Elevance Health Inc

$ 286.48

-1.71%

05 Mar - close price

- Market Cap 64,324,379,000 USD

- Current Price $ 286.48

- High / Low $ 294.98 / 283.13

- Stock P/E 11.56

- Book Value 198.81

- EPS 25.21

- Next Earning Report 2026-04-21

- Dividend Per Share $6.84

- Dividend Yield 2.41 %

- Next Dividend Date 2026-03-25

- ROA 0.04 %

- ROE 0.13 %

- 52 Week High 451.93

- 52 Week Low 270.83

About

Elevance Health Inc. is a health benefits company. The company is headquartered in Indianapolis, Indiana.

Analyst Target Price

$387.85

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-28 | 2025-10-21 | 2025-07-17 | 2025-04-22 | 2025-01-23 | 2024-10-17 | 2024-07-17 | 2024-04-18 | 2024-01-24 | 2023-10-18 | 2023-07-19 | 2023-04-19 |

| Reported EPS | 3.33 | 6.03 | 8.84 | 11.97 | 3.84 | 8.37 | 10.12 | 10.64 | 5.62 | 8.99 | 9.04 | 9.46 |

| Estimated EPS | 3.09 | 4.94 | 8.96 | 11.48 | 3.85 | 9.65 | 10.01 | 10.53 | 5.59 | 8.46 | 8.78 | 9.28 |

| Surprise | 0.24 | 1.09 | -0.12 | 0.49 | -0.01 | -1.28 | 0.11 | 0.11 | 0.03 | 0.53 | 0.26 | 0.18 |

| Surprise Percentage | 7.767% | 22.0648% | -1.3393% | 4.2683% | -0.2597% | -13.2642% | 1.0989% | 1.0446% | 0.5367% | 6.2648% | 2.9613% | 1.9397% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-21 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 10.55 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-25 | 2025-12-19 | 2025-09-25 | 2025-06-25 | 2025-03-25 | 2024-12-20 | 2024-09-25 | 2024-06-25 | 2024-03-22 | 2023-12-21 |

| Amount | $1.72 | $1.71 | $1.71 | $1.71 | $1.71 | $1.63 | $1.63 | $1.63 | $1.63 | $1.48 |

Next Dividend Records

| Dividend per share (year): | $6.84 |

| Dividend Yield | 2.41% |

| Next Dividend Date | 2026-03-25 |

| Ex-Dividend Date | 2026-03-10 |

Recent News: ELV

2026-03-06 16:44:10

Steven Collis, a Director at Elevance Health Inc (ELV), recently purchased 3,000 shares, increasing his total holdings to 3,639 shares. This transaction occurred on March 5, 2026, with the stock trading at $289.84. Elevance Health is currently considered significantly undervalued based on its GF Value, with a price-to-GF-Value ratio of 0.5.

2026-03-06 13:46:12

The Centers for Medicare & Medicaid Services (CMS) has threatened sanctions against Elevance, including freezing new Medicare Advantage Prescription Drug (MA-PD) plan enrollment, due to alleged "substantial and persistent noncompliance" regarding risk score data submission and overpayment refunds. Elevance has reportedly been submitting data via encrypted USB flash drives, a method explicitly rejected by CMS, for over seven years. While Elevance plans to review the letter, the potential financial implications could be significantly higher if CMS demands the recoupment of past overpayments.

2026-03-06 13:11:12

Elevance Health Director Steven H. Collis recently acquired 3,000 shares of the company's stock for over $869,000, noteworthy as the stock is near its 52-week low and InvestingPro analysis suggests it's undervalued. This insider purchase comes amidst significant company news including potential Medicare Advantage sanctions, a reiterated Buy rating from TD Cowen, and a management restructuring with Peter Haytaian reportedly planning to leave.

2026-03-06 12:50:10

Director Steven H. Collis recently acquired 3,000 shares of Elevance Health (ELV) for $869,519, notably near its 52-week low, with InvestingPro suggesting the stock is undervalued. This comes amidst several other significant developments for Elevance Health, including potential CMS sanctions, a reiterated "Buy" rating from TD Cowen, and a management restructuring including Peter Haytaian's reported departure from the Carelon division. Separately, Elevra Lithium Limited signed an MOU to supply spodumene concentrate to Mangrove Lithium.

2026-03-06 02:48:03

Pomerantz LLP is investigating potential securities fraud claims against Elevance Health, Inc. (NYSE: ELV) after the company disclosed that the Centers for Medicare & Medicaid Services (CMS) intends to impose intermediate sanctions. These sanctions, set to take effect on March 31, 2026, are due to alleged noncompliance with Medicare Advantage risk adjustment data submission requirements. Following this news, Elevance's stock price fell by 8.1%.

2026-03-05 20:51:26

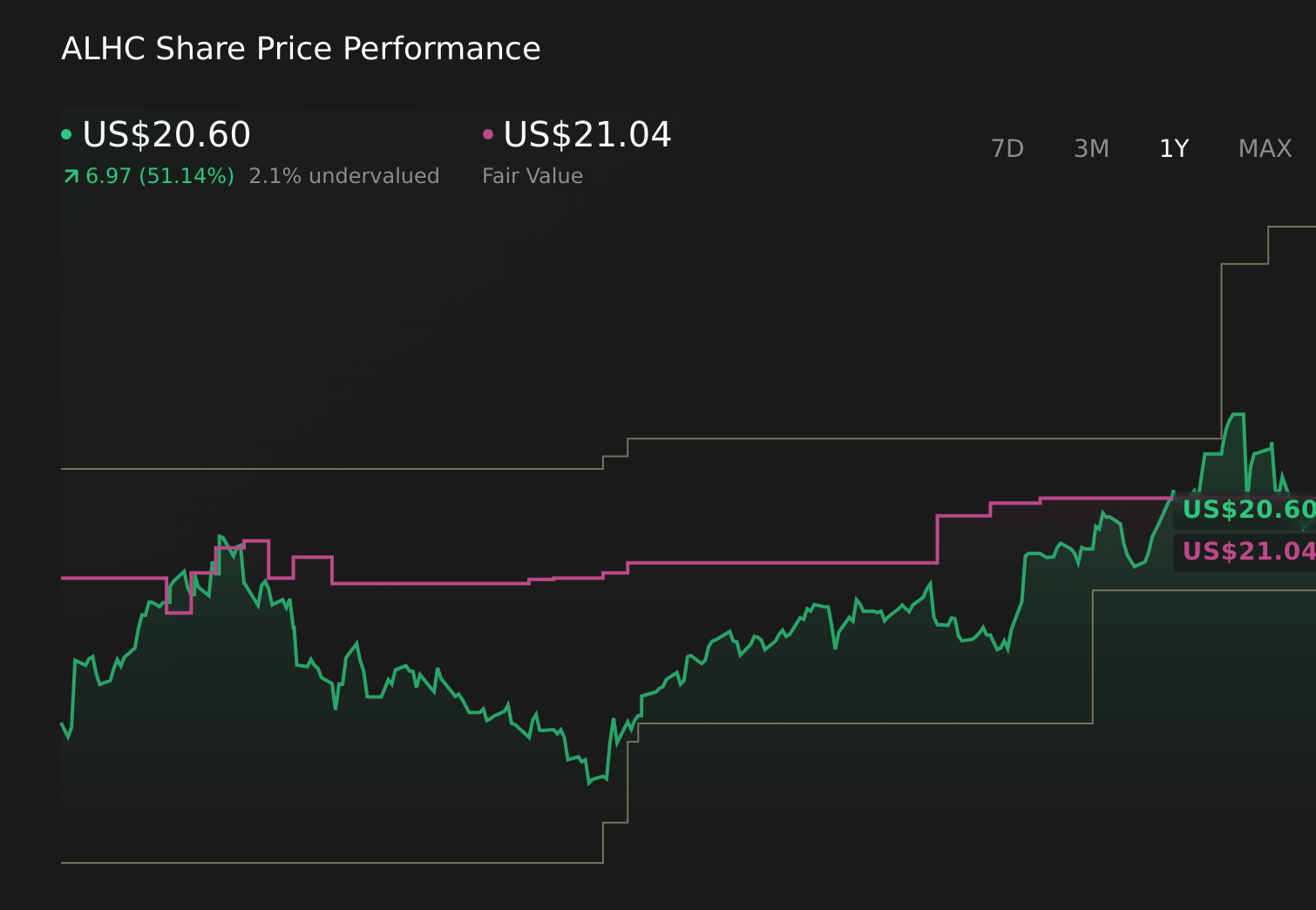

Alignment Healthcare (ALHC) recently completed a significant secondary offering of common shares totaling US$256.24 million, alongside filing an omnibus shelf registration. This activity, coupled with strong 2025 results and optimistic 2026 revenue and EBITDA guidance, signals increased investor interest despite no new capital directly benefiting the company. The article examines how these events, combined with the company's projected long-term growth and fair value, influence Alignment Healthcare's investment outlook, while also cautioning about potential regulatory pressures on Medicare Advantage reimbursement.