BJs Wholesale Club Holdings Inc

$ 96.88

-0.18%

26 Feb - close price

- Market Cap 12,786,665,000 USD

- Current Price $ 96.88

- High / Low $ 98.22 / 96.64

- Stock P/E 22.36

- Book Value 16.60

- EPS 4.34

- Next Earning Report 2026-03-05

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.07 %

- ROE 0.29 %

- 52 Week High 121.10

- 52 Week Low 86.68

About

BJ's Wholesale Club Holdings, Inc., operates warehouse clubs on the East Coast of the United States. The company is headquartered in Westborough, Massachusetts.

Analyst Target Price

$104.20

Quarterly Earnings

| Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | Jul 2023 | Apr 2023 | Jan 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-20 | 2025-08-22 | 2025-05-22 | 2025-03-06 | 2024-11-21 | 2024-08-22 | 2024-05-23 | 2024-03-07 | 2023-11-17 | 2023-08-22 | 2023-05-23 | 2023-03-09 |

| Reported EPS | 1.16 | 1.14 | 1.14 | 0.93 | 1.18 | 1.09 | 0.85 | 1.11 | 0.98 | 0.97 | 0.85 | 1 |

| Estimated EPS | 0.93 | 1.09 | 0.91 | 0.87 | 0.93 | 1 | 0.83 | 1.06 | 0.95 | 0.89 | 0.85 | 0.87 |

| Surprise | 0.23 | 0.05 | 0.23 | 0.06 | 0.25 | 0.09 | 0.02 | 0.05 | 0.03 | 0.08 | 0 | 0.13 |

| Surprise Percentage | 24.7312% | 4.5872% | 25.2747% | 6.8966% | 26.8817% | 9% | 2.4096% | 4.717% | 3.1579% | 8.9888% | 0% | 14.9425% |

Next Quarterly Earnings

| Jan 2026 | |

|---|---|

| Reported Date | 2026-03-05 |

| Fiscal Date Ending | 2026-01-31 |

| Estimated EPS | 0.92 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BJ

2026-02-26 06:51:27

BJ's Wholesale Club Holdings, Inc. (NYSE:BJ) has received an average "Hold" rating from twenty research firms, with an average 12-month price target of $107.63. Insider William C. Werner recently sold 7,000 shares, reducing insider ownership to 1.40%, while institutional investors hold approximately 98.60%. The company's stock opened at $97.17, has a market cap of $12.71 billion, and a P/E ratio of 22.39.

2026-02-23 12:50:58

This article analyzes Bj's Wholesale Club Holdings Inc. (BJ) using AI models to determine its effect on rotational strategy timing. It highlights near-term weak sentiment, a strong mid-term outlook, and a weak long-term bias, along with specific entry, target, and stop-loss prices for various trading strategies. The analysis also identifies a significant risk-reward short setup for BJ.

2026-02-22 12:11:38

Vanguard Group Inc. reduced its stake in BJ's Wholesale Club Holdings, Inc. by 0.9% in the third quarter, selling 115,348 shares and leaving them with over 12.9 million shares valued at $1.21 billion. Other hedge funds also adjusted their positions in BJ, while analysts provided mixed ratings with a consensus "Hold" and a target price of $107.63. Insider William C. Werner also sold 7,000 shares for over $637,000.

2026-02-21 23:46:13

BJ's Wholesale Club is opening its first Tennessee location in La Vergne on June 14, 2023, expanding its footprint to 19 states. The new club, located near Nashville, will include a BJ's Gas station and offer various shopping options and savings programs. BJ's Charitable Foundation is also partnering with Second Harvest Food Bank of Middle Tennessee to combat food insecurity in the community.

2026-02-21 17:18:05

CenterBook Partners LP has made a new investment of $1.07 million in BJ's Wholesale Club Holdings, Inc., acquiring 11,483 shares. This comes as institutional ownership in BJ's Wholesale Club stands at about 98.6%, with several other firms also increasing their stakes. The company recently reported strong Q3 earnings, beating EPS estimates, and currently holds a consensus "Hold" rating from analysts with an average price target of $107.63.

2026-02-20 16:42:58

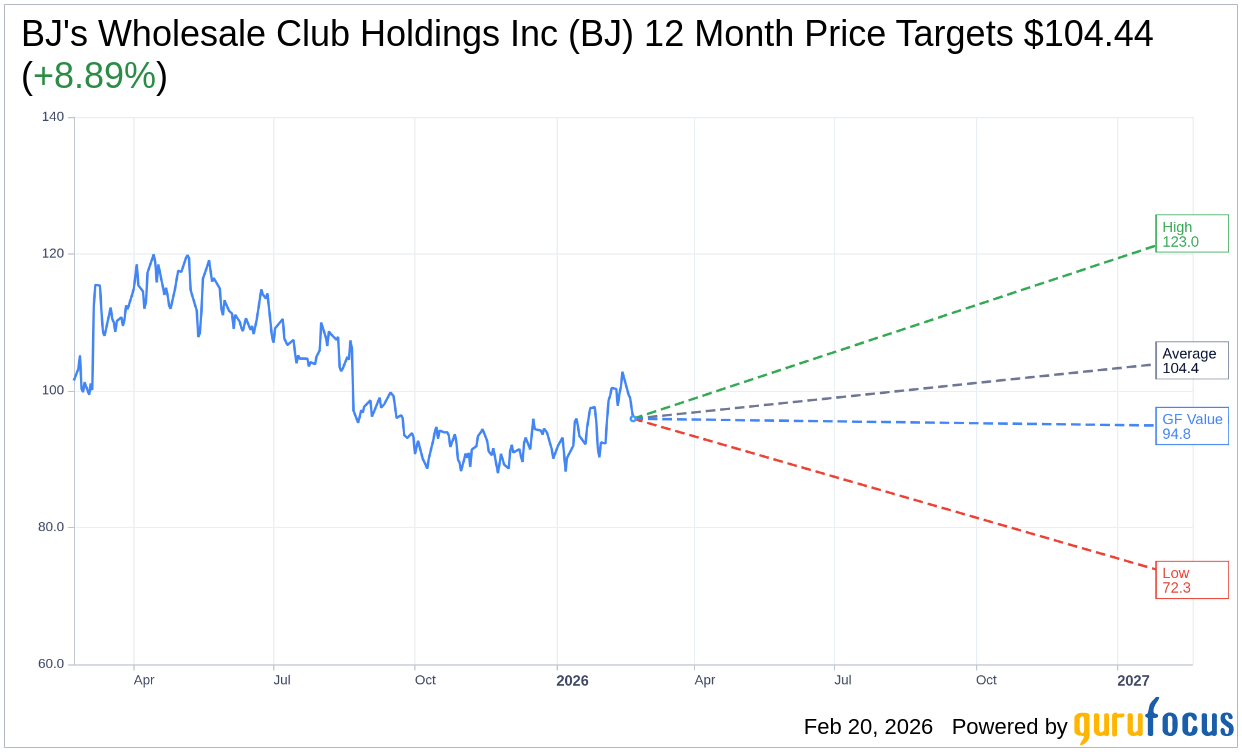

BJ's Wholesale Club Holdings Inc (BJ) saw its shares decline by 3.30% on February 20th, trading at $95.91. This places the stock significantly below its 52-week high but still above its 52-week low. Analyst forecasts suggest an average target price of $104.44, implying an upside, while GuruFocus's GF Value estimate indicates a slight downside from the current price.