Brookfield Infrastructure Partners LP

$ 39.15

1.16%

24 Feb - close price

- Market Cap 17,942,905,000 USD

- Current Price $ 39.15

- High / Low $ 39.48 / 38.80

- Stock P/E 43.00

- Book Value 10.61

- EPS 0.90

- Next Earning Report 2026-04-29

- Dividend Per Share $1.72

- Dividend Yield 4.7 %

- Next Dividend Date 2026-03-31

- ROA 0.03 %

- ROE 0.08 %

- 52 Week High 39.85

- 52 Week Low 24.74

About

Brookfield Infrastructure Partners LP owns and operates utilities, transportation, midstream and data companies in North and South America, Europe and Asia Pacific. The company is headquartered in Hamilton, Bermuda.

Analyst Target Price

$43.36

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-29 | 2025-11-07 | 2025-07-31 | 2025-04-30 | 2025-01-30 | 2024-11-06 | 2024-08-01 | 2024-05-01 | 2024-02-01 | 2023-11-01 | 2023-08-03 | 2023-05-10 |

| Reported EPS | 0.45 | 0.44 | -0.03 | 0.04 | 0.22 | -0.18 | -0.1 | 0.1 | -0.2 | 0.03 | 0.38 | -0.07 |

| Estimated EPS | 0.27 | 0.31 | 0.31 | 0.18 | 0.05 | 0.21 | 0.1 | 0.11 | 0.11 | 0.1 | 0.15 | 0.21 |

| Surprise | 0.18 | 0.13 | -0.34 | -0.14 | 0.17 | -0.39 | -0.2 | -0.01 | -0.31 | -0.07 | 0.23 | -0.28 |

| Surprise Percentage | 66.6667% | 41.9355% | -109.6774% | -77.7778% | 340% | -185.7143% | -200% | -9.0909% | -281.8182% | -70% | 153.3333% | -133.3333% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-29 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.26 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-31 | 2025-12-31 | 2025-09-29 | 2025-06-30 | 2025-03-31 | 2024-12-31 | 2024-09-27 | 2024-06-28 | 2024-03-28 | 2023-12-29 |

| Amount | $0.455 | $0.43 | $0.43 | $0.43 | $0.43 | $0.405 | $0.405 | $0.405 | $0.405 | $0.3825 |

Next Dividend Records

| Dividend per share (year): | $1.72 |

| Dividend Yield | 4.7% |

| Next Dividend Date | 2026-03-31 |

| Ex-Dividend Date | 2026-02-27 |

Recent News: BIP

2026-02-20 02:29:51

The article suggests investing $45,000 in Canadian stocks amid a market rotation from AI and mining to financials, energy, and utilities. It highlights three top Canadian stocks: Toronto-Dominion Bank (TSX:TD) for its dividend consistency, Gibson Energy (TSX:GEI) for its midstream oilfield services and growing dividends, and Brookfield Infrastructure Partners (TSX:BIP.UN) for its global infrastructure assets and strong growth potential. The author recommends allocating $15,000 to each to balance risk and achieve income and long-term growth.

2026-02-19 22:44:34

The article highlights that Hawaiian Electric (HE) and Otter Tail Corporation (OTTR) have the highest short interest in the utilities sector, while Brookfield Infrastructure Partners (BIP) and Edison International (ES) have the lowest. This data indicates the market's varying sentiment towards different companies within the sector.

2026-02-15 19:58:12

Brookfield Infrastructure Partners (BIP) has seen a 24% gain over the last year. While a Discounted Cash Flow (DCF) analysis suggests it is significantly undervalued by 78.3%, its current P/E ratio of 39.81x is above the industry average, indicating it might be slightly overvalued by this metric. The article offers two "Narratives" with different fair values, one bullish at US$52.15 and one more cautious at US$37.00, reflecting differing assumptions about its future performance and risks.

2026-02-13 01:27:48

GATX Corporation, in a joint venture with Brookfield Infrastructure Partners L.P., has successfully acquired Wells Fargo’s rail operating lease portfolio, comprising approximately 101,000 railcars, for $4.2 billion. Separately, Brookfield Infrastructure also acquired Wells Fargo's rail finance lease portfolio, which includes 22,000 railcars and 400 locomotives. Fasken advised GATX and Brookfield Infrastructure on the Canadian legal aspects of these transactions.

2026-02-13 01:27:48

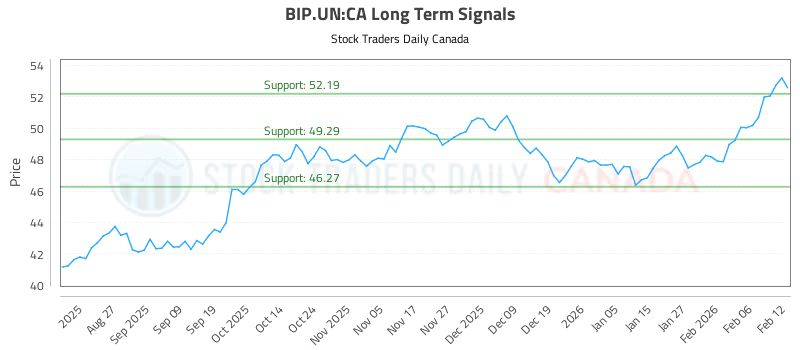

This article provides trading plans, AI-generated signals, and ratings for Brookfield Infrastructure Partners L.P. (BIP.UN:CA) as of February 12, 2026. It suggests buying near 52.19 with a stop loss at 51.93, indicating strong ratings across near, mid, and long terms. The piece also lists numerous recent articles related to BIP.UN:CA, offering various trading and analysis insights.

2026-02-12 14:56:49

Brookfield Infrastructure Partners (BIP) is presenting a potential "Dividend Run" opportunity, as its stock price historically rises before the ex-dividend date. With an upcoming ex-dividend date of February 27, 2026, and a dividend of $0.455 per share, investors might consider purchasing shares in advance to capitalize on potential short-term gains, based on past performance where capital gains often exceeded the dividend amount. The company also offers an attractive annualized yield of 4.65%, making it a relevant option for dividend-focused investors.