Chunghwa Telecom Co Ltd

$ 43.55

1.61%

24 Feb - close price

- Market Cap 33,376,039,000 USD

- Current Price $ 43.55

- High / Low $ 43.68 / 42.80

- Stock P/E 27.47

- Book Value 1.58

- EPS 1.56

- Next Earning Report 2026-05-07

- Dividend Per Share N/A

- Dividend Yield 3.9 %

- Next Dividend Date -

- ROA 0.06 %

- ROE 0.10 %

- 52 Week High 45.80

- 52 Week Low 35.71

About

Chunghwa Telecom Co., Ltd. provides telecommunications services in Taiwan. The company is headquartered in Taipei City, Taiwan.

Analyst Target Price

$41.67

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-03 | 2025-11-06 | 2025-08-05 | 2025-04-30 | 2025-01-23 | 2024-11-06 | 2024-08-06 | 2024-05-02 | 2024-01-30 | 2023-11-02 | 2023-08-08 | 2023-05-09 |

| Reported EPS | 0 | 0.4064 | 1.31 | 0.3834 | 0.3544 | 0.359 | 0.3911 | 0.3845 | 0.3395 | 1.18 | 0.4008 | 1.24 |

| Estimated EPS | 0.3901 | 0.3923 | 0.4046 | 0.3945 | 0.3444 | 0.3699 | 0.3901 | 0.3903 | 0.3378 | 0.38 | 0.4 | 0.391 |

| Surprise | -0.3901 | 0.0141 | 0.9054 | -0.0111 | 0.01 | -0.0109 | 0.001 | -0.0058 | 0.0017 | 0.8 | 0.0008 | 0.849 |

| Surprise Percentage | -100% | 3.5942% | 223.7766% | -2.8137% | 2.9036% | -2.9467% | 0.2563% | -1.486% | 0.5033% | 210.5263% | 0.2% | 217.1355% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-07 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.4098 |

| Currency | USD |

Previous Dividend Records

| Aug 2025 | Aug 2024 | Aug 2023 | Aug 2022 | Oct 2021 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-08-15 | 2024-08-15 | 2023-08-11 | 2022-08-12 | 2021-10-05 | None | None | None | None | None |

| Amount | $1.669449 | $1.4735851 | $1.5291056 | $1.5911052 | $1.5509851 | $1.418692 | $1.443 | $1.59 | $1.29011 | $1.364321 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CHT

2026-02-24 10:37:00

Taiwan's three major telecom operators, Far EasTone, Chunghwa Telecom, and Taiwan Mobile, have received international recognition for their sustainability efforts in the S&P Global Sustainability Yearbook. Far EasTone notably achieved top global rankings, securing full marks in 17 out of 23 evaluation criteria. All three companies demonstrated committed actions toward reducing carbon emissions, expanding green energy use, and implementing technology for environmental conservation, highlighting their dedication to environmental, social, and governance (ESG) criteria.

2026-02-24 02:36:35

Taiwan's three major telecom operators, Far EasTone, Chunghwa Telecom, and Taiwan Mobile, have received international recognition for their sustainability efforts in the S&P Global Sustainability Yearbook. Far EasTone notably achieved full marks in 17 categories and is the first Taiwanese telecom to have its net-zero carbon efforts validated by the Science Based Targets initiative. The companies are implementing various environmental initiatives, including expanding renewable energy, reforestation, and using AI to monitor energy consumption, significantly reducing their carbon footprints and promoting biodiversity.

2026-02-23 21:46:35

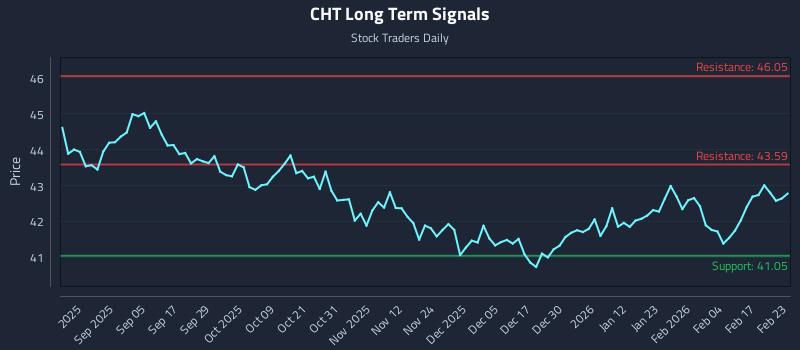

This article provides a detailed analysis of Chunghwa Telecom Co. Ltd. (CHT) focusing on precision trading risk zones. It highlights a neutral sentiment across all horizons, suggesting a wait-and-see approach, and outlines three distinct AI-generated trading strategies: Position Trading, Momentum Breakout, and Risk Hedging. The analysis also includes multi-timeframe signal analysis with key support and resistance levels.

2026-02-22 14:23:03

This article traces the rapid evolution of cell phone ownership in Taiwan from a rare and expensive commodity before 1997 to a widespread status symbol by 2000. It details how market liberalization in 1997 led to intense competition among telecommunication companies, driving down costs and increasing user adoption significantly. The piece also touches on the initial social problems and etiquette issues that arose with the sudden proliferation of mobile phones, as people flaunted their new gadgets.

2026-02-21 02:48:40

Canada-based LGBTQ+ streaming platform OUTtv has partnered with Chunghwa Telecom in Taiwan to launch its first channels in Asia, making its content available on Chunghwa IPTV service Multimedia on Demand and channel 375. This expansion is supported by a three-year strategic collaboration with Singapore-based Ulight Entertainment Technology (UET), which is facilitating OUTtv's entry and growth across Asia. The move continues a period of significant growth for OUTtv, following recent launches in New Zealand and the Nordics.

2026-02-20 16:04:46

Chunghwa Telecom has announced a new slate of six film and TV projects at the Taiwan Creative Content Fest (TCCF), aiming to bring Taiwanese original content to international audiences. The slate includes the Taiwan-Japan co-production "Arrested Memory," an action drama directed by Sabu and starring Ethan Juan, and projects from Greener Grass Production like the crime drama series "The Fame" and the romance film "The Photo From 1977." This initiative underscores Chunghwa Telecom's commitment to fostering international collaborations and showcasing Taiwanese talent on a global scale.