Bank of Marin Bancorp

$ 25.84

0.04%

24 Feb - close price

- Market Cap 415,932,000 USD

- Current Price $ 25.84

- High / Low $ 26.06 / 24.66

- Stock P/E 41.66

- Book Value 24.74

- EPS 0.62

- Next Earning Report 2026-04-27

- Dividend Per Share $1.00

- Dividend Yield 3.68 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.09 %

- 52 Week High 28.26

- 52 Week Low 18.35

About

Bank of Marin Bancorp is the holding company of Bank of Marin providing a range of financial services primarily to professionals, small and medium-sized businesses, individuals, and non-profit organizations in the San Francisco Bay Area, California in the United States. United. State. The company is headquartered in Novato, California.

Analyst Target Price

$30.62

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-26 | 2025-10-27 | 2025-07-28 | 2025-04-28 | 2025-01-27 | 2024-10-28 | 2024-07-29 | 2024-04-29 | 2024-01-29 | 2023-10-23 | 2023-07-24 | 2023-04-24 |

| Reported EPS | 0.52 | 0.47 | 0.36 | 0.3 | 0.38 | 0.28 | 0.06 | 0.18 | 0.04 | 0.33 | 0.28 | 0.59 |

| Estimated EPS | 0.52 | 0.41 | 0.34 | 0.32 | 0.33 | 0.25 | 0.17 | 0.26 | 0.32 | 0.3 | 0.43 | 0.66 |

| Surprise | 0 | 0.06 | 0.02 | -0.02 | 0.05 | 0.03 | -0.11 | -0.08 | -0.28 | 0.03 | -0.15 | -0.07 |

| Surprise Percentage | 0% | 14.6341% | 5.8824% | -6.25% | 15.1515% | 12% | -64.7059% | -30.7692% | -87.5% | 10% | -34.8837% | -10.6061% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-27 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.53 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-12 | 2025-11-13 | 2025-08-14 | 2025-05-15 | 2025-02-13 | 2024-11-14 | 2024-08-15 | 2024-05-16 | 2024-02-15 | 2023-11-10 |

| Amount | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BMRC

2026-02-24 08:51:51

Bank of Marin Bancorp (NASDAQ:BMRC) saw its shares cross above their 200-day moving average, trading as high as $27.21, with its 200-day average at $25.60. Analysts have offered varied price targets, with a consensus "Moderate Buy" rating and an average price target of $30.10. The bank also reported strong Q4 earnings, beating estimates, and recently announced a quarterly dividend of $0.25 per share.

2026-02-23 14:26:00

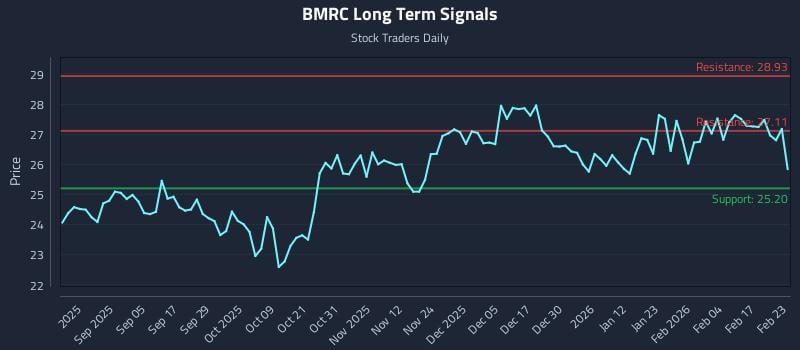

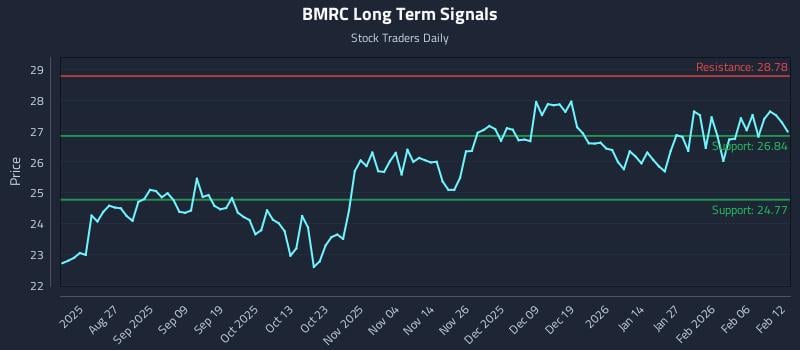

This article from Stock Traders Daily provides a detailed AI-driven analysis of Bank Of Marin Bancorp (BMRC), highlighting a weak near-term sentiment but strong long-term outlook. It presents three distinct trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss zones. The analysis emphasizes a remarkable 27.3:1 risk-reward setup targeting a 7.6% gain against 0.3% risk.

2026-02-12 12:58:00

This article analyzes Bank Of Marin Bancorp (NASDAQ: BMRC), highlighting a strong near-term sentiment that could lead to a long-term positive bias. It details three AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis, providing support and resistance levels. The analysis identifies a significant 24.3:1 risk-reward setup, targeting a 7.2% gain with minimal risk.

2026-02-05 18:59:15

Bank of Marin (BMRC) is showing attractive prospects due to a significant improvement in its earnings outlook, with analysts consistently raising their estimates for the company. This optimism is reflected in the stock's recent strong performance and its Zacks Rank #1 (Strong Buy) rating, suggesting potential for further upside. Investors may consider adding BMRC to their portfolios given the favorable estimate revisions and historical outperformance of top-ranked Zacks stocks.

2026-02-05 13:59:15

Bank of Marin Bancorp (NASDAQ:BMRC) has received a "Moderate Buy" consensus rating from analysts, with an average 1-year price target of $30.10. The company recently reported strong Q4 EPS of $0.59, surpassing estimates, and declared a quarterly dividend of $0.25 per share. Institutional investors hold over 52% of the company's stock.

2026-02-05 12:20:00

Bank of Marin (BMRC) is seeing a positive revision in its earnings outlook, making it an attractive investment according to Zacks Equity Research. The company's earnings estimates have been significantly raised for both the current quarter and the full year, indicating strong analyst optimism. This favorable trend has earned BMRC a Zacks Rank #1 (Strong Buy), suggesting potential for continued stock price momentum.