Brighthouse Financial Inc

$ 17.63

-0.23%

24 Feb - close price

- Market Cap N/A

- Current Price $ 17.63

- High / Low $ 17.85 / 17.54

- Stock P/E 1.40

- Book Value 111.33

- EPS 12.61

- Next Earning Report 2026-05-06

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.16 %

- 52 Week High 20.89

- 52 Week Low 13.49

About

Brighthouse Financial, Inc. offers life insurance and annuity products in the United States. The company is headquartered in Charlotte, North Carolina.

Analyst Target Price

N/A

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Jun 2021 | Mar 2021 | Dec 2020 | Sep 2020 | Jun 2020 | Mar 2020 | Dec 2019 | Sep 2019 | Jun 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-09 | 2025-11-05 | 2025-08-08 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 |

| Reported EPS | None | 7.88 | 1.02 | 4.34 | 0.11 | -6.9656 | -11.6253 | -32.4943 | -21.1 | 47.11 | -9.987 | 6.06 |

| Estimated EPS | None | None | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise | 0 | 0 | 1.02 | 4.34 | 0.11 | -6.9656 | -11.6253 | -32.4943 | -21.1 | 47.11 | -9.987 | 6.06 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-06 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-25 | 2025-12-26 | 2025-09-25 | 2025-06-25 | 2025-03-25 | 2024-12-26 | 2024-09-25 | 2024-06-25 | 2024-03-25 | 2023-12-26 |

| Amount | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 | $0.421875 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: BHFAO

2026-02-21 18:44:24

Brighthouse Financial's Series A preferred stock (BHFAP) recently declared a dividend of $0.4125. The company's common shares (BHF) are currently down, as is the preferred stock, despite an upcoming acquisition by Aquarian Capital for $70 per share in cash, which is expected to close in 2026. This potential acquisition and future Q4 earnings announcement, along with current analyst ratings, suggest a mixed outlook for investors.

2026-02-20 23:05:05

Brighthouse Financial (BHF) is projected to announce a substantial 85.1% increase in Q4 revenue, reaching $2.24 billion, despite an anticipated 11.7% drop in earnings per share to $5.19. The company, a major player in annuities and life insurance, shows robust revenue growth but has a negative EBITDA growth rate, and recent insider selling raises a cautionary flag. Despite this, positive valuation metrics and strong institutional ownership suggest potential undervaluation and market confidence.

2026-02-10 06:58:49

Brighthouse Financial (BHFAM) stock recently reached a 52-week high of $12.08 USD, despite a nearly 20% decline over the past year. The company boasts a 9.57% dividend yield and a P/E ratio of 4.44, with its stock up 9.42% year-to-date. InvestingPro analysis suggests the stock is undervalued, supported by strong fundamentals including a healthy current ratio.

2026-01-21 08:26:00

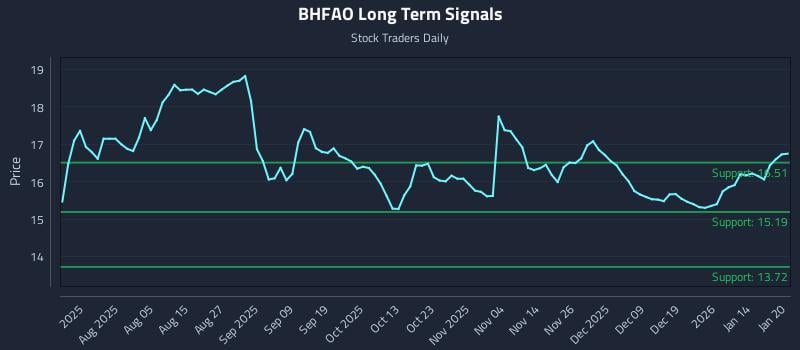

This article analyzes Brighthouse Financial Inc. (NASDAQ: BHFAO) using AI models to provide trading strategies. It identifies strong near and mid-term sentiment but a weak long-term outlook, with elevated downside risk. The analysis offers specific entry, target, and stop-loss levels for position, momentum breakout, and risk hedging strategies.

2026-01-11 10:31:00

This article reviews the Q3 performance of life insurance companies, highlighting Brighthouse Financial (NASDAQ:BHF) as a weak performer with flat revenues that missed analyst expectations. It also benchmarks BHF against peers like Aflac (NYSE:AFL) which had solid results, Unum Group (NYSE:UNM), CNO Financial Group (NYSE:CNO), and Horace Mann Educators (NYSE:HMN), providing revenue figures and stock reactions for each. The broader industry saw mixed results, with revenues beating consensus by 3.8% and share prices up 4.8% on average post-earnings.

2025-10-16 17:31:20

Brighthouse Financial (BHF) is reportedly in acquisition talks with Sixth Street for $55 per share, aligning with market trends of consolidation. The company, which specializes in annuities and life insurance, exhibits strong financial health with robust revenue growth and attractive valuation metrics despite some insider selling. The proposed acquisition highlights Brighthouse Financial's strategic positioning within the financial services sector.