Enel Chile SA ADR

$ 4.02

0.00%

31 Dec - close price

- Market Cap 5,560,991,000 USD

- Current Price $ 4.02

- High / Low $ 4.04 / 4.00

- Stock P/E 100.50

- Book Value 0.07

- EPS 0.04

- Next Earning Report 2026-03-03

- Dividend Per Share N/A

- Dividend Yield 1.13 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.02 %

- 52 Week High 4.05

- 52 Week Low 2.65

About

Enel Chile SA ADR is a prominent electricity services provider based in Santiago, Chile, focused on the generation, transmission, and distribution of energy. With a strong commitment to sustainability, the company is leading the transition to renewable energy sources, positioning itself to capitalize on the growing demand for cleaner energy solutions in Latin America. Enel Chile is dedicated to advancing innovative technologies aimed at reducing carbon emissions and enhancing operational efficiency. Through its strategic initiatives, the company not only strengthens its leadership in the energy sector but also contributes significantly to Chile’s broader energy transition goals.

Analyst Target Price

$4.19

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-28 | 2025-07-22 | 2025-04-28 | 2025-02-26 | 2024-10-29 | 2024-07-24 | 2024-04-29 | 2024-02-28 | 2023-10-31 | 2023-07-25 | 2023-04-27 | 2023-03-01 |

| Reported EPS | 0.0759 | 0.0516 | 0.1264 | -0.2047 | 121 | 74 | 0.1133 | 258.5 | 115.8 | -19.5 | 101.5 | 797 |

| Estimated EPS | 113.67 | 85.82 | 53.97 | 286.14 | 75.75 | 28.37 | 61.22 | 196.18 | 85.13 | 24.83 | 16.09 | 8.27 |

| Surprise | -113.5941 | -85.7684 | -53.8436 | -286.3447 | 45.25 | 45.63 | -61.1067 | 62.32 | 30.67 | -44.33 | 85.41 | 788.73 |

| Surprise Percentage | -99.9332% | -99.9399% | -99.7658% | -100.0715% | 59.736% | 160.8389% | -99.8149% | 31.7667% | 36.0273% | -178.534% | 530.8266% | 9537.243% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-03 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 119.64 |

| Currency | USD |

Previous Dividend Records

| May 2025 | Feb 2025 | Jun 2024 | Feb 2024 | Jun 2023 | Feb 2023 | May 2022 | Feb 2022 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-05-23 | 2025-02-04 | 2024-06-17 | 2024-02-08 | 2023-06-08 | 2023-02-09 | 2022-05-20 | 2022-02-11 | None | None |

| Amount | $0.177891 | $0.045608 | $0.214514 | $0.031721 | $0.315653 | $0.020616 | $0.016171 | $0.006371 | $0.218658 | $0.22637 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ENIC

2026-01-01 18:08:47

|Morgan Stanley analyst Fernando Pompeo Do Amaral assigned a Buy rating and a $4.30 price target to Enel Chile SA (ENIC). The company's shares closed at $3.91, and the general analyst consensus is a Moderate Buy with an average price target of $4.30. Enel Chile reported $1.15 billion in quarterly revenue and a net profit of $106.18 million for the quarter ending September 29.

2026-01-01 07:08:47

Public companies hold a significant majority, 64%, of Enel Chile S.A.'s ownership, indicating substantial influence by the general public over company management. Institutions account for an additional 18% of the ownership, with Enel SpA being the largest single shareholder at 64% of shares outstanding. This ownership structure suggests that while institutions provide some credibility, the collective power of public companies and individual investors is crucial for the company's future direction.

2026-01-01 04:08:47

The Santiago Court of Appeals has ordered Enel Distribución Chile S.A. to provide a definitive solution within 60 days to the continuous electricity supply issues affecting the Mercado Matadero community. The court found that repeated power outages, ongoing since July 2025, were an illegal and arbitrary act, negatively impacting the economic activity and property rights of the market's tenants. Enel had failed to implement permanent technical measures despite numerous complaints, leading to significant losses for businesses, particularly those relying on refrigeration.

2025-12-23 20:09:09

Enel Chile has secured all contracts in the 2025/02 regulated supply tender, marking its third consecutive win in such processes. The tender, aimed at securing 1,470GWh for 2026, saw an average weighted price of US$98.699 per MWh for Enel, significantly higher than the previous process. This success indicates Enel's dominant position in Chile's electricity supply market, despite recent modifications to auction rules and market dynamics.

2025-12-13 21:09:18

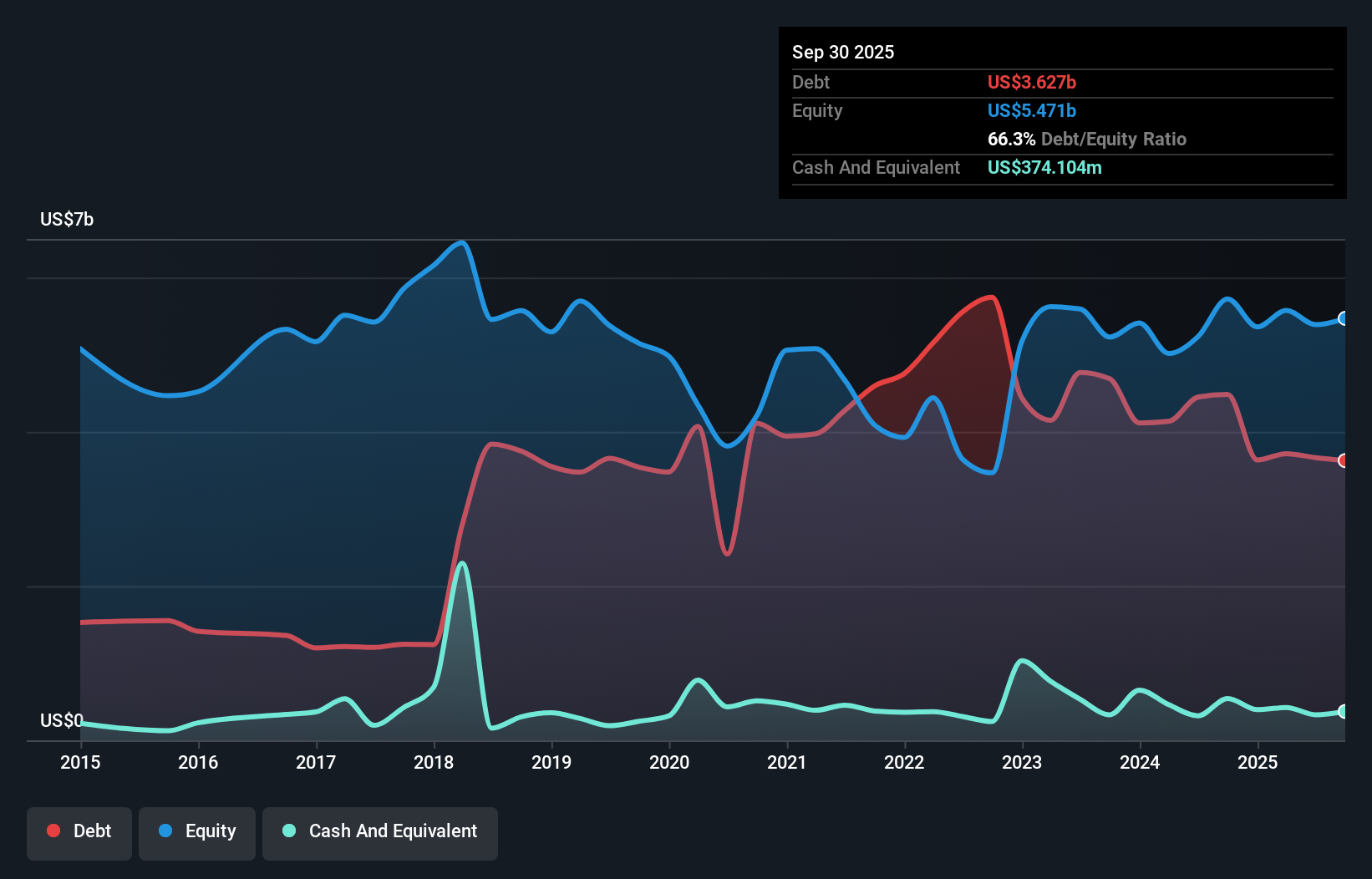

Enel Chile S.A. carries substantial debt, with a net debt of US$3.25 billion as of September 2025, which outweighs its cash and near-term receivables by US$5.19 billion. The company exhibits weak interest cover and a high net debt to EBITDA ratio, alongside a significant 71% decline in EBIT over the last year, raising concerns about its financial risk despite reasonable free cash flow generation. While the Electric Utilities industry often uses debt, Enel Chile's leverage is substantial and poses risks of potential permanent losses for shareholders.

2025-12-13 14:09:02

This article analyzes Enel Chile S.A.'s debt profile, highlighting its significant debt load despite a reduction over the past year. While the company demonstrates good free cash flow conversion, its weak interest cover and high net debt to EBITDA ratio, coupled with a substantial EBIT decline, raise concerns about its financial risk. The analysis suggests potential risks around the balance sheet, though acknowledges that utility companies often use debt.