investors have also been adjusting their positions in the trust.