Cohu Inc

$ 23.49

-0.25%

26 Dec - close price

- Market Cap 1,096,810,000 USD

- Current Price $ 23.49

- High / Low $ 23.64 / 23.41

- Stock P/E N/A

- Book Value 17.80

- EPS -1.57

- Next Earning Report 2026-02-12

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.04 %

- ROE -0.09 %

- 52 Week High 28.03

- 52 Week Low 12.57

About

Cohu, Inc. is a prominent supplier of advanced semiconductor inspection and test equipment, as well as innovative printed circuit board (PCB) test solutions, with a significant operational footprint in critical markets such as China, the United States, Taiwan, and Southeast Asia. Headquartered in Poway, California, the company employs state-of-the-art technology to improve the efficiency and reliability of semiconductor manufacturing, solidifying its role as an essential partner in the fast-evolving electronics industry. Cohu is well-positioned to capitalize on the growing demand for high-performance testing equipment, driven by the increasing complexity and interconnectivity of global electronic systems, and remains committed to delivering excellence through continuous innovation.

Analyst Target Price

$29.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-07-31 | 2025-05-01 | 2025-02-13 | 2024-10-31 | 2024-07-31 | 2024-05-02 | 2024-02-15 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-02-16 |

| Reported EPS | -0.06 | 0.02 | -0.02 | -0.15 | -0.08 | -0.01 | 0.01 | 0.23 | 0.35 | 0.48 | 0.56 | 0.7 |

| Estimated EPS | -0.14 | -0.02 | -0.17 | -0.09 | -0.07 | -0.02 | -0.01 | 0.23 | 0.32 | 0.44 | 0.54 | 0.6 |

| Surprise | 0.08 | 0.04 | 0.15 | -0.06 | -0.01 | 0.01 | 0.02 | 0 | 0.03 | 0.04 | 0.02 | 0.1 |

| Surprise Percentage | 57.1429% | 200% | 88.2353% | -66.6667% | -14.2857% | 50% | 200% | 0% | 9.375% | 9.0909% | 3.7037% | 16.6667% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.04 |

| Currency | USD |

Previous Dividend Records

| Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | None | None | None | None | None | None | None | None | None | None |

| Amount | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: COHU

2025-12-29 08:08:58

Cohu (COHU) experienced an improvement in its Relative Strength (RS) Rating, moving from 79 to 82 on Monday. This proprietary rating from IBD tracks share price performance over 52 weeks, indicating strengthening technical performance for the stock.

2025-12-26 08:09:24

Azarias Capital Management L.P. significantly increased its stake in Cohu, Inc. (NASDAQ:COHU) by 21.1% during the third quarter, now owning 285,648 shares valued at approximately $5.81 million. This makes Cohu the fund's 17th largest position, representing 2.3% of its portfolio. Other institutional investors have also adjusted their holdings, with overall institutional ownership high at 94.67%.

2025-12-25 13:09:31

Voya Investment Management LLC significantly reduced its stake in Cohu, Inc. (NASDAQ:COHU) by 32.1% in Q3, selling 129,012 shares. Despite the sell-off by Voya, other institutional investors have shown mixed activity, with some increasing their holdings. Cohu, a semiconductor company, recently beat Q3 EPS estimates and saw a 32.5% year-over-year revenue increase, although it remains unprofitable.

2025-12-17 23:34:00

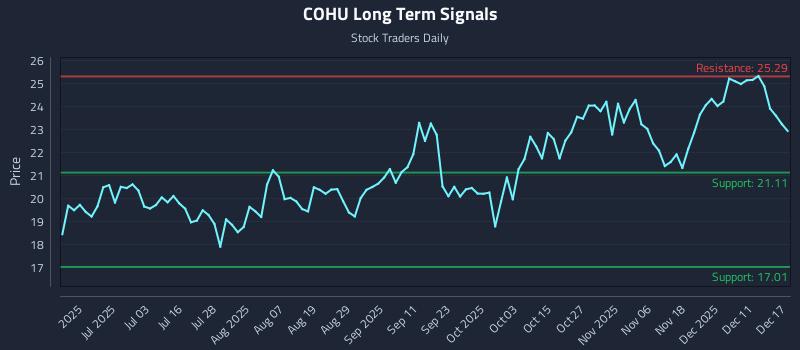

This article analyzes Cohu Inc. (NASDAQ: COHU), highlighting conflicting sentiment and a mid-channel oscillation pattern. It presents three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—tailored for different risk profiles, and provides multi-timeframe signal analysis with support and resistance levels. The piece emphasizes the importance of real-time signals for optimizing position sizing and managing risk.

2025-12-17 13:08:57

Cohu, Inc. (NASDAQ:COHU) has received a consensus "Moderate Buy" rating from six brokerages, with an average 1-year price target of $29.33. The company recently beat earnings estimates, reporting ($0.06) EPS and $126.3 million in revenue, an increase of 32.5% year-over-year. Despite being unprofitable, institutional ownership remains high at 94.67%, with significant new investments from firms like Tudor Investment Corp.

2025-12-15 23:08:57

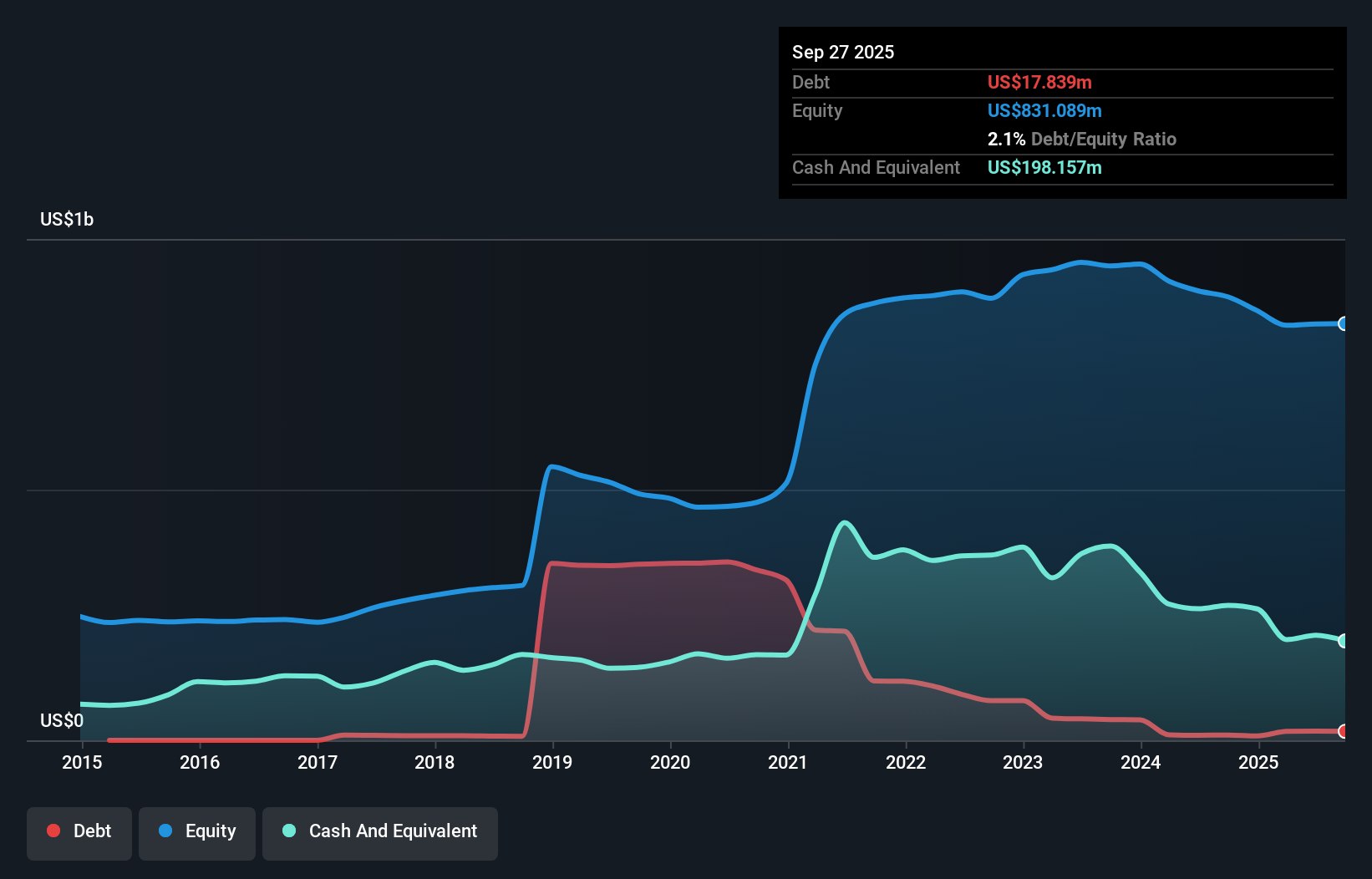

This article analyzes Cohu, Inc.'s debt levels and financial health, noting that while the company has some debt, its significant cash reserves result in a net cash position of US$180.3m. Despite recent losses in EBIT, revenue decline, and negative free cash flow, Cohu's strong liquidity and substantial cash balance suggest its debt load is not currently overly risky. The author advises caution due to the company's unprofitability but highlights its ability to cover expenses for over two years with existing cash.