CareDx Inc

$ 18.79

-0.05%

23 Feb - close price

- Market Cap 1,000,667,000 USD

- Current Price $ 18.79

- High / Low $ 18.98 / 18.23

- Stock P/E 14.69

- Book Value 6.05

- EPS 1.28

- Next Earning Report 2026-02-24

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.04 %

- ROE 0.24 %

- 52 Week High 22.95

- 52 Week Low 10.96

About

CareDx, Inc. discovers, develops and markets diagnostic solutions for transplant patients and caregivers globally. The company is headquartered in South San Francisco, California.

Analyst Target Price

$23.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-04 | 2025-08-06 | 2025-05-07 | 2025-02-26 | 2024-11-04 | 2024-07-31 | 2024-05-09 | 2024-02-28 | 2023-11-08 | 2023-08-08 | 2023-05-10 | 2023-02-27 |

| Reported EPS | 0.28 | 0.1 | 0.1 | 0.18 | 0.14 | 0.25 | -0.03 | -0.17 | -0.18 | -0.18 | -0.11 | -0.07 |

| Estimated EPS | -0.08 | -0.1 | 0.0683 | 0.1475 | 0.01 | -0.14 | -0.21 | -0.27 | -0.4 | -0.31 | -0.11 | -0.09 |

| Surprise | 0.36 | 0.2 | 0.0317 | 0.0325 | 0.13 | 0.39 | 0.18 | 0.1 | 0.22 | 0.13 | 0 | 0.02 |

| Surprise Percentage | 450% | 200% | 46.4129% | 22.0339% | 1300% | 278.5714% | 85.7143% | 37.037% | 55% | 41.9355% | 0% | 22.2222% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.0 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: CDNA

2026-02-19 15:20:00

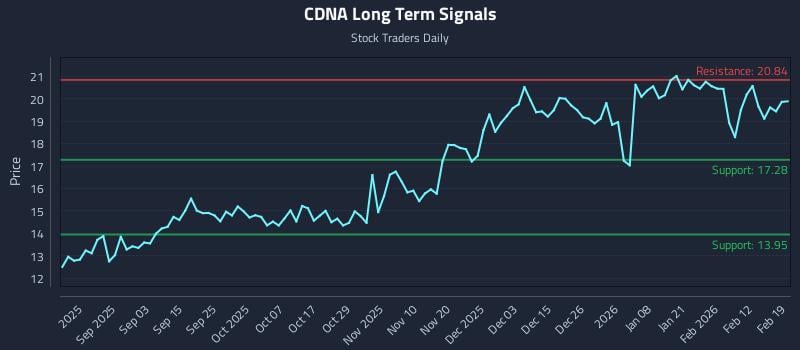

The article analyzes Caredx Inc. (NASDAQ: CDNA) using AI models, highlighting a weak near and mid-term sentiment but a neutral long-term outlook. It identifies a mid-channel oscillation pattern and presents three distinct trading strategies (Position, Momentum Breakout, and Risk Hedging) with specific entry, target, and stop-loss levels. The analysis emphasizes a significant risk-reward short setup for CDNA.

2026-02-18 21:17:28

CareDx, Inc., a leading precision medicine company for transplant patients, announced its participation in the Raymond James 47th Annual Institutional Investors Conference in Orlando, FL, on March 3, 2026. This conference offers an opportunity for the company to engage with institutional investors. CareDx focuses on developing and commercializing high-value healthcare solutions for transplant patients and caregivers.

2026-02-18 13:27:55

CareDx, Inc., a precision medicine company specializing in transplant patient solutions, announced its participation in the Raymond James 47th Annual Institutional Investors Conference. The conference will be held in Orlando, FL, on Tuesday, March 3, 2026. CareDx focuses on improving outcomes for transplant patients through various services, including non-invasive molecular testing, digital health technologies, and patient solutions.

2026-02-17 23:26:43

Zweig DiMenna Associates LLC significantly increased its stake in CareDx, Inc. ($CDNA) by purchasing an additional 348,400 shares, bringing its total holdings to 575,000 shares, valued at approximately $8.36 million. Despite this institutional buying, the article also notes insider selling by CEO John Walter Hanna Jr. and a consensus "Hold" rating from analysts with an average target price of $26.67. CareDx (NASDAQ:CDNA) is a precision diagnostics company specializing in tests for transplant patients.

2026-02-17 16:03:44

CareDx announced positive clinical validation data for AlloHeme, a new blood-based monitoring test designed to predict relapses in AML and MDS patients following allogeneic hematopoietic cell transplant. The ACROBAT study demonstrated AlloHeme's high diagnostic accuracy and ability to detect relapse earlier than traditional methods, supporting its commercialization beginning in 2027 as part of CareDx’s Transplant+ strategy. This advancement positions CareDx for growth in the cell therapy and hematologic oncology markets, expanding its precision medicine portfolio.

2026-02-17 09:57:32

CareDx (NASDAQ:CDNA) is expected to release its Q4 2025 earnings before the market opens on Tuesday, February 24th, with analysts projecting earnings of $0.24 per share and revenue of $102.76 million. The company's shares were up approximately 2.8%, trading at $19.63, and analysts have a consensus "Hold" rating with a target price of $26.67. Recent insider selling by CEO John W. Hanna Jr. and varying institutional investor activities have also been noted.