Enovix Corp

$ 5.87

-1.34%

23 Feb - close price

- Market Cap 1,277,679,000 USD

- Current Price $ 5.87

- High / Low $ 5.90 / 5.71

- Stock P/E N/A

- Book Value 1.40

- EPS -0.85

- Next Earning Report 2026-02-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.17 %

- ROE -0.68 %

- 52 Week High 16.49

- 52 Week Low 5.27

About

Enovix Corp (ENVX) is a cutting-edge technology enterprise dedicated to revolutionizing battery performance through its proprietary 3D silicon lithium-ion architecture. This innovative approach allows Enovix to produce batteries with significantly enhanced energy density, rapid charging capabilities, and improved safety over conventional lithium-ion alternatives. Targeting high-growth sectors such as consumer electronics, electric vehicles, and renewable energy storage, the company is strategically positioned to lead the charge in the global energy transition. With a commitment to sustainability and pioneering advancements, Enovix stands at the forefront of the burgeoning demand for next-generation battery technologies.

Analyst Target Price

$26.90

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-07-29 | 2025-04-29 | 2025-02-18 | 2024-10-29 | 2024-07-31 | 2024-05-01 | 2024-02-20 | 2023-11-07 | 2023-07-26 | 2023-04-26 | 2023-02-22 |

| Reported EPS | -0.14 | -0.225 | -0.15 | -0.11 | -0.17 | -0.14 | -0.31 | -0.28 | -0.19 | -0.19 | -0.2 | -0.19 |

| Estimated EPS | -0.16 | -0.186 | -0.29 | -0.19 | -0.2 | -0.23 | -0.29 | -0.27 | -0.23 | -0.22 | -0.21 | -0.16 |

| Surprise | 0.02 | -0.039 | 0.14 | 0.08 | 0.03 | 0.09 | -0.02 | -0.01 | 0.04 | 0.03 | 0.01 | -0.03 |

| Surprise Percentage | 12.5% | -20.9677% | 48.2759% | 42.1053% | 15% | 39.1304% | -6.8966% | -3.7037% | 17.3913% | 13.6364% | 4.7619% | -18.75% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.23 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ENVX

2026-02-22 10:49:09

Jupiter Asset Management Ltd. recently acquired 247,274 shares of Enovix Corporation (NASDAQ:ENVX), valued at approximately $2.465 million, representing a new position for the firm. Other institutional investors like Goldman Sachs Group Inc. and UBS AM also increased their stakes in Enovix, with institutional ownership now at 50.92%. Enovix, a developer of advanced lithium-ion battery cells, currently has a consensus "Hold" rating from analysts with an average target price of $17.50.

2026-02-21 12:53:13

Enovix (NASDAQ: ENVX) stock surged 35% due to a short-squeeze, driven by two significant deals: one to supply batteries for a "prominent" virtual reality headset manufacturer (potentially Apple) and another potential collaboration with Elentec Co, a supplier for Samsung. These deals validate Enovix's silicon-anode battery technology for high-energy density applications. Analysts project further upside, and institutional buying indicates sustained momentum for the stock.

2026-02-18 03:57:11

This article from MSN discusses how Enovix Corporation (ENVX) has recently flashed a "Golden Cross" signal. The article title poses the question of whether this signal indicates a buying opportunity for investors. No further details are provided in the content beyond the headline.

2026-02-13 10:57:55

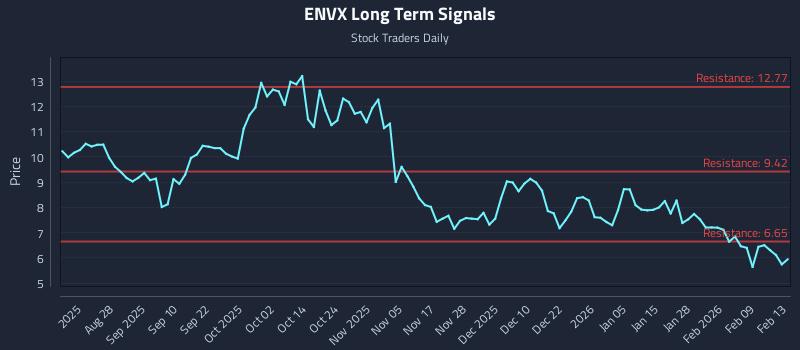

This article analyzes behavioral patterns and institutional flows for Enovix Corporation (NASDAQ: ENVX), highlighting divergent sentiment across all time horizons and suggesting choppy conditions. It provides AI-generated trading strategies including position trading, momentum breakout, and risk hedging, along with a multi-timeframe signal analysis. The report also notes elevated downside risk due to a lack of additional long-term support signals.

2026-02-12 17:28:04

Halper Sadeh LLC, an investor rights law firm, is investigating whether certain officers and directors of Enovix Corp. (NASDAQ: ENVX) breached their fiduciary duties to shareholders. The firm encourages long-term Enovix shareholders to contact them to discuss legal rights and options, including seeking corporate governance reforms or financial incentives. Shareholder participation is highlighted as crucial for improving company oversight and enhancing shareholder value.

2026-02-12 12:22:00

Halper Sadeh LLC, an investor rights law firm, is investigating whether certain officers and directors of Enovix Corp. (NASDAQ: ENVX) breached their fiduciary duties to shareholders. Long-term shareholders are encouraged to contact the firm to discuss potential corporate governance reforms, recovery of funds, or other benefits. The firm operates on a contingent fee basis, and shareholder participation is encouraged to improve company practices and enhance shareholder value.