Carvana Co

$ 398.85

0.97%

04 Dec - close price

- Market Cap 86,472,057,000 USD

- Current Price $ 398.85

- High / Low $ 399.76 / 386.51

- Stock P/E 90.85

- Book Value 16.14

- EPS 4.39

- Next Earning Report 2026-02-19

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.12 %

- ROE 0.68 %

- 52 Week High 413.33

- 52 Week Low 148.25

About

Carvana Co. is a leading e-commerce platform transforming the used car marketplace in the United States, headquartered in Tempe, Arizona. Utilizing advanced technology, Carvana enhances the vehicle buying and selling experience by offering convenience, transparency, and a broad selection of competitively priced vehicles, along with features such as home delivery and a seven-day return policy. As the automotive retail landscape rapidly evolves, Carvana's innovative approach and commitment to customer satisfaction position it for significant growth opportunities in the digital automotive sector.

Analyst Target Price

$420.78

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-29 | 2025-07-30 | 2025-05-07 | 2025-02-20 | 2024-10-30 | 2024-07-31 | 2024-05-01 | 2024-02-22 | 2023-11-02 | 2023-07-19 | 2023-05-04 | 2023-02-23 |

| Reported EPS | 1.03 | 1.28 | 1.5288 | 0.608 | 0.64 | 0.14 | 0.23 | -1 | -0.46 | -0.55 | -1.51 | 0.39 |

| Estimated EPS | 1.32 | 1.14 | 0.5297 | 0.17 | 0.25 | -0.07 | -0.74 | -0.89 | -0.79 | -1.15 | -2 | -2.27 |

| Surprise | -0.29 | 0.14 | 0.9991 | 0.438 | 0.39 | 0.21 | 0.97 | -0.11 | 0.33 | 0.6 | 0.49 | 2.66 |

| Surprise Percentage | -21.9697% | 12.2807% | 188.6162% | 257.6471% | 156% | 300% | 131.0811% | -12.3596% | 41.7722% | 52.1739% | 24.5% | 117.1806% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-19 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.08 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CVNA

2025-11-02 11:19:44

This page provides live quotes and charts for Carvana Co. Class A (CVNA) stock. It includes current stock price, recent performance, an analyst ratings section indicating no current ratings, and information suggesting a lack of earnings data.

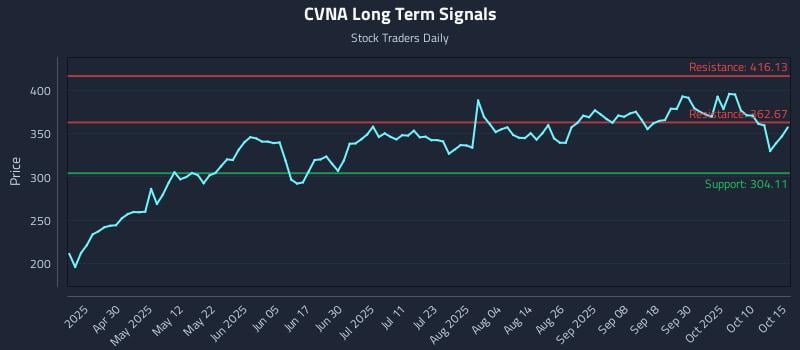

2025-10-15 16:40:01

This article analyzes Carvana Co. Class A (NASDAQ: CVNA) using AI-generated trading strategies and multi-timeframe signal analysis. It highlights weak near and mid-term sentiment, although long-term outlook remains strong, and provides specific entry and exit points for position trading, momentum breakout, and risk hedging strategies. The analysis identifies key support and resistance levels across different time horizons, alongside real-time signals.

2025-10-14 08:49:34

Vanguard Personalized Indexing Management LLC increased its stake in Carvana Co. (NYSE:CVNA) by 13.3% in the second quarter, now holding 15,030 shares valued at $5.065 million. Carvana's stock saw a 2.9% increase, trading at $338.77 with a market capitalization of $72.90 billion, following a strong earnings report where it surpassed analyst expectations with $1.28 EPS and a 41.9% year-over-year revenue increase. Other hedge funds, including Price T Rowe Associates Inc. MD and Vanguard Group Inc., also significantly raised their holdings in the company.

2025-10-14 07:33:28

DAVENPORT & Co LLC recently acquired 773 shares of Carvana Co. (NYSE:CVNA) stock, valued at approximately $260,000, during the second quarter. This purchase is part of a broader trend of institutional investors adjusting their positions in Carvana, with several hedge funds increasing their holdings. Analysts have largely maintained a "Buy" rating on CVNA, with an average target price of $407.44, following strong earnings results that beat consensus estimates.

2025-09-30 20:58:29

Carvana Co. CEO Ernest C. Garcia III indirectly sold $3.73 million worth of Class A Common Stock through trusts, with prices ranging from $369.30 to $378.39. This transaction follows a JPMorgan upgrade of CVNA to an Overweight rating with a price target of $425, citing strong fundamentals despite various industry challenges. Carvana continues to expand market share and strengthen its balance sheet, indicating a positive outlook for the company's future.

2025-07-26 15:40:00

Ernest C. Garcia II, a ten percent owner of Carvana Co., sold approximately $33.6 million worth of Class A Common Stock on July 23 and 24, 2025. These transactions occurred as Carvana's stock has seen a 150% return over the past year and the company is valued at $44.8 billion with a Piotroski Score of 9. The sales precede Carvana's next earnings report and align with recent optimistic analyst updates and price target increases from firms like Citi, Stephens, JPMorgan, BTIG, and Citizens JMP.