Delek Logistics Partners LP

$ 52.29

0.46%

26 Feb - close price

- Market Cap 2,783,655,000 USD

- Current Price $ 52.29

- High / Low $ 53.29 / 49.46

- Stock P/E 16.90

- Book Value 0.33

- EPS 3.08

- Next Earning Report 2026-02-27

- Dividend Per Share $4.45

- Dividend Yield 8.28 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.54 %

- 52 Week High 55.89

- 52 Week Low 31.29

About

Delek Logistics Partners, LP owns and operates logistics and marketing assets for crude oil and refined and intermediate products in the United States. The company is headquartered in Brentwood, Tennessee.

Analyst Target Price

$44.25

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-07 | 2025-08-06 | 2025-05-05 | 2025-02-25 | 2024-11-06 | 2024-08-06 | 2024-05-07 | 2024-02-27 | 2023-11-07 | 2023-08-07 | 2023-05-08 | 2023-02-28 |

| Reported EPS | 0.85 | 0.83 | 0.6482 | 1.3304 | 0.71 | 0.87 | 0.73 | 0.51 | 0.8 | 0.73 | 0.86 | 0.98 |

| Estimated EPS | 0.97 | 0.87 | 0.92 | 1.09 | 0.84 | 0.82 | 0.79 | 0.89 | 0.79 | 0.83 | 1.01 | 1.1 |

| Surprise | -0.12 | -0.04 | -0.2718 | 0.2404 | -0.13 | 0.05 | -0.06 | -0.38 | 0.01 | -0.1 | -0.15 | -0.12 |

| Surprise Percentage | -12.3711% | -4.5977% | -29.5435% | 22.055% | -15.4762% | 6.0976% | -7.5949% | -42.6966% | 1.2658% | -12.0482% | -14.8515% | -10.9091% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-27 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.25 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Mar 2024 | Feb 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-12 | 2025-11-13 | 2025-08-14 | 2025-05-15 | 2025-02-11 | 2024-11-14 | 2024-08-14 | 2024-05-15 | 2024-03-08 | 2024-02-12 |

| Amount | $1.125 | $1.12 | $1.115 | $1.11 | $1.105 | $1.1 | $1.09 | $1.07 | $0.245 | $1.055 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: DKL

2026-02-24 05:51:55

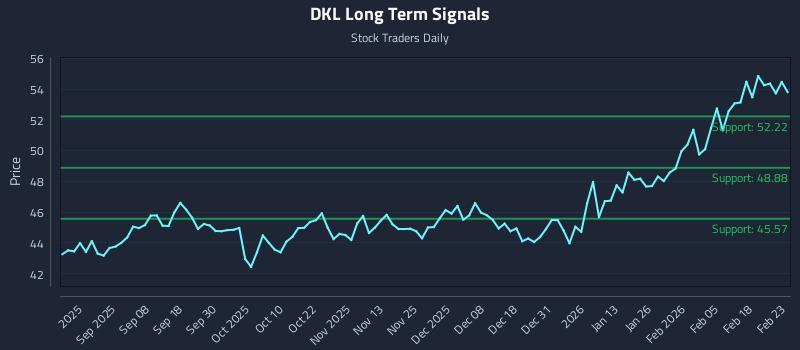

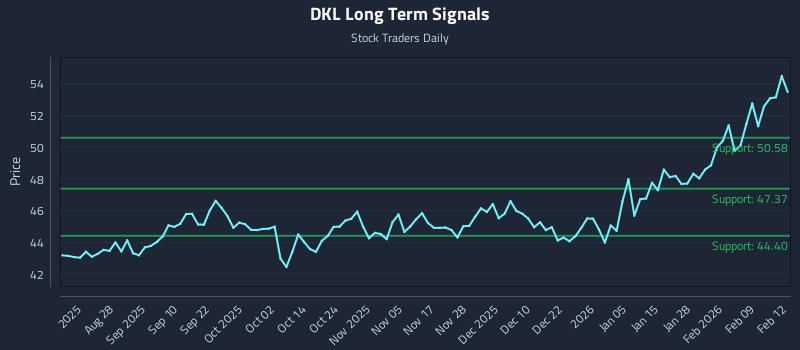

Delek Logistics Partners L.p. (NYSE: DKL) is showing weak near-term sentiment but strong mid and long-term signals, with no clear price positioning identified and elevated downside risk. AI models have generated three trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. The analysis provides multi-timeframe signal strengths, support, and resistance levels for DKL.

2026-02-20 07:44:45

Delek Logistics Partners (DKL) is scheduled to release its Q4 2025 earnings before the market open on Friday, February 27, 2026. Analysts anticipate earnings of $1.26 per share and revenue of $283.64 million. The company recently increased its quarterly dividend to $1.125, resulting in an 8.4% annualized yield, and its shares opened at $53.85 with a market cap of $2.88 billion.

2026-02-19 11:57:46

Delek US Holdings, Inc. announced that its Board of Directors has approved a quarterly dividend of $0.255 per share. The dividend will be paid on March 9, 2026, to shareholders of record as of March 2, 2026. The company is a diversified downstream energy company with assets in petroleum refining, logistics, and pipelines.

2026-02-19 01:27:11

Delek US Holdings, Inc. announced that its Board of Directors has approved a quarterly dividend of $0.255 per share. The dividend will be paid on March 9, 2026, to shareholders of record on March 2, 2026. Delek US Holdings is a diversified downstream energy company involved in petroleum refining, logistics, and pipelines.

2026-02-18 08:14:29

Delek Logistics Partners (NYSE:DKL) stock recently crossed above its 200-day moving average, trading at $54.2680. The company has seen mixed analyst ratings, with an average "Hold" and a consensus price target of $45.00, and recently increased its quarterly dividend to $1.125 per share, yielding 8.3%. Institutional investors have also adjusted their holdings, with several firms increasing their stakes in the oil and gas producer.

2026-02-13 04:57:51

This article provides a liquidity mapping analysis for Delek Logistics Partners L.p. (NYSE: DKL), indicating a strong sentiment supporting an overweight bias across all horizons despite elevated downside risk due to a lack of additional long-term support signals. It outlines institutional trading strategies including position trading, momentum breakout, and risk hedging, along with multi-timeframe signal analysis, and highlights real-time AI-generated signals for traders.