Fortinet Inc

$ 77.35

2.82%

25 Feb - close price

- Market Cap 59,270,676,000 USD

- Current Price $ 77.35

- High / Low $ 77.60 / 74.35

- Stock P/E 31.96

- Book Value 1.66

- EPS 2.42

- Next Earning Report 2026-05-07

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.13 %

- ROE 1.36 %

- 52 Week High 110.67

- 52 Week Low 70.12

About

Fortinet (Nasdaq: FTNT) is an American multinational corporation headquartered in Sunnyvale, California. It develops and sells cybersecurity solutions, including but not limited to physical products such as firewalls, plus software and services such as anti-virus protection, intrusion prevention systems and endpoint security components.

Analyst Target Price

$89.82

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-05 | 2025-11-05 | 2025-08-06 | 2025-05-07 | 2025-02-06 | 2024-11-07 | 2024-08-06 | 2024-05-02 | 2024-02-06 | 2023-11-02 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0.81 | 0.74 | 0.64 | 0.58 | 0.74 | 0.63 | 0.57 | 0.43 | 0.51 | 0.41 | 0.38 | 0.34 |

| Estimated EPS | 0.74 | 0.63 | 0.59 | 0.53 | 0.61 | 0.52 | 0.41 | 0.38 | 0.43 | 0.36 | 0.34 | 0.29 |

| Surprise | 0.07 | 0.11 | 0.05 | 0.05 | 0.13 | 0.11 | 0.16 | 0.05 | 0.08 | 0.05 | 0.04 | 0.05 |

| Surprise Percentage | 9.4595% | 17.4603% | 8.4746% | 9.434% | 21.3115% | 21.1538% | 39.0244% | 13.1579% | 18.6047% | 13.8889% | 11.7647% | 17.2414% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-07 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.62 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FTNT

2026-02-26 06:52:27

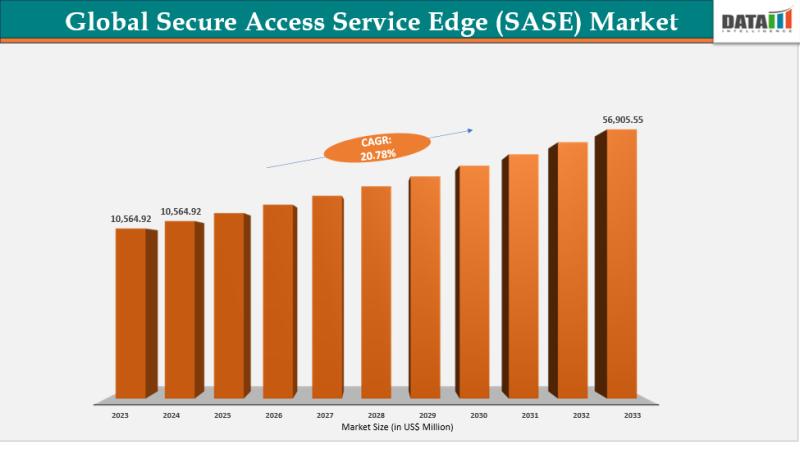

The Global Secure Access Service Edge (SASE) Market is projected to grow explosively from US$12.65 billion in 2024 to US$56.91 billion by 2033, exhibiting a CAGR of 20.78%. This growth is primarily driven by the increasing adoption of remote work, escalating cyber threats, and the shift towards cloud-native security architectures, with North America leading the market share at 46.3%. Key players like Zscaler, Cisco Systems, and Palo Alto Networks are driving innovation with AI-powered threat detection and zero-trust frameworks.

2026-02-26 01:42:24

Fortinet (FTNT) delivered strong Q4 2025 results that exceeded expectations, yet Freedom Capital Markets downgraded the company due to margin risks from rising memory costs, foreign exchange fluctuations, and increased competition. This downgrade highlights investor concerns that customer caution and cost pressures could challenge Fortinet's profitability, despite its growth in services and recent acquisitions. The article suggests investors need to consider these margin pressures against the company's otherwise solid performance and future revenue projections.

2026-02-25 18:34:20

Fortinet (FTNT) shares are down 28% year-to-date despite the company reporting record free cash flow of $2.21 billion for 2025 and exceeding the "Rule of 45" for the sixth consecutive year. The company's Unified SASE segment showed significant growth, with billings up 40% in Q4 and ARR surging over 90%. However, investors are weighing concerns like a planned drop in Q1 2026 operating margin due to infrastructure investment, a recent AI-assisted security breach, and an analyst downgrade.

2026-02-25 10:50:36

Fortinet, Inc. has released its 2025 Form 10-K report, detailing robust financial growth with a 14% increase in total revenue to $6,799.6 million and a 16% increase in operating income. The report highlights strategic investments in R&D, sales, and marketing, alongside capacity expansion, to drive future growth. However, Fortinet acknowledges significant challenges, including operational, regulatory, market, and geopolitical risks, which could impact its financial performance and operational stability.

2026-02-24 17:27:18

Analysts are maintaining neutral ratings on several technology stocks, including Advantest (ADTTF), Fortinet (FTNT), and Snowflake (SNOW), indicating a balanced outlook from experts. Bernstein analysts issued "Hold" ratings for all three companies, noting Advantest's average price target of $181.60 and Fortinet's price target of $88.77. Snowflake also received a "Hold" rating from Bernstein and Guggenheim, with an analyst consensus remaining a Strong Buy.

2026-02-24 13:50:17

Analysts have issued neutral ratings for several technology stocks including Advantest (ADTTF), Fortinet (FTNT), and Snowflake (SNOW). These ratings suggest that experts are neither particularly optimistic nor pessimistic about these companies' stock performance. Price targets and analyst consensus vary for each company, with Advantest and Snowflake having a "Strong Buy" consensus, while Fortinet's consensus is "Hold."