Compania de Minas Buenaventura SAA ADR

$ 28.10

-4.91%

29 Dec - close price

- Market Cap 7,505,312,000 USD

- Current Price $ 28.10

- High / Low $ 28.55 / 27.80

- Stock P/E 16.51

- Book Value 14.63

- EPS 1.79

- Next Earning Report 2026-02-19

- Dividend Per Share $0.29

- Dividend Yield 1.48 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.12 %

- 52 Week High 30.07

- 52 Week Low 11.20

About

Compania de Minas Buenaventura SAA (BVN) is a leading precious metals producer based in Lima, Peru, specializing in the exploration, extraction, and commercialization of gold, silver, and other polymetallic resources. With a robust portfolio of mining assets and a solid commitment to sustainable mining practices, the company enhances its operational efficiency while prioritizing environmental responsibility. Buenaventura's strategic footprint spans markets in the United States, Europe, and Asia, solidifying its role as a significant player in the global mining sector. This positioning offers institutional investors a compelling opportunity for exposure to both precious metals and responsible mining operations.

Analyst Target Price

$27.17

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-07-23 | 2025-04-28 | 2025-02-26 | 2024-10-30 | 2024-07-25 | 2024-04-29 | 2024-02-29 | 2023-10-19 | 2023-07-27 | 2023-04-28 | 2023-02-28 |

| Reported EPS | 0.66 | 0.3716 | 0.5511 | 0.1256 | 0.9328 | 0.28 | 0.24 | -0.04 | -0.0958 | -0.03 | 0.25 | 0.27 |

| Estimated EPS | 0.4 | 0.3672 | 0.305 | 0.245 | 0.28 | 0.35 | 0.14 | 0.15 | 0.11 | -0.03 | 0.25 | 0.25 |

| Surprise | 0.26 | 0.0044 | 0.2461 | -0.1194 | 0.6528 | -0.07 | 0.1 | -0.19 | -0.2058 | 0 | 0 | 0.02 |

| Surprise Percentage | 65% | 1.1983% | 80.6885% | -48.7347% | 233.1429% | -20% | 71.4286% | -126.6667% | -187.0909% | 0% | 0% | 8% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-19 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.59 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | May 2025 | May 2024 | May 2023 | May 2022 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-09 | 2025-05-12 | 2024-05-10 | 2023-05-11 | 2022-05-16 | None | None | None | None | None |

| Amount | $0.1446 | $0.2922 | $0.0726 | $0.073 | $0.073 | $0.027 | $0.06 | $0.06 | $0.03 | $0.03 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BVN

2025-12-18 17:10:04

New options for Compania de Minas Buenaventura S.A. (BVN) with a February 2026 expiration are now available. Our YieldBoost formula at Stock Options Channel identified a put contract at a $28.00 strike price and a call contract at a $29.00 strike price that are of particular interest. Investors can use these contracts as an attractive alternative to outright stock purchases, or as a way to generate additional income through covered calls.

2025-11-17 03:45:14

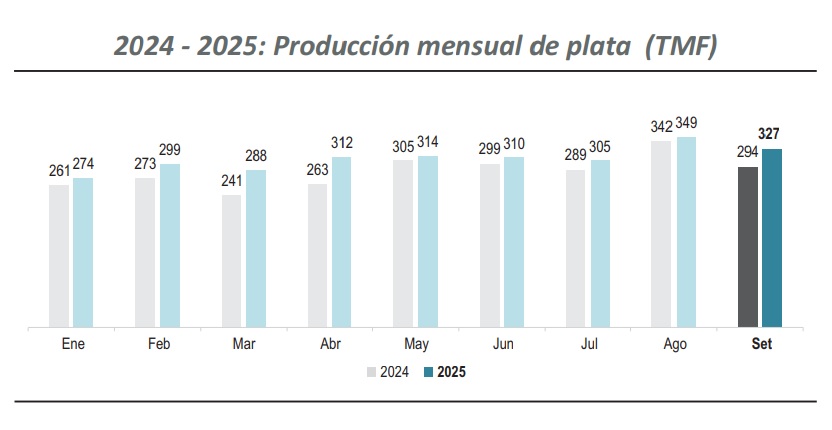

In September, Peru's silver production recorded 326,746 fine kilograms, an 11.3% increase from the previous year, with Compañía Minera Antamina S.A. contributing significantly. For the first nine months of the year, accumulated production showed an 8.3% rise. Antamina, Buenaventura, and Minera Chinalco Perú S.A. were the top three producers, while Áncash, Lima, and Pasco led departmental production.

2025-10-18 14:06:00

Compania de Minas Buenaventura SAA announced its strong Q3 2025 metal production results, detailing significant figures across gold, silver, lead, zinc, and copper operations. This robust performance highlights the company's strong operational efficiency and strategic market position, positively influencing its market presence. Analyst outlook from Spark (TipRanks) indicates strong financial performance and a positive technical sentiment, despite potential overbought conditions.

2025-10-18 11:10:00

Scotiabank maintained a Hold rating on Compania de Minas Buenaventura SAA (BVN) reflecting analyst Jakusconek's insights into the Basic Materials sector. The company reported significant revenue and net profit increases for the quarter ending June 30, with revenue reaching $373.4 million and net profit hitting $92.27 million. Despite these positive earnings, the consensus price target suggests a potential -13.12% downside from current levels.

2025-10-17 02:50:32

Compañía de Minas Buenaventura S.A.A. has released updated production guidance for the year 2025. The company projects total gold production between 112,000 and 128,000 ounces, along with significant output for silver, lead, zinc, and copper. This update provides investors with key expectations for the company's performance in the upcoming year across several commodities.

2025-06-21 02:10:03

Compañía de Minas Buenaventura, through its subsidiary Conenhua, is seeking regulatory approval for a new 220 kV transmission line to power its San Gabriel gold mine in Moquegua. This project includes a new substation and an expanded Chilota substation, ensuring a reliable and efficient power supply for the mine's commercial operations projected to start in October 2025. Conenhua, with its experience in renewable energy, aims to optimize energy costs and operational continuity for one of Buenaventura's key gold projects.