Five Point Holdings LLC

$ 5.53

2.41%

24 Feb - close price

- Market Cap 918,560,000 USD

- Current Price $ 5.53

- High / Low $ 5.62 / 5.32

- Stock P/E 4.82

- Book Value 11.49

- EPS 1.30

- Next Earning Report -

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA N/A %

- ROE 0.11 %

- 52 Week High 6.64

- 52 Week Low 4.58

About

Five Point Holdings, LLC, through its subsidiary, Five Point Operating Company, LP, designs and develops planned and mixed-use communities in Orange, Los Angeles and San Francisco counties. The company is headquartered in Irvine, California.

Analyst Target Price

$12.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-15 | 2025-10-23 | 2025-07-16 | 2025-04-17 | 2025-01-16 | 2024-10-17 | 2024-07-18 | 2024-04-18 | 2024-01-18 | 2023-10-19 | 2023-07-20 | 2023-04-24 |

| Reported EPS | 0.1549 | 0.2847 | 0.0454 | 0.3176 | 0.3155 | 0.0673 | 0.2103 | 0.0333 | 0.39 | 0.0454 | 0.34 | -0.07 |

| Estimated EPS | 0 | 0 | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0.1549 | 0.2847 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FPH

2026-02-20 07:06:00

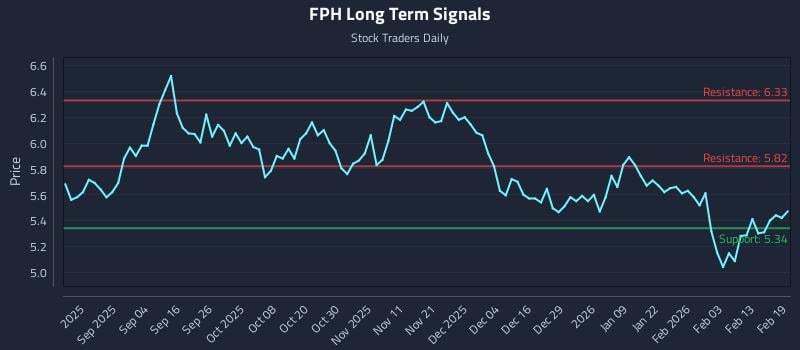

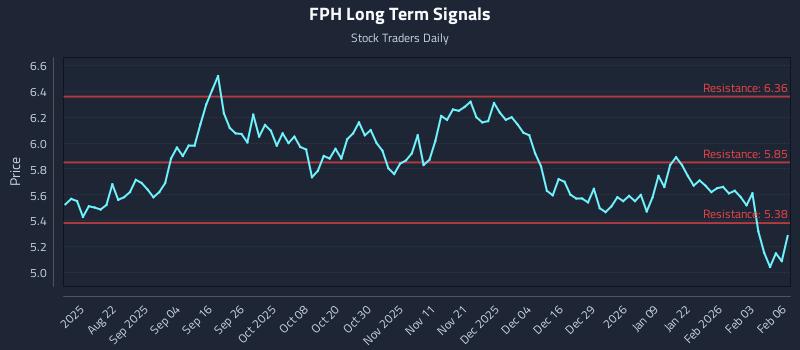

This article provides an AI-generated analysis of Five Point Holdings Llc Class A (NYSE: FPH), highlighting a short-term strong sentiment but neutral mid and long-term outlook. It details specific institutional trading strategies, including position trading, momentum breakout, and risk hedging, with defined entry, target, and stop-loss zones. The analysis also includes multi-timeframe signal strengths and support/resistance levels to guide tactical trading decisions.

2026-02-10 21:27:59

Five Point Holdings, LLC announced a new residential land banking investment partnership with funds managed by Blue Owl Capital Inc. Five Point issued warrants to Blue Owl to purchase up to 1,500,000 Class A shares at $7.00 per share, which will vest based on Blue Owl's capital contributions to the partnership. This collaboration aims to scale Five Point's Hearthstone platform and expand its land banking footprint.

2026-02-09 05:50:19

This article provides a price-driven insight for Five Point Holdings Llc Class A (NYSE: FPH) through Stock Traders Daily's AI models. It highlights weak near and mid-term sentiment, a neutral long-term outlook, and elevated downside risk. The analysis includes three institutional trading strategies (Position, Momentum Breakout, and Risk Hedging) with specific entry, target, and stop-loss levels, along with a multi-timeframe signal analysis.

2026-02-01 01:44:34

Five Point Holdings (FPH) recently reported strong Q3 FY 2025 results, with a net margin of 48.5% and significant earnings growth. The company's trailing P/E ratio of 4x suggests undervaluation, further supported by a DCF fair value of US$22.73, which is about four times its current market price of US$5.31. This valuation gap and high earnings quality reinforce a bullish narrative for the stock.

2026-01-31 00:58:15

Five Point Holdings reported record net income for Q4 and full year 2025, exceeding guidance due to strong execution and the positive impact of the Hearthstone land banking platform acquisition. The company maintains an optimistic outlook for 2026, projecting $100 million in net income, supported by strategic land sales and a strong liquidity position of $425 million in cash and $643 million in total liquidity. This financial health provides a solid foundation for future growth despite market challenges.

2026-01-30 08:06:00

Five Point Holdings, LLC reported a record-setting Q4 and full-year 2025, with $183.5 million in net income, exceeding previous records and revised guidance despite challenging market conditions. The company secured critical entitlement approvals at Valencia and the Great Park, enhancing future cash flows and residential/industrial development. Five Point also significantly strengthened its balance sheet by refinancing senior notes, reducing debt by $175 million since January 2024, and expanding its credit facility, while integrating the Hearthstone land banking platform to diversify earnings.