BRC Inc.

$ 0.63

0.86%

24 Feb - close price

- Market Cap 145,602,000 USD

- Current Price $ 0.63

- High / Low $ 0.66 / 0.61

- Stock P/E N/A

- Book Value 0.42

- EPS -0.13

- Next Earning Report 2026-03-02

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.03 %

- ROE -0.48 %

- 52 Week High 2.77

- 52 Week Low 0.61

About

BRC Inc. (Ticker: BRCC) is a leading specialty coffee brand committed to delivering high-quality, ethically sourced coffee, primarily targeting service members, veterans, and dedicated coffee enthusiasts. The company utilizes a robust direct-to-consumer model, complemented by a rapidly expanding retail footprint, capitalizing on its unique brand heritage to foster customer loyalty and engagement. With a strong emphasis on innovative marketing strategies and product development, BRCC is poised to disrupt the traditional coffee market, aligning its operations with a community-driven ethos. As it continues to scale, BRC Inc. is strategically positioned to capture a larger share of the growing food and beverage market, driving sustainable growth and enhancing shareholder value.

Analyst Target Price

$2.17

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-03 | 2025-08-04 | 2025-05-06 | 2025-03-04 | 2024-11-04 | 2024-08-07 | 2024-05-08 | 2024-03-06 | 2023-11-09 | 2023-08-10 | 2023-05-11 | 2023-03-15 |

| Reported EPS | 0.0404 | -0.07 | -0.0368 | 0.0552 | -0.01 | -0.01 | 0.01 | -0.07 | -0.05 | -0.07 | -0.08 | -0.09 |

| Estimated EPS | -0.01 | -0.03 | -0.04 | -0.05 | -0.02 | -0.02 | -0.04 | -0.01 | -0.02 | -0.06 | -0.08 | -0.07 |

| Surprise | 0.0504 | -0.04 | 0.0032 | 0.1052 | 0.01 | 0.01 | 0.05 | -0.06 | -0.03 | -0.01 | 0 | -0.02 |

| Surprise Percentage | 504% | -133.3333% | 8% | 210.4% | 50% | 50% | 125% | -600% | -150% | -16.6667% | 0% | -28.5714% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-02 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BRCC

2026-02-15 14:27:52

BRC Inc. (Black Rifle Coffee Company) has received a non-compliance notice from the NYSE due to its Class A common stock trading below the $1.00 minimum for 30 consecutive trading days. The company has six months to regain compliance, and while operations remain unchanged, a delisting risk exists. Analysts currently rate BRCC as a Hold with a $0.77 price target, citing weak financial fundamentals despite continued revenue growth.

2026-02-14 04:57:41

BRC Inc. (Black Rifle Coffee Company) has received a notice from the NYSE stating noncompliance with its minimum price criteria. The company's Class A common stock had an average closing price of less than $1.00 per share over a consecutive 30-trading-day period ending on February 11. BRC Inc. had previously affirmed its 2025 revenue outlook of at least $395 million despite noting an impairment charge.

2026-02-13 22:57:43

Black Rifle Coffee Company (BRCC) has received a compliance notice from the NYSE because its Class A common stock's average closing price fell below $1.00 for 30 consecutive trading days. The company has a six-month period to regain compliance by ensuring its stock closes at or above $1.00 on the last trading day of any month within this period. This notice does not affect the company's business operations or financial condition, and BRCC plans to address the issue, considering alternatives that benefit both the company and its shareholders.

2026-02-13 21:57:43

BRC Inc. (BRCC) received a notice from the NYSE on February 11, 2026, indicating non-compliance with Section 802.01C because its Class A common stock traded below $1.00 for 30 consecutive days. The company has six months to regain compliance and is exploring options to address the deficiency while trading continues on the NYSE. This information is based on an SEC filing from February 13, 2026.

2026-02-13 17:00:00

Black Rifle Coffee Company (NYSE: BRCC) has received a notice from the NYSE indicating non-compliance with its continued listing minimum price criteria, as its Class A common stock traded below $1.00 per share over a consecutive 30-trading-day period. The company has six months to regain compliance by ensuring its stock closes at or above $1.00 and maintains an average closing price of at least $1.00 over a 30-trading-day period. This notice does not immediately affect the stock's listing or the company's operations, and BRCC plans to pursue alternatives to cure the deficiency.

2026-01-29 05:27:57

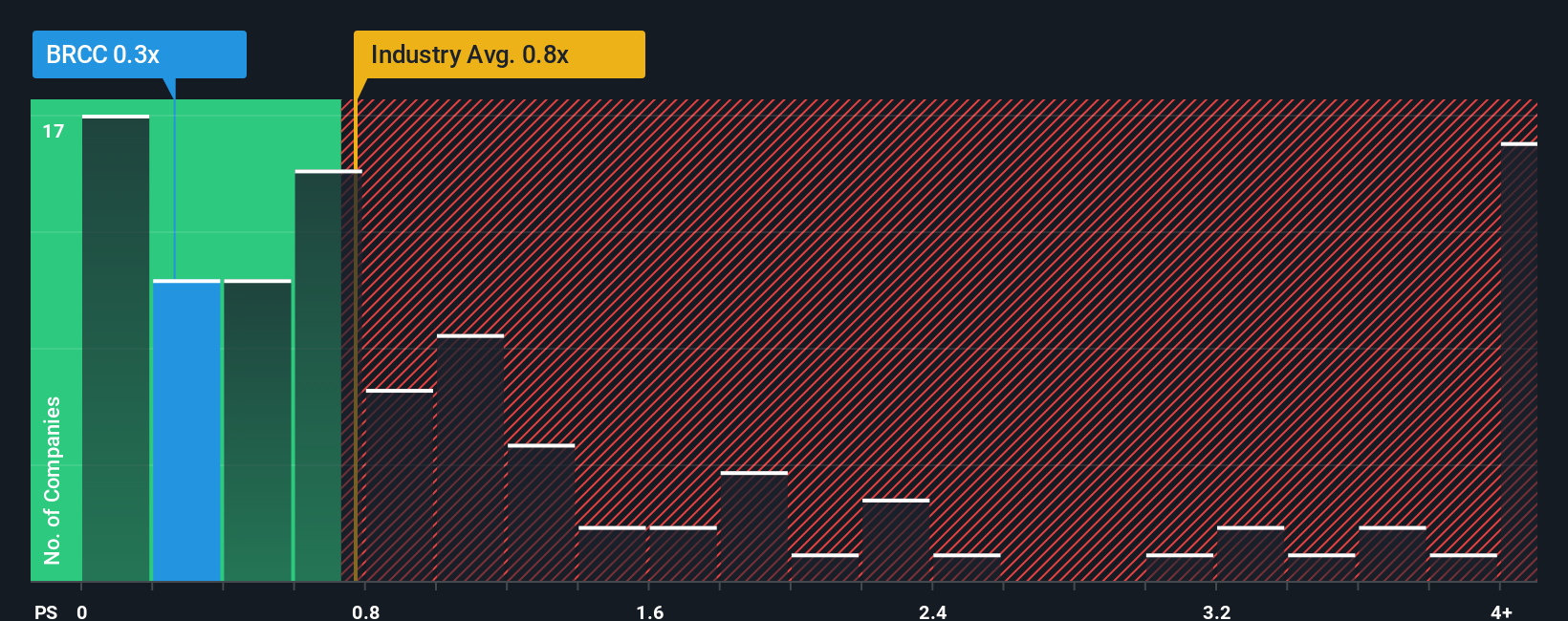

BRC Inc. (NYSE:BRCC) shares have dropped 26% in the last month and 68% over the past year, leading to a low price-to-sales (P/S) ratio of 0.3x compared to an industry average of 0.8x. Despite a forecast of 11% annual revenue growth for the next three years, significantly higher than the industry average, investors appear unconvinced, as reflected by its depressed P/S ratio. This suggests the market might be pricing in risks or doubts about the company's ability to meet future growth expectations.