Broadstone Net Lease Inc

$ 19.40

0.62%

25 Feb - close price

- Market Cap 3,874,926,000 USD

- Current Price $ 19.40

- High / Low $ 19.43 / 19.09

- Stock P/E 38.80

- Book Value 15.16

- EPS 0.50

- Next Earning Report 2026-05-06

- Dividend Per Share $1.16

- Dividend Yield 6.02 %

- Next Dividend Date 2026-04-15

- ROA 0.03 %

- ROE 0.03 %

- 52 Week High 19.91

- 52 Week Low 13.26

About

BNL is an internally managed REIT that primarily acquires, owns and manages single-tenant commercial real estate that is rented out on a long-term basis to a diversified group of tenants.

Analyst Target Price

$20.27

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-18 | 2025-10-29 | 2025-07-28 | 2025-04-29 | 2025-02-19 | 2024-10-30 | 2024-07-30 | 2024-05-01 | 2024-02-21 | 2023-11-01 | 2023-08-02 | 2023-05-03 |

| Reported EPS | 0.1976 | 0.14 | 0.1181 | 0.103 | 0.1067 | 0.19 | 0.19 | 0.35 | 0.03 | 0.26 | 0.32 | 0.21 |

| Estimated EPS | 0.1719 | 0.17 | 0.1828 | 0.1882 | 0.1824 | 0.21 | 0.17 | 0.17 | 0.18 | 0.17 | 0.16 | 0.15 |

| Surprise | 0.0257 | -0.03 | -0.0647 | -0.0852 | -0.0757 | -0.02 | 0.02 | 0.18 | -0.15 | 0.09 | 0.16 | 0.06 |

| Surprise Percentage | 14.9506% | -17.6471% | -35.3939% | -45.271% | -41.5022% | -9.5238% | 11.7647% | 105.8824% | -83.3333% | 52.9412% | 100% | 40% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-06 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.1611 |

| Currency | USD |

Previous Dividend Records

| Apr 2026 | Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-04-15 | 2026-01-15 | 2025-10-15 | 2025-07-15 | 2025-04-15 | 2025-01-15 | 2024-10-15 | 2024-07-15 | 2024-04-15 | 2024-01-12 |

| Amount | $0.2925 | $0.29 | $0.29 | $0.29 | $0.29 | $0.29 | $0.29 | $0.29 | $0.285 | $0.285 |

Next Dividend Records

| Dividend per share (year): | $1.16 |

| Dividend Yield | 6.02% |

| Next Dividend Date | 2026-04-15 |

| Ex-Dividend Date | 2026-03-31 |

Recent News: BNL

2026-02-26 09:51:43

Centersquare Investment Management LLC increased its stake in Broadstone Net Lease (NYSE:BNL) by 3.0% to over 5 million shares, valued at $90.29 million. Broadstone Net Lease reported Q3 earnings per share of $0.17, missing consensus estimates, and set FY2026 guidance at $1.53-$1.57 EPS. The company also raised its quarterly dividend to $0.2925, resulting in an annualized dividend of $1.17 and a 6.0% yield.

2026-02-25 12:51:43

Broadstone Net Lease, Inc. (NYSE: BNL) has announced two new build-to-suit development projects, totaling an estimated $62.1 million investment. These projects include an industrial warehouse in Sarasota, FL, and a retail development in Magnolia, TX, demonstrating the company's focus on high-quality industrial and retail facilities. The announcement highlights BNL's continued growth through strategic tenant and developer relationships.

2026-02-25 11:29:59

Broadstone Net Lease, Inc. (BNL) announced two new build-to-suit development projects, representing an estimated total investment of $62.1 million. These projects include an industrial warehouse in Sarasota, FL, and a retail development in Magnolia, TX, further demonstrating BNL's growth strategy in high-quality industrial and retail facilities. The company also provided a detailed table summarizing its in-process and stabilized developments, highlighting key financial metrics and project timelines.

2026-02-25 11:29:59

Broadstone Net Lease, Inc. (BNL) has committed approximately $62.1 million to two new build-to-suit development projects. These include a state-of-the-art industrial warehouse and distribution center for Amazon in Sarasota, FL, and a retail development in Magnolia, TX. These developments highlight BNL's strong tenant and developer relationships and its differentiated growth strategy.

2026-02-25 07:52:59

Aew Capital Management L P significantly increased its stake in Broadstone Net Lease (NYSE: BNL) by 44.5% during the third quarter, purchasing over 1.1 million additional shares. This acquisition brings their total holdings to 3,644,233 shares, valued at $65.12 million, making BNL their 14th largest holding and representing 1.93% of the company's stock. Broadstone Net Lease also announced a boosted quarterly dividend of $0.2925 per share, leading to a 6.1% yield.

2026-02-23 14:24:25

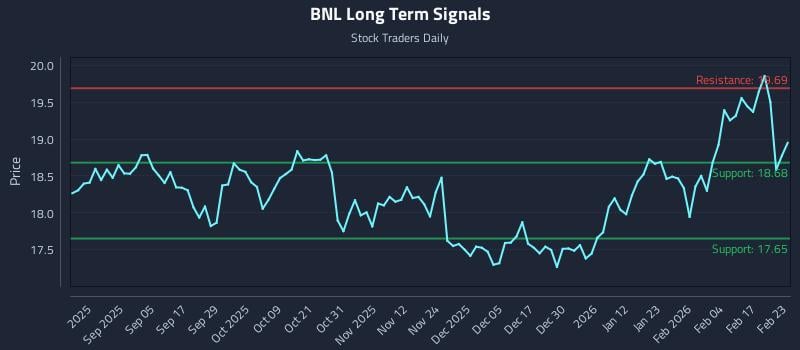

This article analyzes behavioral patterns and institutional flows for Broadstone Net Lease Inc. (NYSE: BNL), identifying weak near-term sentiment but potential for shifts in mid and long-term outlook. It highlights a strong risk-reward setup with a target gain of 5.4% and provides specific institutional trading strategies for different risk profiles. The analysis also includes multi-timeframe signals, indicating strong signals for mid and long-term periods.