Calumet Specialty Products Partners

$ 29.00

3.06%

23 Feb - close price

- Market Cap 2,441,266,000 USD

- Current Price $ 29.00

- High / Low $ 29.26 / 27.80

- Stock P/E N/A

- Book Value -8.02

- EPS -0.42

- Next Earning Report 2026-02-27

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.05 %

- ROE -11.72 %

- 52 Week High 29.92

- 52 Week Low 7.68

About

Calumet Specialty Products Partners, LP produces and sells specialty hydrocarbon products in North America and internationally. The company is headquartered in Indianapolis, Indiana.

Analyst Target Price

$23.45

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-07 | 2025-08-08 | 2025-05-09 | 2025-02-21 | 2024-10-23 | 2024-08-02 | 2024-05-10 | 2024-02-23 | 2023-11-09 | 2023-08-04 | 2023-05-05 | 2023-03-15 |

| Reported EPS | 3.61 | -1.7 | -1.87 | -0.1729 | -1.18 | -0.48 | -0.51 | -0.59 | 1.26 | -0.23 | 0.35 | -0.86 |

| Estimated EPS | -0.38 | -0.26 | -0.38 | -0.3692 | -0.74 | -0.55 | -0.67 | -0.39 | 0.08 | -0.04 | 0.07 | 0.01 |

| Surprise | 3.99 | -1.44 | -1.49 | 0.1963 | -0.44 | 0.07 | 0.16 | -0.2 | 1.18 | -0.19 | 0.28 | -0.87 |

| Surprise Percentage | 1050% | -553.8462% | -392.1053% | 53.169% | -59.4595% | 12.7273% | 23.8806% | -51.2821% | 1475% | -475% | 400% | -8700% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-27 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.67 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CLMT

2026-02-23 22:02:26

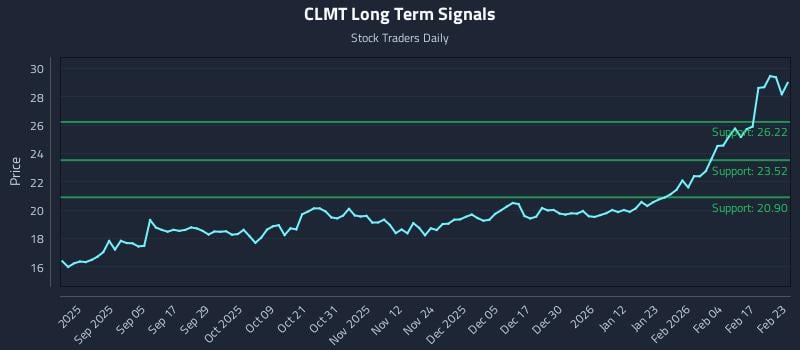

This article analyzes Calumet Specialty Products Partners L.p. (NASDAQ: CLMT) using AI models to identify momentum shifts and provide trading strategies. It highlights strong sentiment across all horizons, no clear price positioning, and elevated downside risk due to a lack of additional long-term support signals. The analysis includes position trading, momentum breakout, and risk hedging strategies tailored to different risk profiles.

2026-02-19 12:28:23

Calumet (NASDAQ: CLMT) subsidiary Montana Renewables and World Energy have partnered to deliver over 70 million gallons of Sustainable Aviation Fuel (SAF) across three years, aiming to reduce CO2 emissions by up to 600,000 metric tons. This collaboration supports U.S. agriculture and energy independence, with Montana Renewables' MaxSAF™ 150 expansion progressing to meet demand. The long-term contract with World Energy validates MRL's capital investments and accelerates the supply of SAF.

2026-02-17 14:58:10

Calumet (CLMT) stock saw a 2.1% premarket dip after a 10.1% surge on February 13th, ahead of its Q4 and full-year 2025 earnings report on February 27th. Investors are keen on updates regarding cash generation, the balance between specialty products and renewables, and any changes in the company's financial outlook, especially after recent debt refinancings. The upcoming earnings call will be crucial for guidance, margin discussions, and renewable energy plans.

2026-02-16 08:31:08

UBS analyst Manav Gupta has upgraded Calumet Inc (CLMT.US) to a hold rating from a previous rating, and significantly increased its target price from $15 to $26. Gupta has a strong track record, with a 68.3% success rate and an average return of 13.6% over the last year, according to TipRanks data. This information is provided for educational purposes and should not be considered investment advice.

2026-02-14 06:27:58

Calumet, Inc. (NASDAQ:CLMT) has received a consensus "Hold" rating from analysts, with an average 12-month price target of $22.83. Institutional investors hold approximately 34.41% of the stock, with significant recent buys, and shares opened at $28.61, near a 1-year high. The company, an independent provider of high-value petroleum and renewable feedstock solutions, has a market capitalization of $2.48 billion.

2026-02-13 20:27:26

Calumet (NASDAQ:CLMT) shares surged 11.2% during mid-day trading on Friday, reaching $28.8850 on 50% lower than average volume. Despite the jump, analysts maintain a consensus "Hold" rating with an average price target of $22.83, and institutional investors collectively own about 34.41% of the company. Several firms modestly increased their positions in Q4, while some analysts recently downgraded or reiterated ratings.