Distribution Solutions Group Inc

$ 29.79

-0.67%

24 Feb - close price

- Market Cap 1,378,535,000 USD

- Current Price $ 29.79

- High / Low $ 30.56 / 29.75

- Stock P/E N/A

- Book Value 14.13

- EPS -0.24

- Next Earning Report 2026-03-05

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.03 %

- ROE -0.02 %

- 52 Week High 33.80

- 52 Week Low 21.87

About

Lawson Products, Inc. sells and distributes specialty products for the industrial, commercial, institutional and government maintenance, repair and operations market. The company is headquartered in Chicago, Illinois.

Analyst Target Price

$38.50

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-07-30 | 2025-04-30 | 2025-03-05 | 2024-10-31 | 2024-08-01 | 2024-05-02 | 2024-03-07 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-03-09 |

| Reported EPS | 0.4 | 0.35 | 0.0688 | 0.42 | 0.37 | 0.4 | 0.25 | 0.22 | 0.17 | 0.52 | 0.52 | 0.25 |

| Estimated EPS | 0.27 | 0.2467 | 0.3533 | 0.3333 | 0.4 | 0.31 | 0.28 | 0.14 | 0.24 | 0.53 | 0.4 | 0.45 |

| Surprise | 0.13 | 0.1033 | -0.2845 | 0.0867 | -0.03 | 0.09 | -0.03 | 0.08 | -0.07 | -0.01 | 0.12 | -0.2 |

| Surprise Percentage | 48.1481% | 41.8727% | -80.5265% | 26.0126% | -7.5% | 29.0323% | -10.7143% | 57.1429% | -29.1667% | -1.8868% | 30% | -44.4444% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-05 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.33 |

| Currency | USD |

Previous Dividend Records

| Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | None | None | None | None | None | None | None | None | None | None |

| Amount | $0.12 | $0.12 | $0.12 | $0.12 | $0.12 | $0.12 | $0.12 | $0.12 | $0.08 | $0.06 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: DSGR

2026-02-24 06:52:07

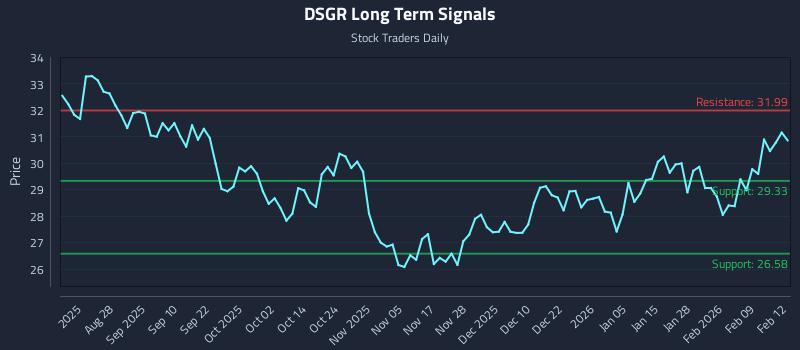

This article analyzes Distribution Solutions Group Inc. (NASDAQ: DSGR) using AI models to provide institutional trading strategies. It highlights conflicting sentiment across different time horizons, suggests choppy conditions, and identifies a significant risk-reward setup. The analysis offers specific entry, target, and stop-loss levels for position trading, momentum breakout, and risk hedging strategies.

2026-02-16 00:27:05

Distribution Solutions Group (DSGR) is currently trading at US$30.84, which is below a fair value estimate of US$38.50 based on discounted cash flow analysis. This undervaluation hinges on successful execution of digital transformation initiatives and acquisitions, along with Lawson's sales transformation. The company's P/S ratio of 0.7x is also significantly lower than its industry and peer averages, suggesting a potential margin of safety or underlying concerns regarding earnings quality or balance sheet risk.

2026-02-13 05:52:00

This article provides an AI-driven analysis of Distribution Solutions Group Inc. (NASDAQ: DSGR), highlighting a potential exceptional short setup with a 29.6:1 risk-reward ratio targeting an 8.3% downside. It details institutional trading strategies including position, momentum breakout, and risk hedging, alongside multi-timeframe signal analysis indicating strong near and mid-term sentiment. The report also offers access to real-time signals and personalized alerts for registered users.

2026-02-05 12:28:10

This article analyzes Distribution Solutions Group (DSGR) stock after its recent mixed share price performance, using Discounted Cash Flow (DCF) and Price to Sales (P/S) valuation methods. The DCF analysis suggests the stock is fairly valued, while the P/S ratio indicates it might be undervalued مقارned to industry and custom benchmarks. It also introduces the concept of "Narratives" for a more personalized valuation approach.

2026-02-05 00:28:12

Distribution Solutions Group (DSGR) has shown mixed share price performance, with a 5.8% year-to-date return but a 6.3% decline over the last year. A Discounted Cash Flow (DCF) analysis suggests the stock is fairly valued at around $29.92 per share, slightly above its current price of $29.67. However, using a Price to Sales (P/S) ratio, DSGR appears undervalued, trading at 0.69x compared to an industry average of 1.34x and a calculated fair ratio of 1.20x.

2026-02-03 14:28:18

Distribution Solutions Group (DSG) announced it will report its Q4 and full year 2025 results on March 5, 2026, followed by a conference call at 9:00 a.m. Eastern Time. A replay of the call will be available until March 19, 2026. DSG is a leading multi-platform specialty distribution company serving approximately 200,000 customers in the Maintenance, Repair & Operations (MRO) market.