DoubleVerify Holdings Inc

$ 9.14

3.33%

24 Feb - close price

- Market Cap 1,448,111,000 USD

- Current Price $ 9.14

- High / Low $ 9.26 / 8.88

- Stock P/E 34.04

- Book Value 6.68

- EPS 0.26

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.04 %

- 52 Week High 22.41

- 52 Week Low 7.64

About

DoubleVerify Holdings, Inc. provides a software platform for digital media measurement, data, and analysis. The company is headquartered in New York, New York with additional locations at Berlin, Germany; Chicago, Illinois; Merelbeke, Belgium; Helsinki, Finland; London, United Kingdom; Los Angeles and San Francisco, California; Miguel Hidalgo, Mexico; Paris, France; So Paulo, Brazil; Singapore, Singapore; Sydney, Australia; Tel Aviv, Israel; and Tokyo, Japan.

Analyst Target Price

$13.78

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-07 | 2025-08-05 | 2025-05-08 | 2025-02-26 | 2024-11-06 | 2024-07-30 | 2024-05-07 | 2024-02-28 | 2023-11-09 | 2023-07-31 | 2023-05-10 | 2023-03-01 |

| Reported EPS | 0.22 | 0.05 | 0.0514 | 0.2147 | 0.1 | 0.04 | 0.04 | 0.19 | 0.08 | 0.07 | 0.07 | 0.1 |

| Estimated EPS | 0.1 | 0.06 | 0.1516 | 0.3155 | 0.07 | 0.04 | 0.02 | 0.14 | 0.06 | 0.06 | 0.04 | 0.11 |

| Surprise | 0.12 | -0.01 | -0.1002 | -0.1008 | 0.03 | 0 | 0.02 | 0.05 | 0.02 | 0.01 | 0.03 | -0.01 |

| Surprise Percentage | 120% | -16.6667% | -66.095% | -31.9493% | 42.8571% | 0% | 100% | 35.7143% | 33.3333% | 16.6667% | 75% | -9.0909% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.2 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: DV

2026-02-18 21:27:32

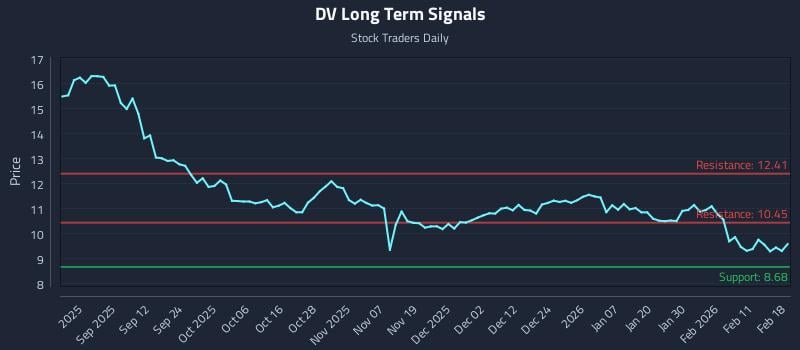

This article from Stock Traders Daily discusses algorithmic entry frameworks for Doubleverify Holdings Inc. (NYSE: DV), highlighting weak sentiment across all time horizons that supports a short bias. It details an exceptional short setup with a significant risk-reward ratio and outlines three distinct institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—tailored for different risk profiles. The analysis includes multi-timeframe signal strengths, support, and resistance levels generated by AI models.

2026-02-15 12:27:09

ING Groep NV significantly reduced its stake in DoubleVerify Holdings, Inc. ($DV) by 83.5% in the third quarter, selling over 420,000 shares. Despite this, institutional investors still hold a substantial 97.29% of the company's stock. Wall Street analysts currently rate DoubleVerify as a "Hold" with an average target price of $16.41.

2026-02-13 16:27:41

Wells Fargo analyst Alec Brondolo maintained a Sell rating on DoubleVerify Holdings (DV) with a price target of $8.00. This is despite the company reporting a quarterly revenue of $188.62 million and a net profit of $10.2 million in its latest earnings. The analyst consensus on DoubleVerify Holdings is currently a Moderate Buy with an average price target of $13.75.

2026-02-13 11:17:00

Analyst opinions on DoubleVerify Holdings Inc. (DV) are split, with approximately 52% recommending a "Buy," 43% a "Hold," and 5% a "Sell" rating, yet a consensus price target suggests a 46% upside. Morgan Stanley recently increased its price target to $15.50 with a "Hold" rating, while Barclays downgraded DV from "Buy" to "Hold" while maintaining its $12 price target. The firm provides media effectiveness platforms and is viewed as an undervalued growth stock, though some suggest other AI stocks may offer better upside.

2026-02-12 14:57:56

RBC Capital analyst Matthew Swanson maintained a Buy rating on DoubleVerify Holdings (DV) with a price target of $17.00. This comes as DoubleVerify reported Q3 revenue of $188.62 million and a net profit of $10.2 million. The analyst consensus for DV is currently a Moderate Buy with an average price target of $14.90.

2026-02-11 10:27:50

The New York State Common Retirement Fund significantly reduced its stake in DoubleVerify Holdings, Inc. ($DV) by 90.3% in Q3, selling over 618,000 shares and retaining 66,597 shares valued at $798,000. DoubleVerify shares are currently trading below their 50-day and 200-day moving averages, with a market capitalization of $1.57 billion and a P/E ratio of 39.08. Analyst consensus for DV is a "Hold" rating with an average price target of $16.41.