CorMedix Inc

$ 7.07

0.86%

24 Feb - close price

- Market Cap 552,311,000 USD

- Current Price $ 7.07

- High / Low $ 7.13 / 6.95

- Stock P/E 3.17

- Book Value 4.78

- EPS 2.21

- Next Earning Report 2026-03-24

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.16 %

- ROE 0.75 %

- 52 Week High 17.43

- 52 Week Low 5.60

About

CorMedix Inc., a biopharmaceutical company, focuses on developing and marketing therapeutic products for the prevention and treatment of infectious and inflammatory diseases in the United States and internationally. The company is headquartered in Berkeley Heights, New Jersey.

Analyst Target Price

$14.86

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-28 | 2025-08-07 | 2025-05-07 | 2025-03-10 | 2024-10-30 | 2024-08-14 | 2024-05-09 | 2024-03-12 | 2023-11-14 | 2023-08-08 | 2023-05-15 | 2023-03-30 |

| Reported EPS | 1.406 | 0.28 | 0.2993 | 0.22 | -0.05 | -0.25 | -0.25 | -0.26 | -0.17 | -0.25 | -0.24 | -0.2 |

| Estimated EPS | 0.2233 | 0.16 | 0.245 | 0.14 | -0.1 | -0.25 | -0.28 | -0.2 | -0.21 | -0.24 | -0.2 | -0.19 |

| Surprise | 1.1827 | 0.12 | 0.0543 | 0.08 | 0.05 | 0 | 0.03 | -0.06 | 0.04 | -0.01 | -0.04 | -0.01 |

| Surprise Percentage | 529.6462% | 75% | 22.1633% | 57.1429% | 50% | 0% | 10.7143% | -30% | 19.0476% | -4.1667% | -20% | -5.2632% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.86 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CRMD

2026-02-23 15:58:34

CorMedix (CRMD) is set to report fourth-quarter and full-year 2025 earnings, with investors focused on DefenCath sales and the recent Melinta acquisition. Despite a strong prior earnings beat history and a positive Earnings ESP, the stock faces competitive pressures from larger players and a conservative 2026 financial outlook, dampening investor sentiment. The article suggests investors consider reducing exposure or selling CRMD due to near-term uncertainty and declining earnings estimates.

2026-02-23 10:45:00

CorMedix (CRMD) is set to release its Q4 and full-year 2025 earnings, with investors focusing on the sales performance of its lead product, DefenCath. Despite a history of beating earnings estimates, the stock is currently rated as a Zacks Rank #5 (Strong Sell) due to competitive pressures and a conservative 2026 financial outlook. Analysts are cautious about CRMD's long-term growth given its reliance on DefenCath and the muted guidance.

2026-02-20 05:57:58

CorMedix is entering a crucial period this spring, marked by investor conferences, the release of Q4 earnings, and significant clinical readouts. The company will participate in several healthcare conferences in March and has authorized a new $75 million share repurchase program. Key clinical trial results for REZZAYO (Phase III "ReSPECT" trial) and development efforts for DefenCath are also anticipated in 2026, which could significantly impact the company's commercial potential.

2026-02-20 05:24:35

CorMedix is entering a critical period with several key events scheduled for the spring of 2026, including investor conferences in March, the release of Q4 earnings, and a new $75 million share repurchase program. Additionally, significant clinical data readouts are anticipated in Q2 2026 for its drug REZZAYO from the Phase III "ReSPECT" trial, and further development for DefenCath. These activities are expected to significantly influence the company's near-term trajectory and investor perception.

2026-02-19 10:10:00

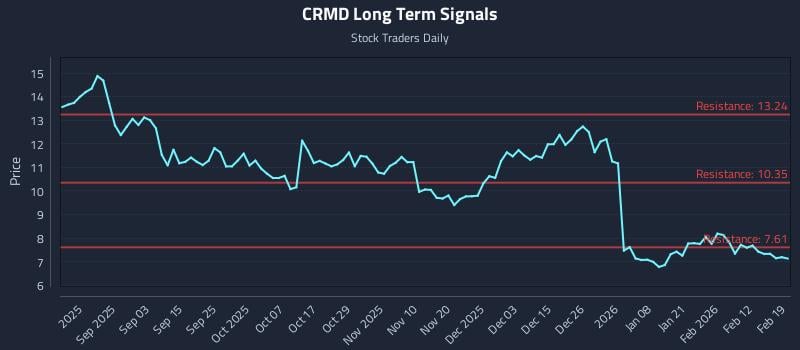

This article from Stock Traders Daily analyzes Cormedix Inc. (NASDAQ: CRMD), highlighting weak near and mid-term sentiment, and a neutral long-term outlook. It identifies elevated downside risk due to a lack of additional long-term support signals. The report also provides three distinct AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—tailored to different risk profiles.

2026-02-17 16:57:23

CorMedix (CRMD) shares have dropped 27% over the past three months due to a cautious 2026 financial outlook, primarily for its lead product DefenCath. Despite initial strong uptake for DefenCath and the acquisition of Melinta Therapeutics for diversification, concerns about slower adoption and increased competition from larger pharmaceutical companies have impacted investor sentiment. The article suggests that due to recent price declines, conservative guidance, and downward earnings revisions, investors might consider reducing their positions or exiting the stock.