Deluxe Corporation

$ 26.88

1.55%

24 Feb - close price

- Market Cap 1,193,307,000 USD

- Current Price $ 26.88

- High / Low $ 27.18 / 26.32

- Stock P/E 14.71

- Book Value 15.12

- EPS 1.80

- Next Earning Report 2026-04-28

- Dividend Per Share $1.20

- Dividend Yield 4.41 %

- Next Dividend Date -

- ROA 0.06 %

- ROE 0.13 %

- 52 Week High 28.29

- 52 Week Low 12.90

About

Deluxe Corporation provides technology-based solutions for small businesses and financial institutions in the United States, Canada, Australia, South America, and Europe. The company is headquartered in Shoreview, Minnesota.

Analyst Target Price

$32.67

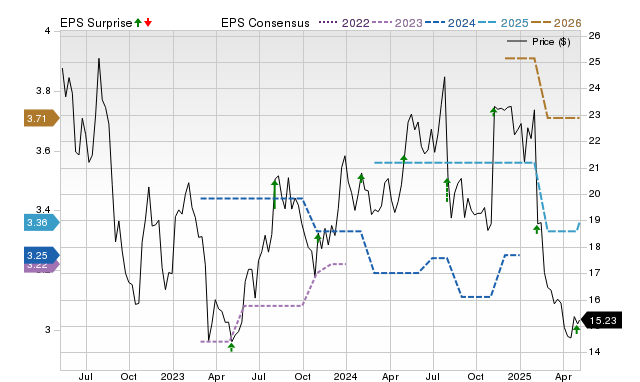

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-03 | 2025-11-10 | 2025-08-06 | 2025-04-30 | 2025-02-05 | 2024-11-06 | 2024-07-31 | 2024-05-01 | 2024-02-01 | 2023-11-02 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0.96 | 1.09 | 0.88 | 0.75 | 0.28 | 0.84 | 0.86 | 0.76 | 0.8 | 0.79 | 0.93 | 0.8 |

| Estimated EPS | 0.8325 | 0.9 | 0.75 | 0.71 | 0.4 | 0.74 | 0.74 | 0.71 | 0.75 | 0.74 | 0.7 | 0.66 |

| Surprise | 0.1275 | 0.19 | 0.13 | 0.04 | -0.12 | 0.1 | 0.12 | 0.05 | 0.05 | 0.05 | 0.23 | 0.14 |

| Surprise Percentage | 15.3153% | 21.1111% | 17.3333% | 5.6338% | -30% | 13.5135% | 16.2162% | 7.0423% | 6.6667% | 6.7568% | 32.8571% | 21.2121% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-28 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-23 | 2025-12-01 | 2025-09-02 | 2025-06-02 | 2025-03-03 | 2024-12-02 | 2024-09-03 | 2024-06-03 | 2024-03-04 | 2023-12-04 |

| Amount | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: DLX

2026-02-15 13:27:55

Versor Investments LP significantly reduced its stake in Deluxe Corporation (NYSE:DLX) by 84.9% in the third quarter, selling 60,620 shares and retaining 10,781 shares valued at $209,000. Despite this, institutional ownership remains high at 93.9%, and several other large managers have increased their positions. Analysts maintain an average "Buy" rating for DLX with a target price of $23.00, while the stock currently trades around $26.19 and offers a 4.6% dividend yield.

2026-02-13 15:57:54

Deluxe (DLX) shares have gained 6.3% recently, with analysts forecasting a 26.2% upside to a mean target of $32.67. While price targets can be misleading, a positive trend in earnings estimate revisions and a Zacks Rank #2 (Buy) suggest potential for the stock's appreciation. Investors are advised to view price targets with skepticism but consider the strong agreement among analysts on earnings prospects as a positive indicator.

2026-02-13 14:57:54

Deluxe Corporation has released its 2025 Form 10-K report, highlighting financial growth with total revenue of $2,133.2 million and a significant increase in net income to $82.2 million. The company is strategically transforming into payments and data solutions, leveraging investments in data analytics and digital capabilities, while managing challenges like declining check usage and regulatory risks.

2026-02-13 08:27:28

Allianz Asset Management GmbH significantly increased its stake in Deluxe Corporation (NYSE:DLX) by 140.2% in the third quarter, reporting ownership of 88,266 shares valued at $1.71 million. Other institutional investors like LSV Asset Management and Geode Capital Management LLC also adjusted their positions in the business services provider. Deluxe Corporation shares experienced a 1.8% drop, with a market cap of $1.16 billion, and the company recently announced a quarterly dividend of $0.30 per share.

2026-02-12 00:34:42

Deluxe Corp's stock has been under pressure, trading closer to its 52-week low amidst investor anxiety regarding its digital transformation efforts. The company's recent earnings report showed mixed results, with revenue in line with expectations but conservative profitability and forward guidance, leading to a bearish sentiment. Analysts generally hold a neutral stance, suggesting the stock is fairly to slightly undervalued but faces unproven execution in its digital pivot and structural headwinds in legacy print products.

.jpg - Foto: THN)

2026-02-12 00:28:21

Deluxe Corp's stock (DLX) is facing downward pressure, trading closer to its 52-week low amidst investor concern about its digital transformation. The company's recent earnings report showed mixed results, with revenue in line but conservative profitability and guidance, failing to fully impress with growth in its digital segments. Despite generating solid operating cash flow, its elevated debt levels and the slow pace of its pivot from legacy print to digital services are leading analysts to maintain a cautious "Hold" rating, making it a "show-me" story for investors.