First Guaranty Bancshares Inc

$ 18.00

1.12%

23 Feb - close price

- Market Cap N/A

- Current Price $ 18.00

- High / Low $ 18.07 / 17.90

- Stock P/E 6.92

- Book Value 12.23

- EPS 2.60

- Next Earning Report 2026-04-27

- Dividend Per Share $0.04

- Dividend Yield 0.22 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.23 %

- 52 Week High 19.96

- 52 Week Low 14.08

About

First Guaranty Bancshares, Inc. is the holding company of First Guaranty Bank providing commercial banking services in Louisiana and Texas. The company is headquartered in Hammond, Louisiana.

Analyst Target Price

N/A

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | |

|---|---|---|---|

| Reported Date | 2026-02-03 | 2025-10-31 | 2025-08-18 |

| Reported EPS | None | -3.01 | -0.61 |

| Estimated EPS | None | 0 | 0 |

| Surprise | 0 | -3.01 | -0.61 |

| Surprise Percentage | None% | None% | None% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-27 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-02 | 2025-12-01 | 2025-09-02 | 2025-06-02 | 2025-03-03 | 2024-12-02 | 2024-09-03 | 2024-06-03 | 2024-03-01 | 2023-12-01 |

| Amount | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FGBIP

2026-02-13 16:22:00

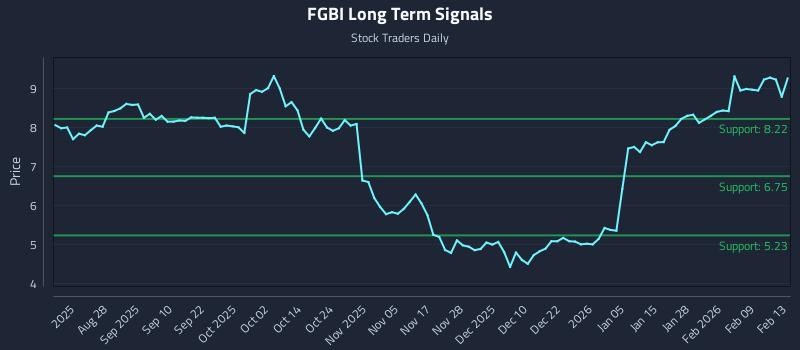

This article analyzes First Guaranty Bancshares Inc. (FGBI) using AI models, highlighting mixed sentiment and elevated downside risk. It provides three trading strategies—Position, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis and support/resistance levels for various horizons.

2026-02-10 10:27:28

First Guaranty Bancshares (FGBI) is expected to report its Q4 2025 earnings before market open on Thursday, February 12th, with analysts predicting a loss of ($0.29) per share. Despite recent negative profitability metrics and a low dividend, significant insider buying activity by directors Bruce McAnally and Marshall T. Reynolds has increased insider ownership to 47.20%. Shares are currently trading around $9.23, and analysts have issued both "Hold" and "Sell" ratings, with an average rating of "Reduce."

2026-02-10 00:30:04

First Guaranty Bancshares, Inc. announced its 117th consecutive quarterly cash dividend of $0.16 per share. The dividend is payable on September 30, 2022, to shareholders of record as of September 23, 2022. First Guaranty Bank, founded in 1934, operates thirty-six locations across Louisiana, Texas, Kentucky, and West Virginia, and its common stock trades on NASDAQ under the symbol FGBI.

2026-02-04 23:58:10

First Guaranty Bancshares Inc (NASDAQ: FGBI) reported strong fourth-quarter results, beating analyst EPS estimates by $0.41 with EPS of $0.12, and revenue topped expectations at $51M against a consensus of $31.2M. Despite a 15.44% decline over the past year, the stock has risen 53.29% in the last three months, with its financial health rated as "weak performance" by InvestingPro.

2026-02-04 12:28:06

First Guaranty Bancshares Inc (NASDAQ: FGBI) reported strong fourth-quarter results, beating analyst EPS estimates by $0.41 with EPS of $0.12, significantly exceeding the $-0.29 estimate. The company also surpassed revenue expectations, bringing in $51M against a consensus estimate of $31.2M. Despite its recent stock performance showing a 53.29% increase in the last three months, the company's financial health is currently rated as "weak performance" by InvestingPro.

2026-02-03 09:58:17

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) experienced a significant increase in short interest during January, rising by 23.9% to 123,798 shares. The company's stock trades at $9.26 with a market capitalization of $142.14 million, and analysts forecast an EPS of $0.89 for the current fiscal year. Insider activity included substantial share purchases by directors in December, and institutional investors like Empowered Funds LLC also increased their holdings.