Ducommun Incorporated

$ 124.73

-1.46%

23 Feb - close price

- Market Cap 1,864,221,000 USD

- Current Price $ 124.73

- High / Low $ 126.09 / 122.78

- Stock P/E N/A

- Book Value 43.43

- EPS -2.32

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE -0.05 %

- 52 Week High 128.17

- 52 Week Low 51.76

About

Ducommun Incorporated provides engineering and manufacturing products and services primarily to the aerospace and defense, industrial, medical and other industries in the United States. The company is headquartered in Santa Ana, California.

Analyst Target Price

$130.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-19 | 2025-11-06 | 2025-08-07 | 2025-05-06 | 2025-02-13 | 2024-11-07 | 2024-08-08 | 2024-05-08 | 2024-02-15 | 2023-11-08 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0 | 0.99 | 0.82 | 0.6926 | 0.75 | 0.99 | 0.83 | 0.7 | 0.7 | 0.7 | 0.54 | 0.63 |

| Estimated EPS | 0.985 | 0.97 | 0.82 | 0.7025 | 0.8952 | 0.74 | 0.6 | 0.57 | 0.63 | 0.61 | 0.57 | 0.6 |

| Surprise | -0.985 | 0.02 | 0 | -0.0099 | -0.1452 | 0.25 | 0.23 | 0.13 | 0.07 | 0.09 | -0.03 | 0.03 |

| Surprise Percentage | -100% | 2.0619% | 0% | -1.4093% | -16.2198% | 33.7838% | 38.3333% | 22.807% | 11.1111% | 14.7541% | -5.2632% | 5% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.91 |

| Currency | USD |

Previous Dividend Records

| Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | None | None | None | None | None | None | None | None | None | None |

| Amount | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 | $0.075 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: DCO

2026-02-23 15:02:59

Ducommun (NYSE:DCO) reached a new 52-week high after Royal Bank of Canada upgraded its rating to "outperform" and increased its price target to $142.00. Other analysts, including Goldman Sachs and Citigroup, have also raised their price targets, contributing to a "Moderate Buy" consensus. Insider selling by VP Jerry L. Redondo was noted, while institutional ownership stands at approximately 92.15%.

2026-02-22 10:27:12

GSA Capital Partners LLP reduced its stake in Ducommun Incorporated by 50.3% in the third quarter, selling 8,087 shares and leaving them with 7,986 shares valued at $768,000. Despite this, Ducommun's stock has been performing well, trading at $126.55, near its one-year high, and analysts maintain a "Moderate Buy" rating with a target price of $123.50. Insider trading also saw VP Jerry L. Redondo sell 2,000 shares, though insiders collectively still own 8.90% of the company.

2026-02-18 16:27:45

Ducommun Inc. (DCO) stock has reached an all-time high of $126.74 USD, reflecting significant growth over the past year. Despite negative earnings, analysts are optimistic about the aerospace and defense company's future, with earnings expected to be reported soon. The company also recently secured a new credit facility and resolved a subrogation claim.

2026-02-15 22:57:54

Wall Street Zen has downgraded Ducommun (NYSE:DCO) from "strong-buy" to "buy," though the stock still maintains a consensus "Moderate Buy" rating with an average analyst target of $113. Shares are trading near a one-year high of approximately $124, with a market capitalization of $1.85 billion. Insider activity shows a VP sold 2,000 shares in December, while institutional ownership remains very high at around 92%, with major investors like Vanguard and State Street increasing their stakes.

2026-02-15 08:27:56

Advisors Asset Management Inc. increased its stake in Ducommun Incorporated (NYSE:DCO) by 63.7% in the third quarter, acquiring an additional 12,353 shares, bringing their total ownership to 31,741 shares valued at approximately $3.05 million. This represents about 0.21% of the company's stock. Ducommun holds a "Moderate Buy" consensus rating from analysts, with an average price target of $113.00, and trades near its 1-year high.

2026-02-13 02:14:00

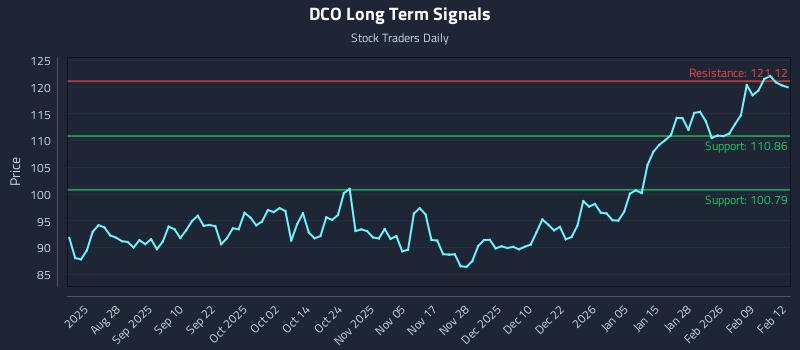

This article provides an AI-generated analysis of Ducommun Incorporated (NYSE: DCO), indicating a near-term neutral sentiment amidst mid and long-term strength. It outlines three institutional trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—tailored for different risk profiles. The analysis highlights key support and resistance levels across various time horizons, with specific entry and exit signals.