CMB.TECH NV

$ 14.36

-1.37%

25 Feb - close price

- Market Cap 4,258,193,000 USD

- Current Price $ 14.36

- High / Low $ 14.58 / 14.16

- Stock P/E 17.30

- Book Value 8.78

- EPS 0.83

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0.7 %

- Next Dividend Date -

- ROA 0.03 %

- ROE 0.08 %

- 52 Week High 14.58

- 52 Week Low 7.49

About

Euronav NV, engages in the transportation and storage of crude oil globally.

Analyst Target Price

$13.67

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-26 | 2025-11-26 | 2025-08-14 | 2025-05-21 | 2025-02-27 | 2024-11-07 | 2024-08-08 | 2024-05-08 | 2024-02-01 | 2023-11-02 | 2023-08-03 | 2023-05-11 |

| Reported EPS | None | -0.0857 | -0.24 | -0.01 | 0.11 | 0.19 | 0.95 | 2.46 | 2.03 | 0.57 | 0.8 | 0.87 |

| Estimated EPS | 0.366 | -0.12 | 0.26 | 0.01 | 0.17 | 0.17 | 0.27 | 0.56 | 0.54 | 0.42 | 0.81 | 0.72 |

| Surprise | 0 | 0.0343 | -0.5 | -0.02 | -0.06 | 0.02 | 0.68 | 1.9 | 1.49 | 0.15 | -0.01 | 0.15 |

| Surprise Percentage | None% | 28.5833% | -192.3077% | -200% | -35.2941% | 11.7647% | 251.8519% | 339.2857% | 275.9259% | 35.7143% | -1.2346% | 20.8333% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Jul 2024 | Jan 1970 | May 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Jun 2023 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-15 | 2025-10-09 | 2024-07-18 | None | 2024-05-31 | 2023-12-20 | 2023-09-19 | 2023-06-20 | 2023-06-13 | None |

| Amount | $0.05 | $0.05 | $0.27 | $1.15 | $1.08 | $0.57 | $0.8 | $0.7 | $0.051 | $0.03 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CMBT

2026-02-19 05:57:46

Euronav NV has transformed its business after selling most of its large crude tanker fleet to Frontline. The company is now cash-rich and controlled by the Saverys family (CMB), shifting its focus from pure tanker operations to capital allocation and potential investments in maritime and energy-transition strategies. This change means Euronav's stock now trades more like a special-situation asset than a traditional cyclical tanker play, altering its risk profile and investor appeal.

2026-02-18 13:30:00

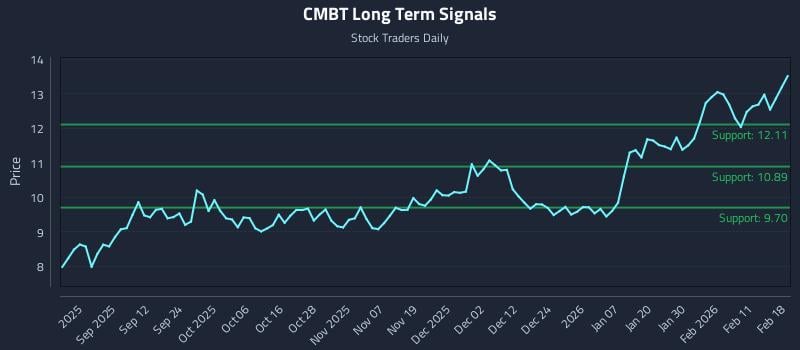

This article provides a price-driven analysis for Euronav Nv (NASDAQ: CMBT), indicating strong sentiment across all horizons and a potential breakout. It outlines an overweight bias based on AI-generated signals, including position trading, momentum breakout, and risk hedging strategies. The analysis highlights key support and resistance levels across different timeframes to guide rule-based trading.

2026-02-13 21:57:50

CMB.TECH NV has announced it will release its fourth-quarter 2025 earnings before the market opens on Thursday, February 26, 2026. The company will host an audio webcast and slide presentation that day to discuss the results and maintain transparent communication with shareholders. Investors will be looking for insights into trading conditions in the maritime and alternative fuels markets, as well as updates on the company's diversified fleet and energy operations.

2026-02-13 09:27:39

CMB.TECH NV has announced that it will publish its fourth-quarter 2025 earnings on Thursday, February 26, 2026, before market open. The company will host an audio webcast to discuss the results, which investors will monitor for insights into the maritime and alternative fuels markets. CMB.TECH, a diversified maritime group, also supplies hydrogen and ammonia fuel and is listed on Euronext Brussels, NYSE, and Euronext Oslo Børs.

2026-02-09 07:29:09

CMB.TECH NV has announced the sale of two VLCCs, Ingrid and Ilma, which are expected to generate a capital gain of approximately 98.2 million USD in Q2 2026. The vessels will be delivered to their new owner in the same quarter. This move is part of the diversified maritime group's ongoing operations.

2026-02-09 02:16:00

CMB.TECH has announced the sale of two VLCC vessels, Ingrid and Ilma, expected to generate a capital gain of approximately $98.2 million USD in Q2 2026. The vessels are scheduled for delivery to their new owner during the same quarter. CMB.TECH is a diversified maritime group with a fleet of about 250 vessels, also providing hydrogen and ammonia fuel solutions.