Canterbury Park Holding Corporation

$ 15.27

0.44%

03 Dec - close price

- Market Cap 80,670,000 USD

- Current Price $ 15.27

- High / Low $ 15.27 / 15.04

- Stock P/E N/A

- Book Value 16.70

- EPS -0.28

- Next Earning Report -

- Dividend Per Share $0.07

- Dividend Yield 0.44 %

- Next Dividend Date -

- ROA 0.02 %

- ROE N/A %

- 52 Week High 22.59

- 52 Week Low 15.03

About

Canterbury Park Holding Corporation (CPHC) is a leading diversified gaming and entertainment company located in Shakopee, Minnesota. The firm operates a prominent racetrack and card casino, offering a unique combination of horse racing and unbanked card gaming, which enhances the entertainment options available to the local community. With a commitment to responsible gaming and active community engagement, CPHC is well-positioned to capitalize on growth opportunities in the regional gaming market, providing exceptional experiences for a diverse clientele while fostering sustainable revenue streams.

Analyst Target Price

$11.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-09-30 | 2025-08-08 | 2025-05-07 | 2025-03-10 | 2024-11-07 | 2024-08-08 | 2024-05-09 | 2024-03-11 | 2023-11-09 | 2023-08-10 | 2023-05-11 | 2023-03-20 |

| Reported EPS | 0.0955 | -0.06 | -0.0594 | -0.2473 | 0.402 | 0.0675 | 0.2 | 0.2748 | 0.2295 | 1.0734 | 0.5628 | 0.22 |

| Estimated EPS | None | 0 | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | -0.06 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | Jul 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-10-14 | 2025-07-14 | 2025-04-14 | 2025-01-14 | 2024-10-14 | 2024-07-12 | 2024-04-12 | 2024-01-12 | 2023-10-13 | 2023-07-14 |

| Amount | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 | $0.07 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CPHC

2025-11-28 16:52:11

Canterbury Park Holding Corporation (CPHC) filed its 10-K report for the fiscal year ended December 31, 2024, detailing operations in pari-mutuel wagering, casino operations, food and beverage, and real estate development. The company saw a slight increase in net revenues to $61,562,000 but a significant decrease in net income to $2,112,842 due to lower income from equity investments and land transactions. CPHC's management continues to focus on strategic growth and diversifying its business amidst competition and potential legislative changes.

2025-11-28 16:52:11

Canterbury Park Holding Corp (CPHC) released its 2024 10-K report, revealing a slight increase in total net revenues to $61.56 million but a significant decrease in net income to $2.11 million due to lower gains on land sales and increased operating expenses. The company detailed its business segments, financial highlights, future outlook, and operational challenges, including intense competition and regulatory risks. CPHC is focusing on growing Casino revenue, real estate development, and managing capital while navigating a challenging economic and regulatory environment.

2025-11-23 13:22:00

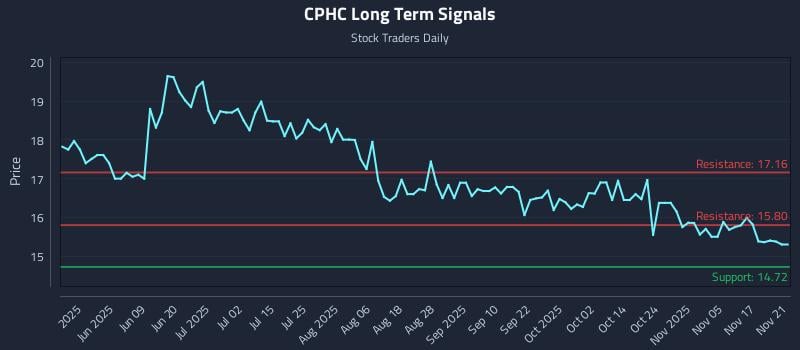

This article analyzes Canterbury Park Holding Corporation (NASDAQ: CPHC) based on AI models, identifying stable neutral readings in shorter horizons and a mid-channel oscillation pattern. It outlines three distinct trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. The analysis also provides multi-timeframe signal strengths and support/resistance levels for the stock.

2025-11-13 18:21:00

Canterbury Park (CPHC) reported a significant decline in Q3 2025 earnings and revenue, primarily due to reduced casino revenues stemming from increased competition and lower hold rates, alongside an absence of a prior-year land transfer gain. Despite the financial downturn, the company highlighted strong performance in food and beverage, ongoing operational efficiency efforts, and substantial progress in its Canterbury Commons development initiatives. Management remains optimistic, citing a strong balance sheet and undervalued stock based on asset holdings and future development potential.

2025-11-13 13:35:06

Canterbury Park Holding (NASDAQ:CPHC) investors have experienced an unprofitable three years, with the share price dropping 39% while the broader market gained 80%. This decline coincided with a fall in the company's earnings per share to a loss. However, considering dividends reinvested, the total shareholder return (TSR) was slightly better at -36%.

2025-11-06 16:05:00

Canterbury Park Holding Corporation reported financial results for Q3 2025, showing a 5.0% decline in net revenues to $18.3 million and a net income of $487,000, significantly down from $2.0 million in Q3 2024. The company attributed revenue decline to reduced casino revenues and highlighted ongoing growth initiatives in real estate development, including the successful opening of Boardwalk Kitchen & Bar and progress on the Canterbury Commons project. Canterbury Park also emphasized its strong balance sheet with no debt and substantial cash and real estate assets valued at over $10 per share.