ESCO Technologies Inc

$ 285.56

3.08%

24 Feb - close price

- Market Cap 7,174,162,000 USD

- Current Price $ 285.56

- High / Low $ 285.91 / 277.05

- Stock P/E 57.48

- Book Value 60.27

- EPS 4.82

- Next Earning Report 2026-05-11

- Dividend Per Share $0.32

- Dividend Yield 0.12 %

- Next Dividend Date 2026-04-17

- ROA 0.05 %

- ROE 0.09 %

- 52 Week High 291.31

- 52 Week Low 134.62

About

ESCO Technologies Inc. produces and supplies products and systems designed for the industrial and commercial markets worldwide. The company is headquartered in St. Louis, Missouri.

Analyst Target Price

$285.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-05 | 2025-11-20 | 2025-08-07 | 2025-05-07 | 2025-02-06 | 2024-11-14 | 2024-08-07 | 2024-05-09 | 2024-02-08 | 2023-11-16 | 2023-08-08 | 2023-05-09 |

| Reported EPS | 1.64 | 2.32 | 1.6 | 1.35 | 1.07 | 1.46 | 1.16 | 0.94 | 0.62 | 1.25 | 1.09 | 0.76 |

| Estimated EPS | 1.32 | 2.13 | 1.65 | 1.25 | 0.73 | 1.44 | 1.2 | 0.87 | 0.65 | 1.22 | 1 | 0.71 |

| Surprise | 0.32 | 0.19 | -0.05 | 0.1 | 0.34 | 0.02 | -0.04 | 0.07 | -0.03 | 0.03 | 0.09 | 0.05 |

| Surprise Percentage | 24.2424% | 8.9202% | -3.0303% | 8% | 46.5753% | 1.3889% | -3.3333% | 8.046% | -4.6154% | 2.459% | 9% | 7.0423% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-11 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.75 |

| Currency | USD |

Previous Dividend Records

| Apr 2026 | Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-04-17 | 2026-01-16 | 2025-10-16 | 2025-07-17 | 2025-04-17 | 2025-01-17 | 2024-10-16 | 2024-07-19 | 2024-04-16 | 2024-01-19 |

| Amount | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 |

Next Dividend Records

| Dividend per share (year): | $0.32 |

| Dividend Yield | 0.12% |

| Next Dividend Date | 2026-04-17 |

| Ex-Dividend Date | 2026-04-02 |

Recent News: ESE

2026-02-14 10:57:56

Public Sector Pension Investment Board increased its holdings in ESCO Technologies Inc. (NYSE:ESE) by 14.5% in the third quarter, now owning 100,725 shares valued at $21.26 million. ESCO Technologies reported strong Q1 earnings, beating analyst expectations with $1.64 EPS on $289.66 million revenue, and provided optimistic guidance for Q2 and FY 2026. Despite insider selling by the CEO and a director totaling $4.78 million, institutional investors hold a significant 95.7% stake in the company.

2026-02-13 11:57:27

ESCO Technologies (ESE) reported strong first-quarter 2026 results, leading to raised full-year revenue and earnings outlooks, driven by significant growth in its Aerospace & Defense segment. Despite a recent pullback, the stock has shown strong momentum, with a 27.36% one-month and 38.02% year-to-date return. However, Simply Wall St's analysis suggests ESCO Technologies is currently 7% overvalued, with a fair value of $255 compared to its last close of $272.76, based on detailed growth and margin assumptions.

2026-02-13 08:27:47

Advisors Asset Management Inc. increased its stake in ESCO Technologies Inc. (NYSE:ESE) by 34.6%, bringing their total to 28,965 shares valued at approximately $6.12 million. ESCO Technologies recently surpassed quarterly earnings and revenue expectations, reporting $1.64 EPS against a $1.32 consensus and revenue of $289.66 million, up 17.3% year-over-year. Despite a consensus price target of $187.50, the stock currently trades around $272.50, and insiders have been net sellers in recent months.

2026-02-11 01:27:44

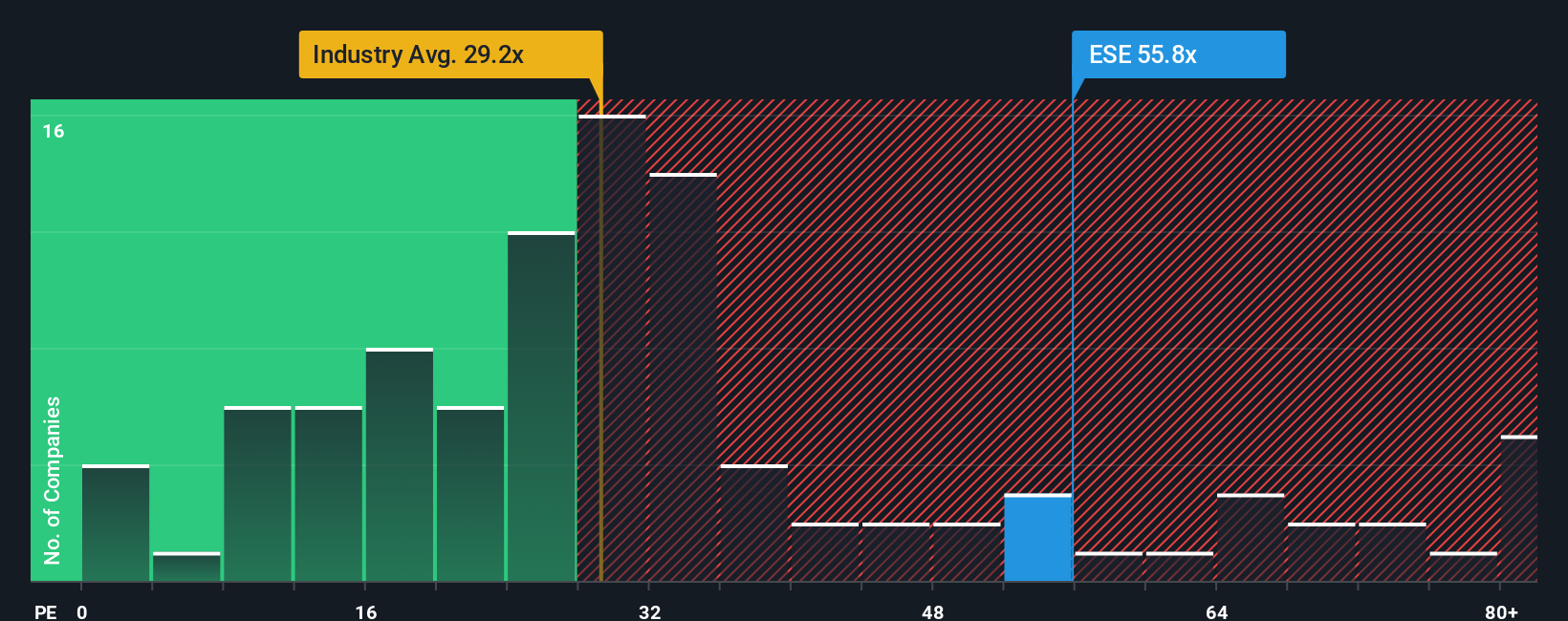

ESCO Technologies Inc. (NYSE:ESE) shares have gained 27% over the last month and 65% in the past year. The company's high P/E ratio of 55.8x, compared to the U.S. market's average of 19x, is attributed to its superior earnings growth, which analysts forecast to be 29% next year against the market's 16%. Investors are willing to pay a premium for ESCO Technologies due to its strong future growth prospects.

2026-02-10 12:28:04

ESCO Technologies (NYSE:ESE) recently hit a new 52-week high of $271.17, trading significantly above its moving averages and consensus price target. The company beat Q1 earnings estimates with $1.64 EPS and $289.66M revenue, providing strong Q2 and FY2026 guidance. Despite upgrades from analysts to "Buy" and "Strong Buy" ratings, insiders have sold shares totaling approximately $4.78 million in the last 90 days.

2026-02-10 11:28:04

ESCO Technologies Inc. (NYSE:ESE) has seen a significant 27% rise in its share price over the past month, contributing to a 65% increase over the last year. The company's high P/E ratio of 55.8x, compared to the market average of 19x, is attributed to strong past earnings growth of 13% last year (46% over three years) and a forecasted 29% growth for the next year, outpacing the broader market's expected 16% expansion. This optimistic earnings outlook is seen as a key reason investors are willing to pay a premium for the stock.