Dine Brands Global Inc

$ 34.10

4.51%

26 Dec - close price

- Market Cap 524,435,000 USD

- Current Price $ 34.10

- High / Low $ 34.22 / 32.88

- Stock P/E 15.22

- Book Value -16.09

- EPS 2.24

- Next Earning Report -

- Dividend Per Share $2.04

- Dividend Yield 6.25 %

- Next Dividend Date 2026-01-07

- ROA 0.05 %

- ROE N/A %

- 52 Week High 35.14

- 52 Week Low 17.80

About

Dine Brands Global, Inc. is a leading entity in the full-service dining industry, recognized primarily for its iconic brands, Applebee's and IHOP. Based in Glendale, California, the company effectively combines franchising with corporate operations to facilitate growth in both domestic and international markets. Dine Brands emphasizes customer engagement through innovative menu development and strategic marketing, fostering brand loyalty across diverse consumer segments. With a strong network of franchise partners and significant operational prowess, the company is well-equipped to navigate the competitive landscape and achieve long-term profitability and expansion.

Analyst Target Price

$25.75

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-29 | 2025-08-06 | 2025-05-06 | 2025-02-26 | 2024-11-06 | 2024-08-07 | 2024-05-08 | 2024-02-28 | 2023-11-01 | 2023-08-03 | 2023-05-03 | 2023-03-01 |

| Reported EPS | 0.73 | 1.17 | 1.03 | 0.87 | 1.44 | 1.71 | 1.33 | 1.4 | 1.46 | 1.82 | 1.97 | 1.34 |

| Estimated EPS | 1.09 | 1.45 | 1.2363 | 1.3477 | 1.35 | 1.64 | 1.57 | 1.15 | 1.31 | 1.54 | 1.71 | 1.24 |

| Surprise | -0.36 | -0.28 | -0.2063 | -0.4777 | 0.09 | 0.07 | -0.24 | 0.25 | 0.15 | 0.28 | 0.26 | 0.1 |

| Surprise Percentage | -33.0275% | -19.3103% | -16.6869% | -35.4456% | 6.6667% | 4.2683% | -15.2866% | 21.7391% | 11.4504% | 18.1818% | 15.2047% | 8.0645% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-07 | 2025-10-08 | 2025-07-09 | 2025-04-04 | 2025-01-07 | 2024-10-08 | 2024-07-05 | 2024-04-05 | 2024-01-05 | 2023-09-29 |

| Amount | $0.19 | $0.51 | $0.51 | $0.51 | $0.51 | $0.51 | $0.51 | $0.51 | $0.51 | $0.51 |

Next Dividend Records

| Dividend per share (year): | $2.04 |

| Dividend Yield | 6.25% |

| Next Dividend Date | 2026-01-07 |

| Ex-Dividend Date | 2025-12-23 |

Recent News: DIN

2025-12-19 03:10:05

Dine Brands Global is appealing to cautious consumers through strategically discounted menu options and an improved dining experience, or "vibe." This approach has helped IHOP and Applebee's increase comparable sales and attract higher-income customers who are also seeking value. The company is also expanding its dual-brand concept, combining IHOP and Applebee's under one roof, which has shown significant revenue growth.

2025-12-18 11:51:00

Shares of Dine Brands (DIN) jumped 2.8% in morning trading after competitor Darden Restaurants reported strong Q2 results, boosting investor sentiment for the broader restaurant industry. Darden's positive performance, with a 7.3% increase in total sales and a 4.3% rise in same-restaurant sales, suggested healthy consumer spending on dining out. This uplifted the outlook for companies like Dine Brands, which saw its stock cool down to $35.07, up 3.3% from its previous close, setting a new 52-week high.

2025-12-18 03:09:29

Dine Brands Global is attracting cautious consumers by offering strategically discounted menu options and an appealing "vibe" in its IHOP and Applebee's restaurants. This approach has led to increased year-over-year comparable sales and offset traffic declines from lower-income customers. The company is also expanding its dual-branded IHOP/Applebee's concept, which combines both menus under one roof and significantly boosts revenue and profit margins.

2025-12-09 05:08:44

Dine Brands Global (NYSE:DIN) Director Martha Poulter recently purchased 650 shares of the company's stock at an average price of $33.16, increasing her stake to 7,074 shares. The acquisition, valued at $21,554, occurred on December 5th. Despite the insider buying, the company missed quarterly earnings estimates, reporting $0.73 EPS against an expected $0.82, though revenue saw an increase of 10.8% year-over-year.

2025-12-04 03:53:06

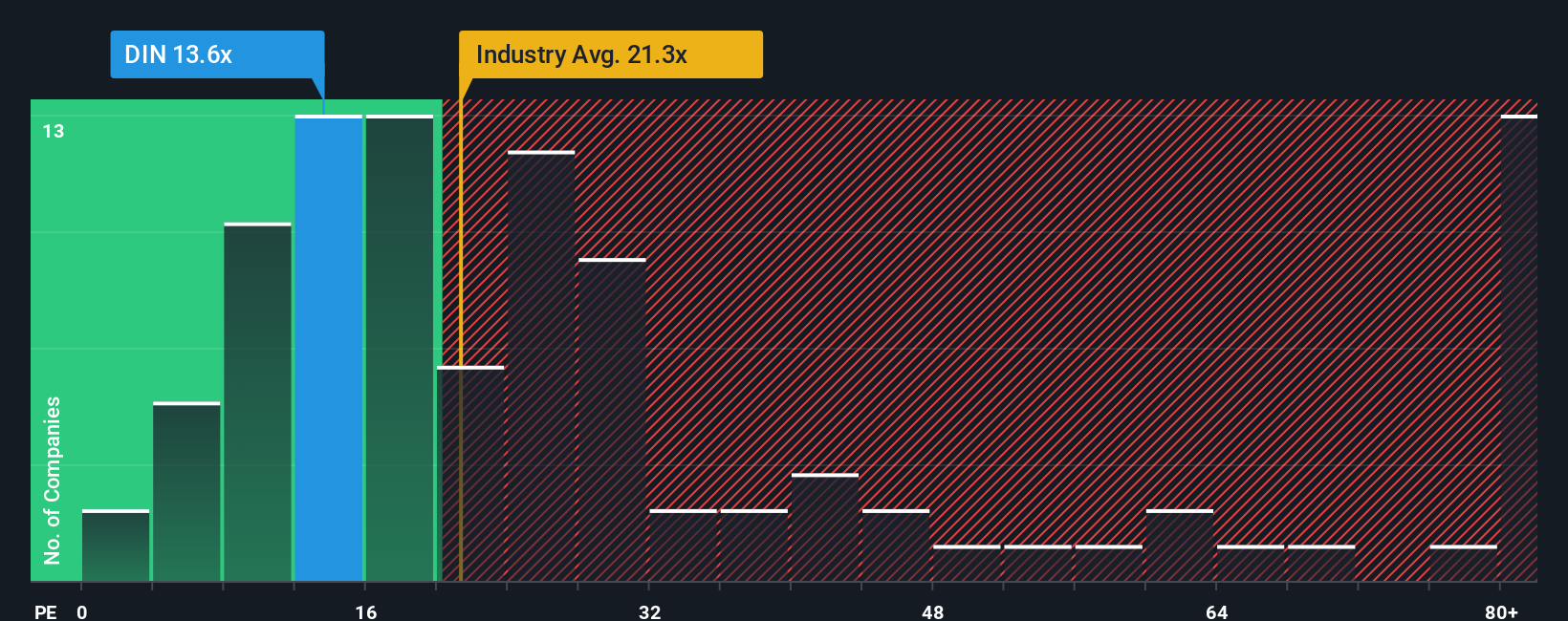

Dine Brands Global, Inc. (NYSE:DIN) shares have risen 26% in the last 30 days, yet the stock remains down 10% over the past year. Despite a low P/E ratio of 13.6x compared to the broader market, the company's earnings have decreased by 63% in the last year and 57% over three years. While analysts forecast 62% earnings growth for the next year, significantly higher than the market's 16%, investors appear unconvinced, suppressing the P/E ratio due to concerns about future earning volatility.

2025-12-04 03:53:06

Dine Brands Global (NYSE:DIN) shareholders have experienced a 45% loss over the past five years, underperforming a typical index fund. Despite recent gains of 36% in the last three months and a 1.5% annual revenue increase over five years, the stock's longer-term performance has been negative. The article suggests that while insider buying is positive, further examination of revenue and earnings trends is needed to understand the share price stagnation.