Black Stone Minerals LP

$ 13.43

0.60%

29 Dec - close price

- Market Cap 2,828,363,000 USD

- Current Price $ 13.43

- High / Low $ 13.49 / 13.32

- Stock P/E 11.51

- Book Value 3.89

- EPS 1.16

- Next Earning Report 2026-02-24

- Dividend Per Share $1.32

- Dividend Yield 9.89 %

- Next Dividend Date -

- ROA 0.14 %

- ROE 0.24 %

- 52 Week High 14.78

- 52 Week Low 11.43

About

Black Stone Minerals LP (BSM), based in Houston, Texas, is a prominent player in the management and ownership of oil and natural gas mineral interests, with a strategically diversified portfolio spanning key North American basins. The company emphasizes strong cash flow generation through a favorable royalty structure, aiming to deliver robust returns to its unitholders. Committed to sustainable growth, BSM actively seeks acquisitions and investment opportunities that enhance its competitive positioning while navigating the dynamic energy landscape. Its innovative asset management practices solidify its reputation within the energy sector, positioning BSM for continued success in an evolving market environment.

Analyst Target Price

$13.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-03 | 2025-08-04 | 2025-05-05 | 2025-02-17 | 2024-11-04 | 2024-08-05 | 2024-05-06 | 2024-02-19 | 2023-10-30 | 2023-07-31 | 2023-05-01 | 2023-02-21 |

| Reported EPS | 0.4 | 0.2794 | 0.2902 | 0.3251 | 0.41 | 0.29 | 0.27 | 0.65 | 0.27 | 0.35 | 0.6 | 0.82 |

| Estimated EPS | 0.3 | 0.3233 | 0.35 | 0.33 | 0.35 | 0.36 | 0.35 | 0.49 | 0.43 | 0.39 | 0.45 | 0.41 |

| Surprise | 0.1 | -0.0439 | -0.0598 | -0.0049 | 0.06 | -0.07 | -0.08 | 0.16 | -0.16 | -0.04 | 0.15 | 0.41 |

| Surprise Percentage | 33.3333% | -13.5787% | -17.0857% | -1.4848% | 17.1429% | -19.4444% | -22.8571% | 32.6531% | -37.2093% | -10.2564% | 33.3333% | 100% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.2533 |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | Aug 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-13 | 2025-08-14 | 2025-05-15 | 2025-02-25 | 2024-11-15 | 2024-08-16 | 2024-05-17 | 2024-02-23 | 2023-11-16 | 2023-08-18 |

| Amount | $0.3 | $0.3 | $0.375 | $0.375 | $0.375 | $0.375 | $0.375 | $0.475 | $0.475 | $0.475 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BSM

2025-12-27 13:09:54

Kempner Capital Management Inc. significantly reduced its stake in Black Stone Minerals, L.P. (NYSE:BSM) by 23.3% in the third quarter, holding 582,128 shares valued at $7.65 million. Despite this, Black Stone Minerals exceeded Q3 earnings expectations with an EPS of $0.40 and revenue of $132.47 million, maintaining strong margins. The company offers a substantial 9.0% dividend yield but currently holds a consensus "Hold" rating from analysts with a target price of $13.00.

2025-12-24 08:11:50

Black Stone Minerals, L.P. (NYSE:BSM) has an average "Hold" recommendation from five analysts, with a consensus 12-month target price of $13.00. The company recently surpassed earnings and revenue estimates but has a dividend payout ratio exceeding current earnings coverage. Institutional investors have significantly adjusted their holdings in the stock recently.

2025-12-19 08:46:00

This article discusses Black Stone Minerals L.p. (NYSE: BSM), highlighting a weak near-term sentiment and a mid-channel oscillation pattern. It presents an exceptional 25.5:1 risk-reward short setup and details three AI-generated trading strategies tailored for different risk profiles: Position Trading, Momentum Breakout, and Risk Hedging. The analysis also includes multi-timeframe signal analysis with support and resistance levels.

2025-12-18 10:10:08

Black Stone Minerals (NYSE:BSM) stock recently crossed above its fifty-day moving average, trading at $13.7550. The oil and gas producer beat Q3 earnings estimates with EPS of $0.40 and revenue of $132.5M, but its high dividend payout ratio of 104.35% raises sustainability concerns despite an 8.7% yield. Institutional investors have been adjusting their stakes in the company, which currently holds an average analyst rating of "Hold" and a consensus price target of $13.00.

2025-12-11 04:09:00

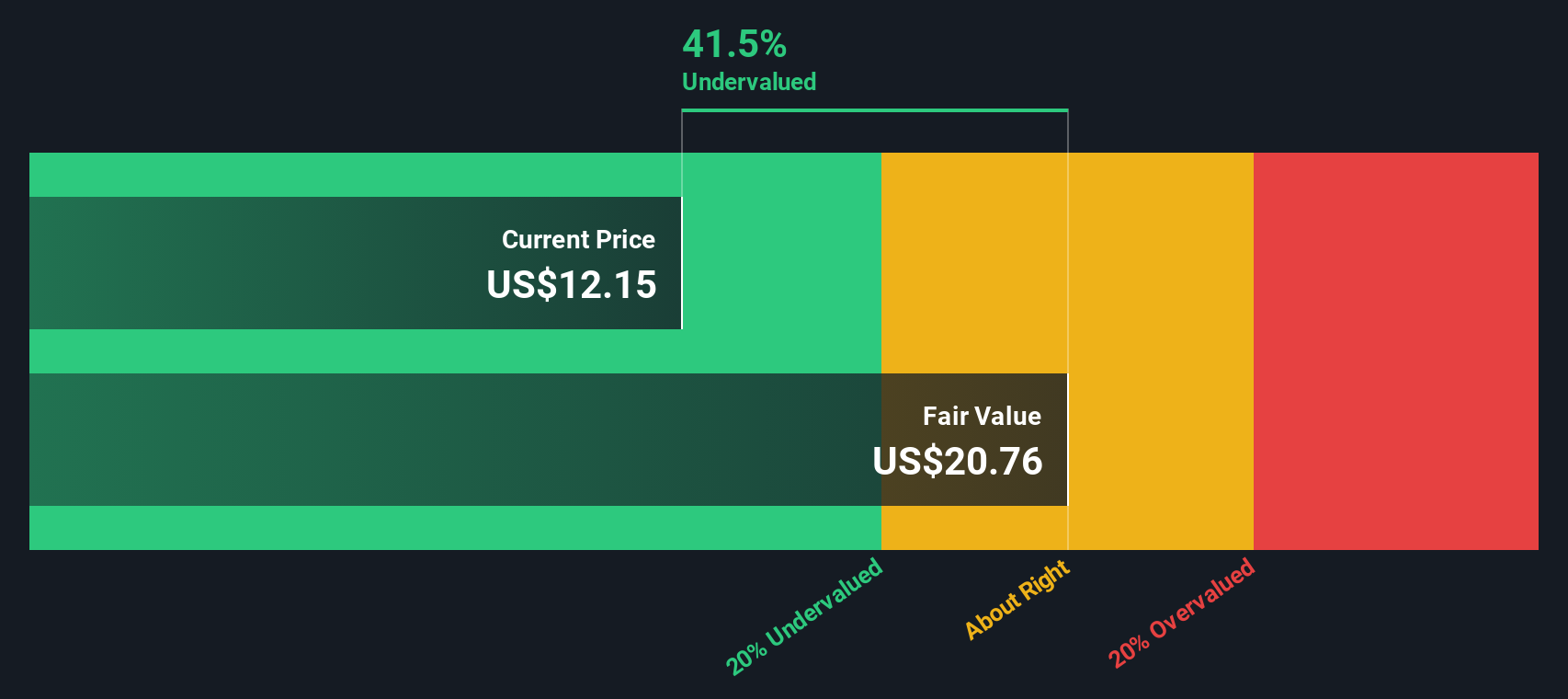

Black Stone Minerals (BSM) recently signed a significant 220,000 gross acre development agreement with Caturus Energy, providing a six-year drilling plan to meet rising Gulf Coast natural gas demand. The article discusses BSM's valuation, noting that analysts consider it 12.4% overvalued at $14.61 against a narrative fair value of $13.00, while a DCF model suggests a fair value closer to $19.74, indicating potential upside.

2025-12-08 03:09:28

Black Stone Minerals (BSM) has entered into a multi-year development agreement with Caturus Energy for drilling in the Shelby Trough and Haynesville Expansion, aiming to meet growing natural gas demand. This pact, covering 220,000 gross acres, outlines a structured drilling ramp-up, potentially boosting the value of Black Stone's undeveloped net acres. The agreement could significantly reshape Black Stone Minerals' investment narrative by providing greater clarity on future drilling schedules and production growth, reinforcing its royalty model.