First Guaranty Bancshares Inc

$ 9.23

1.37%

25 Feb - close price

- Market Cap 145,852,000 USD

- Current Price $ 9.23

- High / Low $ 9.29 / 9.08

- Stock P/E N/A

- Book Value 12.23

- EPS -4.17

- Next Earning Report 2026-02-26

- Dividend Per Share $0.04

- Dividend Yield 0.44 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.23 %

- 52 Week High 10.50

- 52 Week Low 4.30

About

First Guaranty Bancshares, Inc. is the holding company of First Guaranty Bank providing commercial banking services in Louisiana and Texas. The company is headquartered in Hammond, Louisiana.

Analyst Target Price

$9.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-28 | 2025-10-31 | 2025-08-01 | 2025-04-29 | 2025-01-30 | 2024-10-30 | 2024-07-23 | 2024-04-29 | 2024-02-05 | 2023-10-27 | 2023-08-08 | 2023-04-26 |

| Reported EPS | 0.13 | -2.3 | -0.5 | -0.54 | 0.03 | 0.11 | 0.53 | 0.14 | 0.06 | 0.1 | 0.19 | 0.27 |

| Estimated EPS | -0.29 | -0.32 | -0.2 | 0.17 | 0.23 | 0.01 | 0.2 | 0.1 | 0.09 | 0.16 | 0.28 | 0.32 |

| Surprise | 0.42 | -1.98 | -0.3 | -0.71 | -0.2 | 0.1 | 0.33 | 0.04 | -0.03 | -0.06 | -0.09 | -0.05 |

| Surprise Percentage | 144.8276% | -618.75% | -150% | -417.6471% | -86.9565% | 1000% | 165% | 40% | -33.3333% | -37.5% | -32.1429% | -15.625% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.29 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-31 | 2025-09-30 | 2025-06-30 | 2025-03-31 | 2024-12-31 | 2024-09-30 | 2024-06-28 | 2024-03-29 | 2023-12-29 | 2023-09-29 |

| Amount | $0.01 | $0.01 | $0.01 | $0.01 | $0.01 | $0.08 | $0.16 | $0.16 | $0.16 | $0.16 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: FGBI

2026-02-24 17:50:00

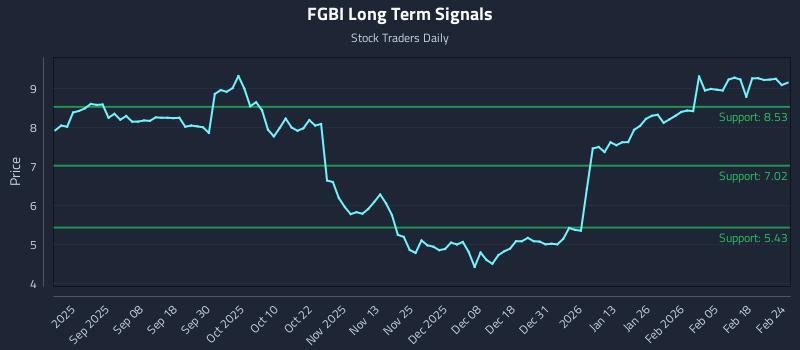

This article analyzes First Guaranty Bancshares Inc. (NASDAQ: FGBI) using AI models to provide tactical trading strategies. It identifies weak near-term and long-term sentiment, with mid-term strength, and offers specific position, momentum, and risk-hedging trading strategies with entry zones, targets, and stop losses. The analysis highlights key support and resistance levels across different time horizons for informed decision-making.

2026-02-05 08:28:27

First Guaranty Bancshares Inc (NASDAQ: FGBI) significantly beat Q4 analyst estimates, reporting an EPS of $0.12 against an expected $-0.29, and revenue of $51M, surpassing the $31.2M consensus. The company's stock has seen a 53.29% increase in the last three months, despite a 15.44% decline over the past year, with its financial health noted as "weak performance" by InvestingPro.

2026-01-03 12:58:36

First Guaranty Bancshares announced a quarterly cash dividend of $0.01 per share on its common stock, marking its 130th consecutive quarterly dividend. Despite this, TipRanks' AI Analyst, Spark, rates FGBI as Neutral due to weak financial performance and bearish technical indicators. The company has a $73.69M market cap and an average trading volume of 16,211.

2025-12-31 20:47:21

Short interest in First Guaranty Bancshares, Inc. (NASDAQ:FGBI) rose by 23.5% in December to 71,248 shares, indicating increased bearish sentiment. Despite a recent steep quarterly loss and negative financial metrics, company insiders have been actively purchasing shares, now owning 47.20% of the company. The bank also declared a quarterly dividend of $0.01 per share.

2025-12-20 15:27:18

The article provides a title, "With First Guaranty Bancshares Stock Surging, Have You Considered The Downside?", but the content is primarily navigational links and disclaimers about an interactive model. It appears to be a placeholder or an incomplete article, lacking any substantive analysis about First Guaranty Bancshares or its stock performance. The available text mostly details website features, legal disclaimers, and data sourcing.

2025-11-24 14:51:35

First Guaranty Bancshares Director Edgar R. Smith III purchased 21,300 shares of the company's common stock across two transactions in November 2025, totaling $106,480. The share prices ranged from $4.81 to $5.78 per share. Following these acquisitions, Smith's direct ownership increased to 2,867,467 shares, with an additional 2,114,838 shares held indirectly.