Energizer Holdings Inc

$ 22.69

1.16%

23 Feb - close price

- Market Cap 1,555,867,000 USD

- Current Price $ 22.69

- High / Low $ 23.06 / 21.78

- Stock P/E 7.64

- Book Value 2.06

- EPS 2.97

- Next Earning Report 2026-05-05

- Dividend Per Share $1.20

- Dividend Yield 5.35 %

- Next Dividend Date 2026-03-11

- ROA 0.07 %

- ROE 1.51 %

- 52 Week High 30.13

- 52 Week Low 16.55

About

Energizer Holdings, Inc., manufactures, markets and distributes household batteries, specialty batteries and lighting products worldwide. The company is headquartered in St. Louis, Missouri.

Analyst Target Price

$23.67

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-05 | 2025-11-18 | 2025-08-04 | 2025-05-06 | 2025-02-04 | 2024-11-19 | 2024-08-06 | 2024-05-07 | 2024-02-06 | 2023-11-14 | 2023-08-08 | 2023-05-08 |

| Reported EPS | 0.31 | 1.05 | 1.13 | 0.67 | 0.67 | 1.22 | 0.79 | 0.72 | 0.59 | 1.2 | 0.54 | 0.64 |

| Estimated EPS | 0.26 | 1.16 | 0.62 | 0.68 | 0.65 | 1.17 | 0.68 | 0.67 | 0.57 | 1.13 | 0.67 | 0.52 |

| Surprise | 0.05 | -0.11 | 0.51 | -0.01 | 0.02 | 0.05 | 0.11 | 0.05 | 0.02 | 0.07 | -0.13 | 0.12 |

| Surprise Percentage | 19.2308% | -9.4828% | 82.2581% | -1.4706% | 3.0769% | 4.2735% | 16.1765% | 7.4627% | 3.5088% | 6.1947% | -19.403% | 23.0769% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-05 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.46 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-11 | 2025-12-10 | 2025-09-10 | 2025-06-11 | 2025-03-13 | 2024-12-12 | 2024-09-10 | 2024-06-12 | 2024-03-14 | 2023-12-14 |

| Amount | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 |

Next Dividend Records

| Dividend per share (year): | $1.20 |

| Dividend Yield | 5.35% |

| Next Dividend Date | 2026-03-11 |

| Ex-Dividend Date | 2026-02-18 |

Recent News: ENR

2026-02-23 15:51:55

Energizer Holdings, Inc. (NYSE:ENR) has received an average rating of "Hold" from eight analysts, with a 12-month average price target of $25.29. The company recently reported strong Q4 results, surpassing EPS and revenue expectations, and declared a quarterly dividend of $0.30 per share. Insider activity shows recent stock purchases by the CEO and a director, while institutional investors hold a significant majority of the shares.

2026-02-20 19:07:43

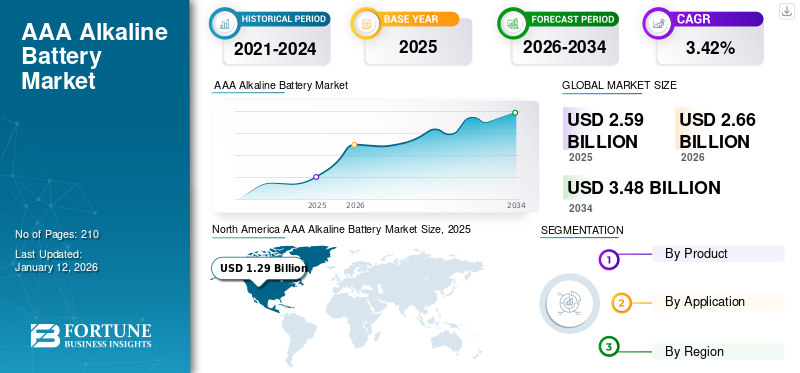

The global AAA alkaline battery market was valued at USD 2.59 billion in 2025 and is projected to reach USD 3.48 billion by 2034, growing at a CAGR of 3.42%. Key drivers include increasing demand for portable devices, while restraints include the rise of alternative technologies. North America dominated the market in 2025 with a 50.04% share, and key players like Duracell and Energizer are expanding production to meet growing demand.

2026-02-20 17:49:30

S&P Global Ratings has revised its outlook on Energizer Holdings Inc. to negative from stable, citing concerns about the company's expected leverage of approximately 6.3x in 2026, which exceeds S&P's downgrade threshold. The negative outlook is driven by weak consumer spending, input cost volatility, and a downward revision of S&P's base-case forecasts due to continued softness in Energizer's battery, lights, and auto care segments. Despite initiatives like Project Momentum and production tax credits, the company's Q1 fiscal 2026 performance was weak, and its full-year guidance relies heavily on a second-half recovery.

2026-02-20 17:41:04

S&P Global Ratings has revised its outlook on Energizer Holdings Inc. from stable to negative due to concerns over the company's leverage, which is projected to reach approximately 6.3x in 2026, exceeding S&P's downgrade threshold. The revision follows weak first-quarter fiscal 2026 performance and a forecast incorporating continued organic volume declines across key segments. S&P highlighted risks from weak consumer spending, input cost volatility, and significant tariff and restructuring costs, while noting the company's efforts to sell down inventory and prepay debt.

2026-02-20 14:19:32

Zacks Research has lowered its FY2026 EPS estimates for Energizer Holdings, Inc. (NYSE:ENR) to $3.37, down from $3.43, as noted in a research report issued on Thursday, February 19th. The firm maintains a "Hold" rating on the stock. Energizer recently surpassed Q4 consensus earnings estimates, reporting $0.31 EPS against $0.26, and revenue of $778.90 million exceeding expectations of $712.82 million.

2026-02-16 23:28:10

Energizer Holdings (NYSE:ENR) has declared a dividend, placing it within the Russell 1000 watchlist. The article covers details about Energizer Holdings' product portfolio, manufacturing processes, distribution channels, and its participation in the Russell 1000, emphasizing transparency in exchange communication. Further access to the article content requires logging in or creating an account.