Cantaloupe Inc

$ 10.30

0.29%

24 Feb - close price

- Market Cap 757,106,000 USD

- Current Price $ 10.30

- High / Low $ 10.44 / 10.22

- Stock P/E 14.07

- Book Value 3.42

- EPS 0.73

- Next Earning Report 2026-04-30

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.24 %

- 52 Week High 11.16

- 52 Week Low 7.01

About

Cantaloupe, Inc., a software and payments company, provides technology solutions for the underserved retail market. The company is headquartered in Malvern, Pennsylvania.

Analyst Target Price

$11.20

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-05 | 2025-11-06 | 2025-09-10 | 2025-05-07 | 2025-02-06 | 2024-11-07 | 2024-09-04 | 2024-05-09 | 2024-02-08 | 2023-11-09 | 2023-09-06 | 2023-05-04 |

| Reported EPS | -0.0009 | 0.09 | 0.09 | 0.6513 | 0.0789 | 0.04 | 0.03 | 0.06 | 0.04 | 0.02 | 0.04 | 0.09 |

| Estimated EPS | 0.1 | 0.0967 | 0.105 | 0.105 | 0.07 | 0.04 | 0.05 | 0.04 | 0.03 | 0.01 | 0.05 | 0.04 |

| Surprise | -0.1009 | -0.0067 | -0.015 | 0.5463 | 0.0089 | 0 | -0.02 | 0.02 | 0.01 | 0.01 | -0.01 | 0.05 |

| Surprise Percentage | -100.9% | -6.9286% | -14.2857% | 520.2857% | 12.7143% | 0% | -40% | 50% | 33.3333% | 100% | -20% | 125% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-30 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.1 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CTLP

2026-02-24 01:53:08

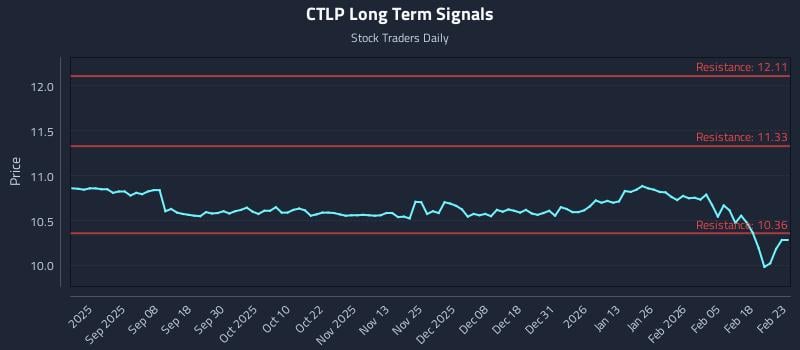

This article provides an AI-driven analysis of Cantaloupe Inc. (CTLP), highlighting a positive near-term sentiment that may counter mid-term weakness within a long-term strength context. It offers three institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss zones. The analysis also includes multi-timeframe signal strengths, support, and resistance levels for the stock.

2026-02-21 10:01:42

BCK Capital Management LP significantly increased its stake in Cantaloupe, Inc. (NASDAQ:CTLP) by 330.9% in the third quarter, making it their 4th largest position. Other institutional investors like Vanguard Group, Magnetar Financial, and Alpine Associates Management also raised their holdings, collectively owning 75.75% of the company's stock. Despite increased institutional investment, analysts maintain a "Hold" rating with an average target of $12.73, following Cantaloupe missing recent quarterly earnings and revenue estimates.

2026-02-21 07:15:34

Cantaloupe (NASDAQ:CTLP) has received a "hold" rating upgrade from Wall Street Zen, consistent with the overall analyst consensus of "Hold" and an average price target of $12.73. Despite missing recent EPS and revenue estimates, institutional investors, including Magnetar and AllianceBernstein, have significantly increased their stakes. The company's stock currently trades at $10.27 with a market capitalization of $757.1 million and a P/E ratio of 57.06.

2026-02-19 02:56:58

Principal Financial Group Inc. recently acquired 187,121 shares of Cantaloupe, Inc. (NASDAQ:CTLP), valued at approximately $1.98 million, representing a 0.25% ownership stake. This move highlights increased institutional interest in Cantaloupe, with hedge funds and institutional investors now owning 75.75% of the stock, despite the company missing its recent quarterly earnings estimates. Analysts currently hold a consensus "Hold" rating on CTLP with a target price of $12.73.

2026-02-15 03:14:19

Cantaloupe Inc., a digital payments and software services company, has launched "The 46" micro market kiosk, developed by its recent acquisition Three Square Market. This new kiosk is fully Americans with Disabilities Act (ADA) compliant, featuring an accessible height button, built-in speakers, an audio jack, and a braille overlay to accommodate users with mobility challenges, those in wheelchairs, and individuals with low vision or complete vision loss. The company highlights "The 46" as a significant differentiator in the market due to its comprehensive accessibility features, which are crucial for companies aiming to provide inclusive self-service commerce solutions.

2026-02-13 10:27:54

New York Life Investment Management LLC has acquired 145,348 shares of Cantaloupe, Inc. (NASDAQ:CTLP) in the third quarter, representing a 0.20% ownership stake in the company. Institutional investors now collectively own about 75.75% of Cantaloupe. The purchase follows Cantaloupe missing its quarterly earnings and revenue expectations, with the stock currently trading around $10.36.