Franklin BSP Realty Trust Inc

$ 8.83

-1.78%

24 Feb - close price

- Market Cap 720,586,000 USD

- Current Price $ 8.83

- High / Low $ 9.08 / 8.79

- Stock P/E 13.80

- Book Value 14.50

- EPS 0.64

- Next Earning Report 2026-02-25

- Dividend Per Share $1.42

- Dividend Yield 15.8 %

- Next Dividend Date 2026-04-10

- ROA 0.01 %

- ROE 0.05 %

- 52 Week High 11.96

- 52 Week Low 8.42

About

Franklin BSP Realty Trust, Inc. is a real estate investment trust that originates, acquires and manages a portfolio of commercial real estate debt investments secured by properties located in the United States and internationally. The company is headquartered in New York, New York.

Analyst Target Price

$13.25

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-25 | 2025-10-29 | 2025-07-30 | 2025-04-28 | 2025-02-12 | 2024-11-04 | 2024-07-31 | 2024-04-29 | 2024-02-14 | 2023-10-30 | 2023-07-31 | 2023-05-03 |

| Reported EPS | 0.12 | 0.22 | 0.27 | -0.12 | 0.433 | -0.1 | 0.31 | 0.41 | 0.39 | 0.43 | 0.66 | 0.42 |

| Estimated EPS | 0.3025 | 0.28 | 0.3 | 0.3033 | 0.336 | 0.34 | 0.4 | 0.39 | 0.4 | 0.4 | 0.5 | 0.37 |

| Surprise | -0.1825 | -0.06 | -0.03 | -0.4233 | 0.097 | -0.44 | -0.09 | 0.02 | -0.01 | 0.03 | 0.16 | 0.05 |

| Surprise Percentage | -60.3306% | -21.4286% | -10% | -139.5648% | 28.869% | -129.4118% | -22.5% | 5.1282% | -2.5% | 7.5% | 32% | 13.5135% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.3025 |

| Currency | USD |

Previous Dividend Records

| Apr 2026 | Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-04-10 | 2026-01-12 | 2025-10-10 | 2025-07-10 | 2025-04-10 | 2025-01-10 | 2024-10-10 | 2024-07-10 | 2024-04-10 | 2024-01-10 |

| Amount | $0.2 | $0.355 | $0.355 | $0.355 | $0.355 | $0.355 | $0.355 | $0.355 | $0.355 | $0.355 |

Next Dividend Records

| Dividend per share (year): | $1.42 |

| Dividend Yield | 15.8% |

| Next Dividend Date | 2026-04-10 |

| Ex-Dividend Date | 2026-03-31 |

Recent News: FBRT

2026-02-12 14:28:09

Franklin BSP Realty Trust (NYSE:FBRT) has declared a quarterly dividend of $0.20 per share, payable on April 10th to stockholders of record by March 31st. This dividend implies a 7.9% yield, but the company's current payout ratio of 103.6% indicates it relies on its balance sheet to cover payments. However, analysts predict future earnings of $1.49 per share will result in a more sustainable payout ratio of approximately 95.3% against a $1.42 annual dividend.

2026-02-11 20:32:00

Franklin BSP Realty Trust (FBRT) reported its fourth-quarter earnings, showing a profit of $17.7 million, or 13 cents per share. Adjusted earnings were 12 cents per share, with revenue reaching $76.1 million for the period. For the full year, the company had a profit of $82.3 million ($0.64 per share) and $270.1 million in revenue.

2025-12-16 06:00:00

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) has announced its fourth-quarter 2025 common stock dividend of $0.355 per share, payable around January 12, 2026, to stockholders of record as of December 31, 2025. Additionally, the company declared a fourth-quarter 2025 dividend of $0.46875 per share for its 7.50% Series E Cumulative Redeemable Preferred Stock, payable on January 15, 2026, to Series E preferred stockholders of record as of December 31, 2025. FBRT is a real estate investment trust managing a diversified portfolio of commercial real estate debt, with approximately $6.2 billion in assets as of September 30, 2025.

2025-11-02 11:06:04

Franklin BSP Realty Trust, Inc. announced its Q3 2025 financial results, reporting a decrease in GAAP net income and diluted EPS compared to the previous quarter. Despite this, the company highlighted strategic initiatives, including the acquisition of NewPoint Holdings JV LLC and significant loan commitments, aiming to enhance distributable earnings. Management expressed optimism regarding future growth through integration and strategic execution.

2025-10-29 10:45:00

Franklin BSP Realty Trust Inc (FBRT) reported adjusted earnings of 22 cents per share for the quarter ended September 30, missing analysts' expectations of 28 cents per share. Revenue for the quarter fell by 25.7% to $36.90 million, significantly below the anticipated $53.30 million. The company's shares have experienced a decline this quarter and year-to-date, despite analysts maintaining a "buy" rating with a median price target of $14.25.

2025-10-18 01:16:02

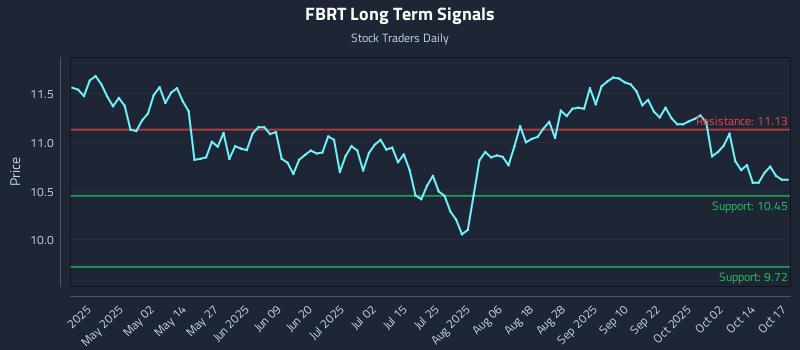

StockTradersDaily.com analyzes Franklin BSP Realty Trust Inc. (FBRT) using predictive AI, indicating a neutral sentiment with a wait-and-see approach. The article outlines specific institutional trading strategies, including position trading, momentum breakout, and risk hedging, along with multi-timeframe signal analysis, suggesting an attractive risk-reward setup.